Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Despite these clear benefits, the market faces significant impediments due to the substantial initial capital expenditure needed to transition from legacy infrastructure to continuous systems. The complex integration of process analytical technology and the necessity for specialized technical expertise create high barriers to entry, particularly for smaller contract manufacturing organizations. Furthermore, while regulatory alignment is improving, the financial strain of validating new continuous lines while retiring fully depreciated batch facilities remains a major hurdle that could delay widespread adoption within the generic drug sector.

Market Drivers

Technological Advancements in Continuous Flow Chemistry and Automation are fundamentally reshaping the industry by facilitating the creation of highly integrated, scalable production facilities that supersede fragmented batch operations. These sophisticated systems minimize human intervention and support digital-first processing strategies, which are critical for handling the volume and complexity of contemporary small molecule portfolios. This shift towards automated platforms encourages the replacement of legacy infrastructure with facilities offering enhanced process control and speed; for instance, Eli Lilly announced in September 2024 that it has allocated $1.8 billion to expand its manufacturing footprint in Ireland, specifically utilizing continuous manufacturing technology to produce complex active ingredients.The focus on Environmental Sustainability and Green Chemistry represents a second crucial driver, as the industry aims to dissociate production volume from environmental impact through process intensification. Continuous manufacturing notably reduces process mass intensity by recycling solvents and minimizing energy consumption during steady-state operations, providing a clear route to net-zero goals. According to the American Chemical Society in March 2024, Boehringer Ingelheim achieved a 99% reduction in organic solvent use and a 76% drop in water consumption by implementing continuous flow synthesis for a common intermediate. This transition is scaling rapidly, with WuXi AppTec reporting in 2024 that their flow chemistry platform successfully manufactured over 400 compounds and 30 late-phase commercial drugs, highlighting the widespread industrial adoption of these green technologies.

Market Challenges

The substantial initial capital expenditure necessary to switch from legacy infrastructure to continuous systems serves as a significant obstacle to market growth. This financial hurdle is especially acute for smaller contract manufacturing organizations that lack the resources to absorb the costs associated with integrated process analytical technology and specialized technical expertise. Consequently, the market remains divided; while well-capitalized pharmaceutical giants can utilize these advanced workflows to enhance speed and quality, smaller entities are often restricted to traditional batch methods, effectively limiting the technology's expansion into the generic drug sector.Moreover, the financial burden extends beyond the acquisition of new equipment to include the economic consequences of retiring fully depreciated batch facilities. The requirement to write off functional assets while simultaneously funding the validation of new continuous lines acts as a deterrent for established manufacturers. According to the Drug, Chemical & Associated Technologies Association (DCAT) in 2024, leading pharmaceutical companies announced manufacturing investments exceeding $6.8 billion to build advanced production networks, highlighting the massive capital intensity required to modernize infrastructure. This prohibitive cost structure restricts competitive entry and slows the widespread replacement of batch processing globally.

Market Trends

The expansion of continuous flow services by Contract Manufacturing Organizations (CDMOs) is democratizing access to continuous manufacturing for developers who lack the resources for dedicated facilities. By incorporating flow capabilities, CDMOs enable companies to utilize efficiency benefits without facing prohibitive capital expenditures, a shift that is driving infrastructure investments aimed at increasing global capacity for complex production. For example, SK pharmteco announced in September 2024 a commitment of $260 million to construct a new facility in South Korea to enhance its small molecule capabilities, directly addressing the industry demand for outsourced advanced manufacturing solutions.Additionally, the utilization of flow chemistry for hazardous and high-energy reactions is promoting the adoption of continuous processing for ingredients that are unsafe to synthesize using traditional batch methods. Continuous reactors offer superior process control, allowing for the safe management of extreme conditions often necessitated by modern complex chemistries and enabling reactions previously deemed unscalable. In October 2024, Sterling Pharma Solutions announced a partnership with Soligenix to manufacture an oncology-targeted API, deploying a customized flow reactor for synthetic hypericin; the company explicitly noted that the chemistry relies on flow processing to achieve the required photointensity, validating the essential role of continuous systems in enabling high-energy synthesis routes.

Key Players Profiled in the Continuous Manufacturing for Small Molecule APIs Market

- Pfizer Inc.

- GSK PLC

- Vertex Pharmaceuticals Incorporated

- Abbvie Inc.

- Sterling Pharma Solutions Limited

- Evonik Industries AG

- Cambrex Corporation

- Asymchem Inc.

- Thermo Fisher Scientific Inc.

- Corning Incorporated

Report Scope

In this report, the Global Continuous Manufacturing for Small Molecule APIs Market has been segmented into the following categories:Continuous Manufacturing for Small Molecule APIs Market, by Equipment:

- Reactors

- Crystallizers

- Filtration Systems

- Mixers

- Heat Exchangers

- Others

Continuous Manufacturing for Small Molecule APIs Market, by Unit Operation:

- Synthesis

- Separation & Purification

- Drying

Continuous Manufacturing for Small Molecule APIs Market, by Type:

- Generic APIs

- Innovative APIs

Continuous Manufacturing for Small Molecule APIs Market, by End Use:

- CMOs/CDMOs

- Pharmaceutical Companies

- Academic & Research Institutes

Continuous Manufacturing for Small Molecule APIs Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Continuous Manufacturing for Small Molecule APIs Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Continuous Manufacturing for Small Molecule APIs market report include:- Pfizer Inc.

- GSK PLC

- Vertex Pharmaceuticals Incorporated

- Abbvie Inc.

- Sterling Pharma Solutions Limited

- Evonik Industries AG

- Cambrex Corporation

- Asymchem Inc.

- Thermo Fisher Scientific Inc.

- Corning Incorporated

Table Information

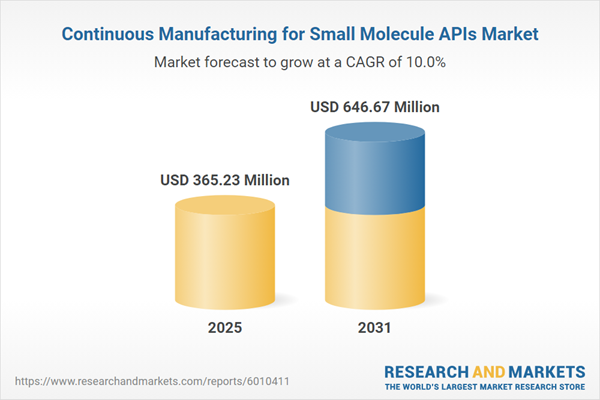

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 365.23 Million |

| Forecasted Market Value ( USD | $ 646.67 Million |

| Compound Annual Growth Rate | 9.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |