Global Smart Bumpers Market - Key Trends & Drivers Summarized

How Are Smart Bumpers Transforming Vehicle Safety and Design?

The rise of smart bumpers in the automotive industry marks a significant evolution in vehicle safety, functionality, and design. Unlike traditional bumpers, which primarily serve the purpose of absorbing impact during collisions, smart bumpers incorporate advanced technologies like sensors, cameras, and communication systems that enhance a vehicle's ability to detect and respond to external conditions. These bumpers are designed to interact with Advanced Driver Assistance Systems (ADAS), helping to prevent accidents before they happen by alerting drivers to potential hazards such as nearby obstacles or erratic driving behaviors. Moreover, smart bumpers can play an integral role in active pedestrian protection systems by automatically activating emergency braking mechanisms if a collision with a pedestrian is imminent. Manufacturers are also focusing on making these bumpers lighter and more aerodynamic, contributing to improved vehicle fuel efficiency. The integration of smart bumpers is not only revolutionizing vehicle safety but also pushing the boundaries of automotive design by seamlessly blending technology with aesthetics.What Role Does Technology Play in the Evolution of Smart Bumpers?

The development of smart bumpers is heavily driven by advancements in sensor technology, artificial intelligence (AI), and connectivity. One key innovation is the incorporation of ultrasonic, radar, and LiDAR sensors, which provide vehicles with a 360-degree view of their surroundings, enabling real-time analysis of road conditions. These sensors are integrated into the bumper systems to offer enhanced object detection capabilities, which is particularly useful in parking assistance and collision avoidance. AI algorithms are employed to process the data gathered by these sensors, allowing the vehicle to interpret the environment and make autonomous decisions, such as adjusting speed or direction to avoid accidents. Additionally, the rise of vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) communication technologies is allowing smart bumpers to act as a critical node in connected car ecosystems. By exchanging information with nearby vehicles and road infrastructure, smart bumpers can anticipate potential accidents or traffic disruptions, enabling proactive safety measures. The continuous evolution of these technologies is a key factor driving the adoption of smart bumpers in both luxury and mass-market vehicles.How Are Changing Consumer Expectations Impacting the Smart Bumper Market?

Consumer behavior is playing an increasingly influential role in the smart bumper market, as vehicle buyers now prioritize safety features and connectivity alongside traditional attributes like performance and style. The demand for vehicles equipped with ADAS and autonomous driving features has surged, pushing manufacturers to incorporate smart bumpers as a standard feature in many mid - to high-end vehicles. Consumers today expect their cars to offer intelligent safety features that protect both occupants and pedestrians, making smart bumpers an essential component in meeting these expectations. Moreover, as electric vehicles (EVs) gain popularity, smart bumpers are being designed to integrate with the unique needs of these cars, such as enhanced pedestrian detection systems due to the quieter operation of EVs, which can pose additional risks in urban settings. The increasing focus on sustainability is also influencing the design of smart bumpers, with consumers seeking materials that are both eco-friendly and durable, aligning with the broader trend towards environmentally conscious automotive solutions. This shift in consumer preferences has made smart bumpers a key differentiator in the competitive automotive market.What Are the Major Growth Drivers in the Smart Bumper Market?

The growth in the smart bumper market is driven by several factors, including technological advancements, changing vehicle designs, and evolving consumer demands. A major driver is the increasing integration of autonomous driving technologies, which require sophisticated sensor systems embedded in bumpers to ensure comprehensive environmental awareness. The rise of connected cars, fueled by the expansion of 5G networks, is also pushing demand for smart bumpers that can facilitate real-time communication with other vehicles and road infrastructure. End-use applications are expanding beyond just safety, as smart bumpers are now being used for parking assistance, obstacle detection, and pedestrian protection, making them a critical feature in modern vehicles. Additionally, as governments worldwide introduce stricter safety regulations, automakers are increasingly incorporating smart bumpers to comply with new crash test standards and pedestrian safety laws. Finally, the growing adoption of electric and hybrid vehicles is creating a need for lightweight, energy-efficient smart bumpers that can improve vehicle aerodynamics while supporting advanced safety features. These diverse factors are collectively accelerating the adoption of smart bumpers across various segments of the automotive industry.Report Scope

The report analyzes the Smart Bumpers market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: End-Use (OEM End-Use, Aftermarket End-Use).

- Geographic Regions/Countries:World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Rest of Europe; Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the OEM End-Use segment, which is expected to reach US$3.5 Billion by 2030 with a CAGR of a 2.7%. The Aftermarket End-Use segment is also set to grow at 2.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.4 Billion in 2024, and China, forecasted to grow at an impressive 2.4% CAGR to reach $993.6 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Smart Bumpers Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Smart Bumpers Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Smart Bumpers Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AimControllers LLC, BreakerLink, CARiD.com, DM-Autoteile GmbH, Ford Motor Company and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 39 companies featured in this Smart Bumpers market report include:

- AimControllers LLC

- BreakerLink

- CARiD.com

- DM-Autoteile GmbH

- Ford Motor Company

- Ingenext Technologies

- Kia India Pvt. Limited

- Opmobility

- REHAU Automotive SE & Co. KG

- Smart Madness

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AimControllers LLC

- BreakerLink

- CARiD.com

- DM-Autoteile GmbH

- Ford Motor Company

- Ingenext Technologies

- Kia India Pvt. Limited

- Opmobility

- REHAU Automotive SE & Co. KG

- Smart Madness

Table Information

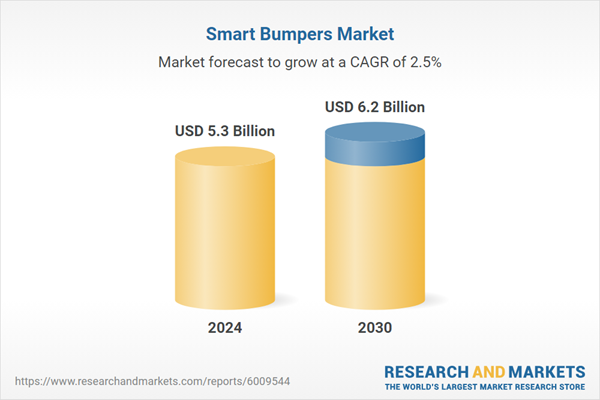

| Report Attribute | Details |

|---|---|

| No. of Pages | 123 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 5.3 Billion |

| Forecasted Market Value ( USD | $ 6.2 Billion |

| Compound Annual Growth Rate | 2.5% |

| Regions Covered | Global |