Global Tire Building Machinery Market - Key Trends & Drivers Summarized

Why Is Tire Building Machinery Becoming Critical In Modern Manufacturing?

The global tire building machinery market is experiencing significant growth due to the increasing demand for advanced and efficient tire production systems. Tire building machines are essential in the manufacturing process as they assemble various components such as treads, sidewalls, and beads into a complete tire structure. The need for precise, durable, and high-performance tires, driven by the automotive industry's demand for better safety, fuel efficiency, and enhanced driving experience, has made tire building machinery a critical component in tire production. Modern tire building machines offer high levels of automation, which not only improves production efficiency but also ensures uniformity and quality in tire construction, reducing the chances of defects. As the automotive industry shifts toward electric vehicles (EVs), there is a growing need for specialized tires, which further fuels the demand for advanced tire building machinery that can meet these specific requirements.Moreover, tire manufacturers are increasingly adopting tire building machines that are capable of producing a wider range of tire types, from passenger vehicle tires to large off-road tires. This flexibility is essential as the market for specialty tires continues to expand, driven by industries such as agriculture, construction, and aviation. The ability to quickly switch between tire models and sizes without compromising quality or production speed is one of the key advantages of modern tire building machinery. Additionally, the push for sustainability in the automotive sector has resulted in the development of green tires, which require precise assembly and construction techniques to minimize rolling resistance and improve fuel efficiency. As a result, tire building machinery equipped with cutting-edge technologies is becoming increasingly crucial for manufacturers aiming to stay competitive in the market.

How Is Technology Shaping The Future Of Tire Building Machinery?

Technological innovation is a major force driving the evolution of tire building machinery, making it faster, more efficient, and capable of producing increasingly complex tire designs. Automation is at the forefront of this transformation, with manufacturers investing heavily in fully automated tire building machines that reduce manual labor and improve overall production speed. These machines utilize robotics, sensors, and advanced control systems to automate various stages of the tire building process, from component handling to tire assembly. The result is not only faster production times but also greater consistency in the final product. Additionally, the integration of data analytics and real-time monitoring systems into tire building machinery allows manufacturers to track performance metrics such as cycle times, machine utilization, and defect rates, enabling them to optimize production processes and reduce waste. This level of technological sophistication is particularly important in the highly competitive automotive industry, where manufacturers are under constant pressure to increase efficiency and reduce costs.In addition to automation, advancements in materials science are also influencing the design and functionality of tire building machinery. The growing use of new materials such as silica-based compounds and reinforced synthetic rubbers in tire production requires machines capable of handling these materials with precision. As a result, manufacturers are developing tire building machines with enhanced material handling capabilities, ensuring that each component is accurately placed and bonded during the tire construction process. Another key technological trend is the development of modular tire building machines, which offer greater flexibility and scalability. These machines allow manufacturers to easily upgrade or reconfigure their production lines to accommodate changes in tire design or production volumes. With the rise of electric vehicles and the increasing demand for custom-made tires, this ability to adapt to new market demands is becoming a crucial advantage for tire manufacturers. As technology continues to advance, tire building machinery is set to play an even more pivotal role in shaping the future of tire production.

What Role Does Consumer Demand Play In The Growth Of Tire Building Machinery?

Consumer demand, particularly in the automotive sector, is a significant driver of growth in the tire building machinery market. As consumer preferences shift toward vehicles that offer better performance, safety, and fuel efficiency, the demand for high-quality, specialized tires has increased. This trend is most evident in the growing electric vehicle (EV) market, where tires need to be designed to handle higher torque levels and provide lower rolling resistance to maximize battery life. Consequently, tire manufacturers are under pressure to produce tires that meet these specific requirements, and this has led to a surge in demand for tire building machinery that can produce high-performance tires with precision and efficiency. The shift toward eco-friendly and energy-efficient vehicles has also spurred the development of low rolling resistance tires, which require specialized manufacturing processes that tire building machines must accommodate.In addition to the EV revolution, consumer preferences for safer and longer-lasting tires are pushing tire manufacturers to invest in advanced tire building machinery. As drivers become more knowledgeable about the importance of tire quality for vehicle safety and performance, they are more willing to invest in premium tires. This growing market for premium and high-performance tires is directly influencing the machinery sector, as manufacturers need advanced equipment to produce these tires with consistent quality. Furthermore, the increasing popularity of SUVs, trucks, and off-road vehicles is driving demand for larger, more robust tires, further propelling the need for versatile and powerful tire building machinery. This shift in consumer demand is not just limited to passenger vehicles; industries such as aviation, agriculture, and construction also require specialized tires for their heavy-duty vehicles, adding to the diversity of the tire building machinery market.

