The Germany market dominated the Europe Generative AI in BFSI Market by Country in 2023, and is expected to continue to be a dominant market till 2031; thereby, achieving a market value of $554.7 Million by 2031. The UK market is expected to witness a CAGR of 31.3% during 2024-2031. Additionally, the France market would register a CAGR of 33.8% during 2024-2031.

The consumer experience is one of the most apparent effects of generative AI in BFSI. Customers' expectations for financial services have also evolved as they become accustomed to rapid, on-demand services in other industries. Generative AI helps banks, insurers, and financial firms meet these demands by powering intelligent virtual assistants, personalized product recommendations, and chatbots that deliver real-time, conversational support.

For example, through generative AI, financial firms can create highly personalized customer interactions, tailoring recommendations and advice to individual preferences and past behaviors. This level of personalization not only enhances the customer experience but also deepens engagement, as customers feel that their financial needs are being met in a uniquely tailored manner. Studies indicate that companies using AI to personalize customer interactions report higher satisfaction rates and stronger customer loyalty. With AI handling routine inquiries and providing personalized advice, human staff can focus on more complex client needs, thus improving service efficiency and customer trust.

Austria's financial sector increasingly integrates generative AI technologies to enhance operational efficiency and customer service. A notable example is Raiffeisen Bank International (RBI), which has implemented AI-driven chatbots to provide personalized customer support, streamline interactions, and improve user experience. Austria’s banking sector also showed resilience, with a 10% year-on-year rise in aggregated operating profit in 2021, paired with a significant 60% decrease in risk provisioning. Total profits rose to €6.1 billion, signaling a strong post-pandemic recovery.

The Austrian government's support for digital innovation, including initiatives like the "Artificial Intelligence Mission Austria 2030," further encourages the adoption of AI in financial services, fostering a conducive environment for technological advancement in the sector. Hence, the region will present lucrative opportunities for market growth.

List of Key Companies Profiled

- Accenture PLC

- SAS Institute Inc.

- Google LLC

- Salesforce, Inc.

- Microsoft Corporation

- Adobe, Inc.

- OpenAI, LLC

- IBM Corporation

- NVIDIA Corporation

- Intel Corporation

Market Report Segmentation

By End-User

- Banks

- Insurance Companies

- Financial Service Providers

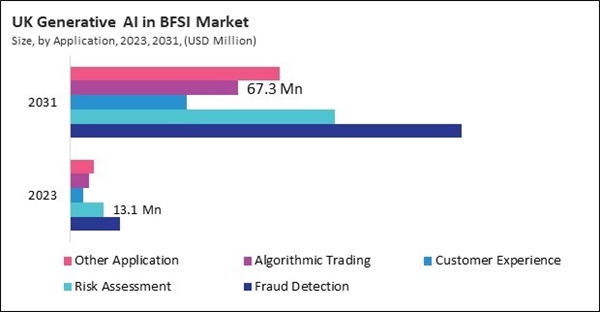

By Application

- Fraud Detection

- Risk Assessment

- Customer Experience

- Algorithmic Trading

- Other Application

By Country

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

Table of Contents

Companies Mentioned

- Accenture PLC

- SAS Institute Inc.

- Google LLC

- Salesforce, Inc.

- Microsoft Corporation

- Adobe, Inc.

- OpenAI, LLC

- IBM Corporation

- NVIDIA Corporation

- Intel Corporation