The Germany market dominated the Europe Generative AI In Financial Services Market by Country in 2023, and is expected to continue to be a dominant market till 2031; thereby, achieving a market value of USD1.33 billion by 2031. The UK market is exhibiting a CAGR of 37.1% during 2024-2031. Additionally, the France market would experience a CAGR of 39.5% during 2024-2031.

Generative AI can assess creditworthiness more comprehensively by generating alternative credit scoring models. It can analyze a wider array of data points, including non-traditional indicators such as social media behavior and transaction patterns, providing a more nuanced view of an individual’s credit risk. Generative AI can power advanced chatbots that provide real-time financial coaching. These chatbots can generate personalized financial advice based on users’ current financial situations and goals, making financial literacy accessible and empowering customers to make informed decisions.

The adoption of Generative AI in financial services market is gaining momentum as institutions recognize its transformative potential. Financial institutions face stringent regulatory requirements. Generative AI helps automate compliance processes, generating reports and risk assessments that meet regulatory standards. This reduces the burden of manual compliance and enhances the institution’s ability to mitigate risks proactively.

The rising trend of digital banking and mobile payments in Europe significantly boosts the demand for Generative AI applications. As consumers increasingly expect seamless and personalized digital experiences, financial institutions must leverage AI technologies to meet these expectations. By utilizing Generative AI to analyze customer behavior and preferences, banks can offer tailored financial products and services, improving customer satisfaction and loyalty in an increasingly competitive market. In conclusion, expanding the BFSI sector in Europe creates a dynamic landscape for Generative AI in financial services market. Combining increased financial services exports, improving profitability in traditional banking, and a thriving fintech ecosystem positions Europe at the forefront of AI adoption in finance.

List of Key Companies Profiled

- Amazon Web Services, Inc.

- Google LLC

- IBM Corporation

- Intel Corporation

- Microsoft Corporation

- Salesforce, Inc.

- OpenAI, LLC

- SAP SE

- Oracle Corporation

- Accenture PLC

Market Report Segmentation

By Deployment

- Cloud-based

- On-premises

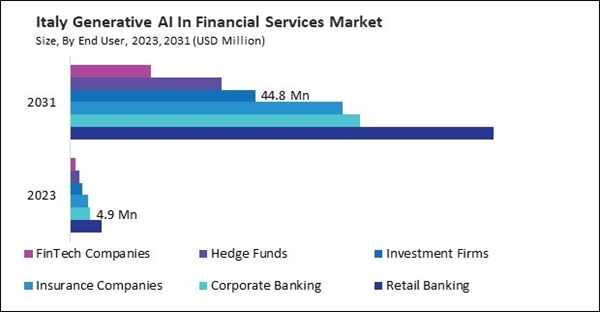

By End User

- Retail Banking

- Corporate Banking

- Insurance Companies

- Investment Firms

- Hedge Funds

- FinTech Companies

By Application

- Risk Management

- Fraud Detection

- Credit Scoring

- Forecasting & Reporting

- Customer Service & Chatbots

By Country

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

Table of Contents

Companies Mentioned

Some of the key companies in the Europe Generative AI In Financial Services Market include:- Amazon Web Services, Inc.

- Google LLC

- IBM Corporation

- Intel Corporation

- Microsoft Corporation

- Salesforce, Inc.

- OpenAI, LLC

- SAP SE

- Oracle Corporation

- Accenture PLC