What Is Driving The Growth Of The Tire Building Machinery Market?

The growth in the tire building machinery market is driven by several factors, including the rise of electric vehicles, increasing demand for premium tires, and technological advancements in manufacturing processes. As the automotive industry transitions toward electric vehicles (EVs), tire manufacturers are investing heavily in machinery that can meet the specific requirements of EV tires, which include enhanced durability, lower rolling resistance, and greater noise reduction. This shift is creating a new demand for tire building machines capable of producing high-performance tires designed specifically for electric vehicles. Additionally, the broader trend toward vehicle electrification is encouraging manufacturers to develop lighter and more energy-efficient tires, further driving the need for specialized tire building equipment.Technological advancements, particularly in automation and robotics, are also major growth drivers. Tire manufacturers are increasingly adopting fully automated tire building machines to improve production efficiency and reduce labor costs. These machines not only speed up the manufacturing process but also ensure higher levels of precision, reducing the likelihood of defects and improving overall tire quality. Moreover, the global push for sustainable and eco-friendly tires, driven by both regulatory pressures and consumer preferences, has resulted in the need for tire building machinery that can handle the production of green tires. These tires, which are designed to reduce rolling resistance and improve fuel efficiency, require highly precise assembly techniques to ensure their performance characteristics are met. Additionally, the rise of smart manufacturing and Industry 4.0 technologies is enabling tire manufacturers to implement real-time monitoring and predictive maintenance systems, further boosting the efficiency and reliability of tire building machinery. These factors, coupled with the growing demand for specialty tires in sectors such as aviation, agriculture, and construction, are fueling the expansion of the tire building machinery market on a global scale.

Report Scope

The report analyzes the Tire Building Machinery market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Tire Type (Radial Tires, Bias Tires); End-Use (Light Commercial Vehicle Tires End-Use, Passenger Car Tires End-Use, Medium & Heavy Vehicle Tires End-Use, Off-Road Vehicle Tires End-Use, Two-Wheeler Tires End-Use, Aircraft Tires End-Use).

- Geographic Regions/Countries:World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Regional Analysis

Gain insights into the U.S. market, valued at $178.1 Million in 2024, and China, forecasted to grow at an impressive 3.8% CAGR to reach $141.4 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Tire Building Machinery Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Tire Building Machinery Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Tire Building Machinery Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

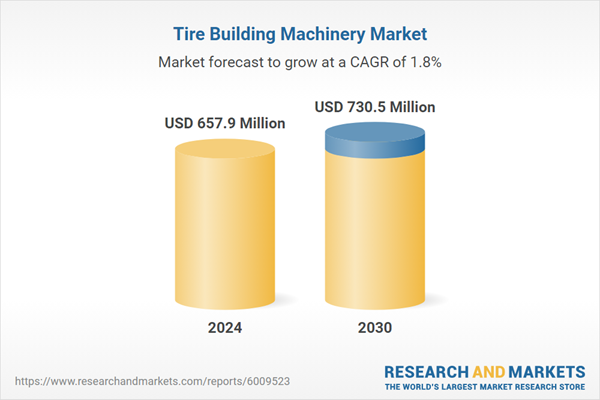

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as All Well Industry Co., Ltd., Criamos Engineering Pvt. Ltd., Erdemtas Makine Elekt.San.Tic. Ltd., Harburg Freudenberger Maschinenbau GmbH, HERBERT Maschinenbau GmbH & Co. KG and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Tire Building Machinery market report include:

- All Well Industry Co., Ltd.

- Criamos Engineering Pvt. Ltd.

- Erdemtas Makine Elekt.San.Tic. Ltd.

- Harburg Freudenberger Maschinenbau GmbH

- HERBERT Maschinenbau GmbH & Co. KG

- HF TireTech Group

- INTEREUROPEAN Srl

- MARANGONI Group

- Mitsubishi Heavy Industries Ltd.

- RRR Development Co. Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- All Well Industry Co., Ltd.

- Criamos Engineering Pvt. Ltd.

- Erdemtas Makine Elekt.San.Tic. Ltd.

- Harburg Freudenberger Maschinenbau GmbH

- HERBERT Maschinenbau GmbH & Co. KG

- HF TireTech Group

- INTEREUROPEAN Srl

- MARANGONI Group

- Mitsubishi Heavy Industries Ltd.

- RRR Development Co. Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 285 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 657.9 Million |

| Forecasted Market Value ( USD | $ 730.5 Million |

| Compound Annual Growth Rate | 1.8% |

| Regions Covered | Global |