Artificial sweeteners are food ingredients prepared using various forms of chemicals. These sweeteners offer multiple benefits over traditional sweeteners, such as helping in managing weight loss, as they consist of low or no calories. Additionally, they also support dental and heart health.

Market Trends:

- Rising demand for processed beverages: A key driver of the global artificial sweetener market is the increasing consumer demand for processed beverages such as soft drinks, juices, and carbonated drinks. Artificial sweeteners offer benefits like weight management and blood sugar control, making them a popular choice among health-conscious consumers.

- Increased food consumption fueling demand: Over the past few years, the rise in food consumption has significantly boosted the use of artificial sweeteners in beverages. As global health awareness grows, more people are seeking sugar substitutes to reduce calorie intake and support weight loss. This trend has led beverage manufacturers to incorporate more artificial sweeteners into their products.

- Geographic segmentation and market drivers: The global artificial sweetener market is segmented into North America, South America, Europe, the Middle East and Africa, and Asia Pacific. Growing awareness of the benefits of artificial sweeteners, coupled with rising concerns about diabetes and obesity, is driving market growth worldwide. According to the World Obesity Federation, obesity rates nearly tripled among women (from 6.6% to 18.5%) and quadrupled among men (from 3% to 14.0%) between 1975 and 2022, with approximately 504 million women and 374 million men living with obesity in 2022.

- North America’s market growth: The North American artificial sweetener market is expanding due to the growing food and beverage industry, increasing diabetes prevalence, regulatory compliance, clean label trends, and the presence of major market players. The U.S. is one of the largest importers of saccharin and its salts, ranking as the second-largest importer globally in 2023.

- Asia Pacific’s dominant market share: The Asia Pacific region is expected to hold a significant share of the global artificial sweetener market, driven by the rising demand for processed food and beverage products.

Key Benefits of this Report:

- Insightful Analysis: Gain detailed market insights covering major as well as emerging geographical regions, focusing on customer segments, government policies and socio-economic factors, consumer preferences, industry verticals, and other sub-segments.

- Competitive Landscape: Understand the strategic maneuvers employed by key players globally to understand possible market penetration with the correct strategy.

- Market Drivers & Future Trends: Explore the dynamic factors and pivotal market trends and how they will shape future market developments.

- Actionable Recommendations: Utilize the insights to exercise strategic decisions to uncover new business streams and revenues in a dynamic environment.

- Caters to a Wide Audience: Beneficial and cost-effective for startups, research institutions, consultants, SMEs, and large enterprises.

What can businesses use this report for?

Industry and Market Insights, Opportunity Assessment, Product Demand Forecasting, Market Entry Strategy, Geographical Expansion, Capital Investment Decisions, Regulatory Framework & Implications, New Product Development, Competitive Intelligence.Report Coverage:

- Historical data from 2022 to 2024 & forecast data from 2025 to 2030

- Growth Opportunities, Challenges, Supply Chain Outlook, Regulatory Framework, and Trend Analysis

- Competitive Positioning, Strategies, and Market Share Analysis

- Revenue Growth and Forecast Assessment of segments and regions including countries

- Company Profiling (Strategies, Products, Financial Information, and Key Developments among others)

Artificial Sweetener Market is analyzed into the following segments:

By Type

- Aspartame

- Acesulfame K

- Saccharin

- Sucralose

- Neotame

- Others

By Form

- Liquid

- Solid

By Distribution Channel

- Online

- Offline

By Application

- Dairy

- Beverages

- Confectionary and Bakery

- Processed Food

- Others

By Region

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- UK

- France

- Spain

- Others

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Indonesia

- Thailand

- Taiwan

- Others

Table of Contents

Companies Mentioned

- B&G Foods, Inc.

- Ajinomoto Co, Inc.

- Roquette Frères

- ADM

- Cargill Inc.

- Ingredion Incorporated

- Tate & Lyle

- DuPont

- NutraSweet Company

- Tereos SA

- GLG Life Tech Corporation

- Sweegen

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 140 |

| Published | February 2025 |

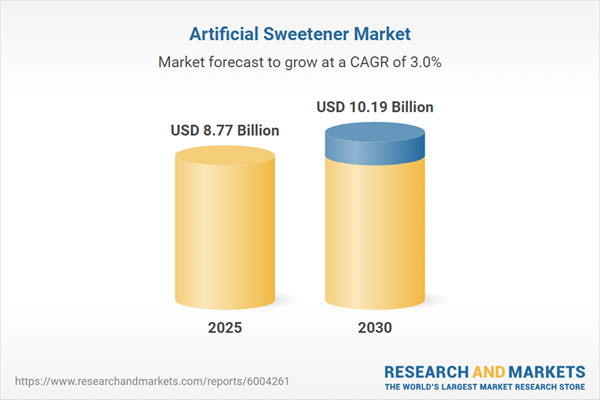

| Forecast Period | 2025 - 2030 |

| Estimated Market Value ( USD | $ 8.77 Billion |

| Forecasted Market Value ( USD | $ 10.19 Billion |

| Compound Annual Growth Rate | 3.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |