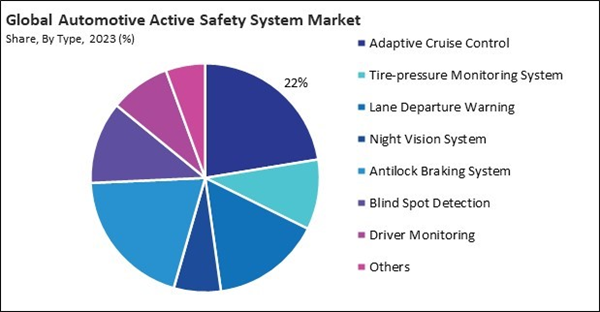

ACC offers significant convenience by automatically adjusting the vehicle’s speed to maintain a safe distance from the car ahead, reducing driver fatigue, especially on long highway drives. This makes it a highly sought-after feature among consumers. Adaptive Cruise Control (ACC) greatly improves road safety by reducing the risk of rear-end collisions, among the most frequent types of accidents. As safety becomes a top priority for consumers and regulators, the demand for ACC systems has surged. Thus, the adaptive cruise control segment garnered 22% revenue share in the automotive active safety system market 2023.

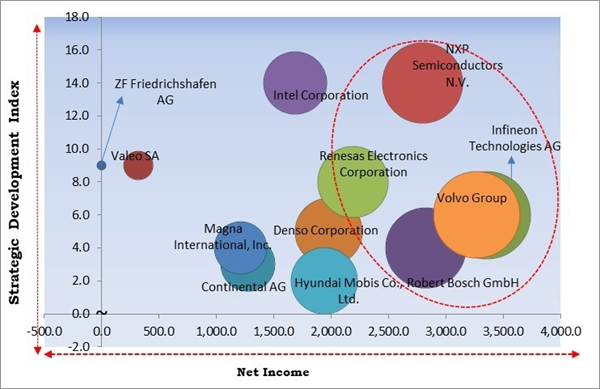

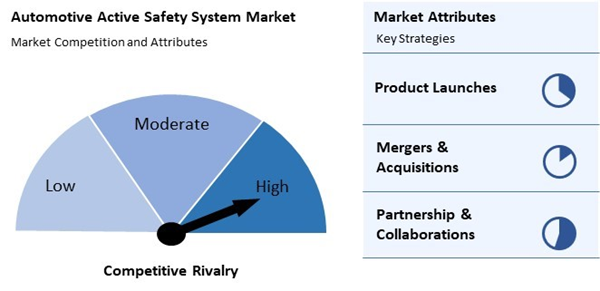

The major strategies followed by the market participants are Partnerships as the key developmental strategy to keep pace with the changing demands of end users. For instance, In January, 2024, NXP Semiconductors N.V. announced a partnership with Damon Motors, an urban mobility solutions provider, to integrate NXP's advanced automotive technology into Damon motor's electric motorcycles, enhancing safety, connectivity, and performance. This partnership leverages NXP's robust automotive ICs, embedded security solutions, and technical expertise, enabling Damon to accelerate development cycles and deliver secure, over-the-air updates for smarter, safer riding. Additionally, In 2024, August, Intel Corporation came into partnership with Karma Automotive, a vehicle manufacturer, to develop Software Defined Vehicle Architecture (SDVA) for future vehicles. This partnership would revolutionize vehicle architecture by enhancing efficiency, performance, and flexibility.

Cardinal Matrix - Market Competition Analysis

Based on the Analysis presented in the Cardinal matrix; NXP Semiconductors N.V., Infineon Technologies AG, Volvo Group and Robert Bosch GmbH are the forerunners in the Automotive Active Safety System Market. Companies such as Intel Corporation, Renesas Electronics Corporation and Denso Corporation are some of the key innovators in Automotive Active Safety System Market. In August, 2024, Intel Corporation came into partnership with Karma Automotive, a vehicle manufacturer, to develop Software Defined Vehicle Architecture (SDVA) for future vehicles. This partnership would revolutionize vehicle architecture by enhancing efficiency, performance, and flexibility.Market Growth Factors

Active safety systems are designed to mitigate the impact of human error, which is a leading cause of accidents. By implementing technologies that assist with driving tasks, the industry aims to reduce the risk associated with human fallibility.Additionally, technologies like pedestrian automatic emergency braking (PAEB) are designed to address the risks associated with pedestrians and cyclists, contributing to safer urban mobility and reducing the likelihood of severe accidents.

Market Restraining Factors

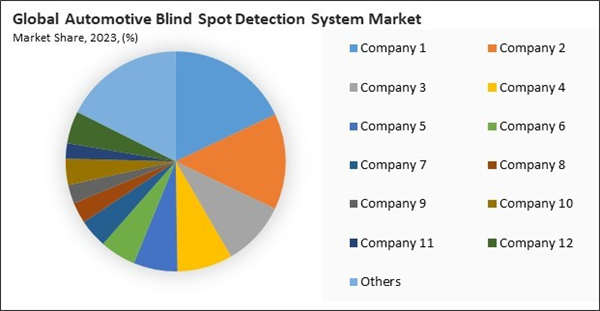

Automakers face pressure on profit margins when incorporating costly safety technologies into their vehicles. To maintain profitability, manufacturers might limit the inclusion of these features to higher-end models, reducing their availability in more affordable segments. Thus, the high costs of advanced safety technologies impede the market's growth.The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Partnerships & Collaborations.

Driving and Restraining Factors

Drivers- Rising focus on vehicle safety and high-demand vehicle safety features

- Growing focus on improving urban mobility

- Increasing vehicle production worldwide

- High costs of advanced safety technologies

- Potential for system failures and liability concerns

- Government regulations mandating advanced vehicle safety systems

- Rise of shared mobility and fleet management services

- Aftermarket compatibility and upgradation issues

- Interference from external environmental factors

Type Outlook

Based on type, the market is divided into tire-pressure monitoring system, lane departure warning, adaptive cruise control, night vision system, driver monitoring, antilock braking system, blind spot detection, and others. The antilock braking system segment attained 20% revenue share in the automotive active safety system market in 2023. With a global emphasis on reducing road accidents and fatalities, ABS is recognized as a critical technology that helps prevent collisions caused by uncontrolled braking.Sensor Type Outlook

On the basis of sensor type, the market is segmented into camera sensor, radar sensor, and lidar sensor. The radar sensor segment recorded 48% revenue share in the automotive active safety system market in 2023. Radar sensors are highly effective in detecting objects regardless of weather conditions, like rain, snow, or fog.Vehicle Type Outlook

By vehicle type, the market is classified into passenger cars, light commercial vehicles, heavy commercial vehicles, and buses & coaches. The light commercial vehicles segment procured 19% revenue share in the automotive active safety system market in 2023. Active safety systems provide valuable assistance to drivers by reducing fatigue and improving comfort during long drives.Propulsion type Outlook

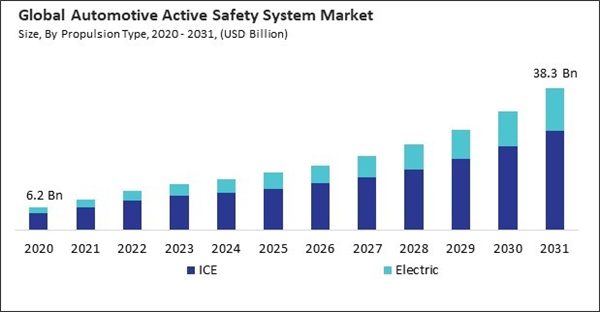

Based on propulsion type, the market is bifurcated into ICE and electric. In 2023, the electric segment procured 27% revenue share in the market. The growing adoption of electric vehicles globally is a key driver of the segment’s expansion.By Regional Analysis

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. In 2023, the Asia Pacific region generated 29% revenue share in the market. The Asia-Pacific region is experiencing rapid urbanization and an increase in vehicle ownership.Market Competition and Attributes

The automotive active safety system market is highly competitive, with numerous global players vying for market share. Key attributes driving competition include technological innovation, such as advanced driver assistance systems (ADAS), and integration of AI and machine learning for enhanced safety. Leading companies focus on developing cutting-edge sensors, cameras, and radar systems to improve vehicle safety. Market competition is intensified by rapid technological advancements, regulatory pressures, and the demand for cost-effective, reliable safety solutions.

Recent Strategies Deployed in the Market

- Aug-2024: Intel Corporation came into partnership with Karma Automotive, a vehicle manufacturer, to develop Software Defined Vehicle Architecture (SDVA) for future vehicles. This partnership would revolutionize vehicle architecture by enhancing efficiency, performance, and flexibility.

- Jul-2024: Valeo SA came into partnership with Seeing Machines, an automotive safety solutions provider, to advance driver and occupant monitoring technologies.This partnership enhances Valeo’s interior sensing systems.

- Apr-2024: Volvo Buses released new active safety systems with features like pedestrian-responsive emergency braking and Side Collision Avoidance Support. These systems, standard on electric and Euro 6 models, focus on safe driving, collision avoidance, and protection.

- Mar-2024: Intel Corporation collaborated with Concept Reply, an IoT solutions provider, to launch an AI-driven solution enhancing autonomous vehicle safety through precise traffic light detection. Utilizing the CARLA simulation platform and Intel's computing technologies, the solution would improve road safety, scales efficiently, and aid individuals with color vision deficiencies, setting new safety benchmarks.

- Feb-2024: Infineon Technologies AG collaborated with Honda, a global automotive company. The partnership aimed at developing solutions for power semiconductors, ADAS, and E/E architectures to accelerate advanced vehicle technologies.

- Jan-2024: ZF Friedrichshafen AG introduced a Multi-Stage Load Limiter (MSLL) for seat belts, enhancing adaptability to occupant size and weight. This system improves crash protection by adjusting belt forces throughout the collision. It integrates with other safety systems and sensors to provide tailored safety for different occupants and crash scenarios.

List of Key Companies Profiled

- Robert Bosch GmbH

- Continental AG

- ZF Friedrichshafen AG

- Valeo SA

- Magna International, Inc.

- Denso Corporation

- Intel Corporation

- NXP Semiconductors N.V.

- Infineon Technologies AG

- Renesas Electronics Corporation

- Teledyne FLIR LLC (Teledyne Technologies Incorporated)

- Hyundai Mobis Co., Ltd. (Hyundai Motor)

- Forvia SE

- Knorr-Bremse AG

- Volvo Group

Market Report Segmentation

By Propulsion Type- ICE

- Electric

- Radar Sensor

- Camera Sensor

- Lidar Sensor

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Buses & Coaches

- Adaptive Cruise Control

- Tire-pressure Monitoring System

- Lane Departure Warning

- Night Vision System

- Antilock Braking System

- Blind Spot Detection

- Driver Monitoring

- Others

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Robert Bosch GmbH

- Continental AG

- ZF Friedrichshafen AG

- Valeo SA

- Magna International, Inc.

- Denso Corporation

- Intel Corporation

- NXP Semiconductors N.V.

- Infineon Technologies AG

- Renesas Electronics Corporation

- Teledyne FLIR LLC (Teledyne Technologies Incorporated)

- Hyundai Mobis Co., Ltd. (Hyundai Motor)

- Forvia SE

- Knorr-Bremse AG

- Volvo Group