Rapid urbanization in China and India has led to more pet-friendly apartments and housing. Urban dwellers often seek convenient and premium pet products, including snacks and treats, to accommodate their pets’ needs in smaller living spaces. Consequently, the Asia Pacific region would acquire nearly 22% of the total market share by 2031. Also, the Chinese supermarkets would register a volume of 88.25 kilo tonnes by 2031.

The major strategies followed by the market participants are Product launches as the key developmental strategy to keep pace with the changing demands of end users. For instance, in August, 2024, Wellness Pet Company introduces new products, featuring protein-rich cat food, comprehensive dog supplements, and dental treats. These innovations focus on improving pet wellbeing by addressing hydration, overall health, and providing diverse, flavourful options. Moreover, in June, 2024, ADM launched seven functional pet treat and supplement formulas in Europe, catering to the growing demand for pet wellness products. These science-backed offerings, including soft chews and supplements, support various aspects of pet health, such as digestion, mobility, and skin care.

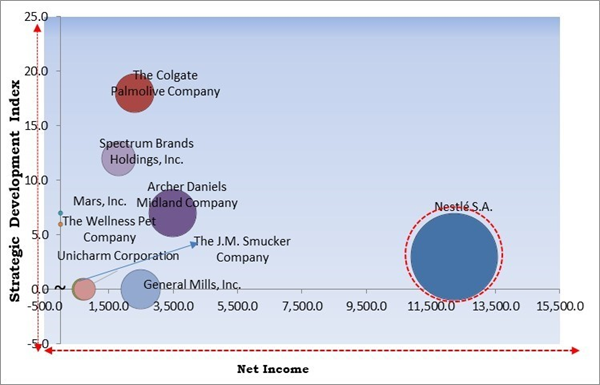

The Cardinal Matrix - Market Competition Analysis

Based on the Analysis presented in the Cardinal matrix; Nestlé S.A. is the forerunners in the Market. In November, 2020, Nestlé Purina has unveiled a new line of pet food featuring alternative proteins to enhance sustainability and optimize resource use. This innovative range incorporates insect proteins and plant-based proteins from fava beans and millet. The new offerings are designed to meet the diverse nutritional needs of both cats and dogs while promoting environmental responsibility. Companies such as The Colgate Palmolive Company and Spectrum Brands Holdings, Inc. are some of the key innovators in Market.

Market Growth Factors

As pet owners become more informed about their pets' nutritional needs, they seek snacks and treats that contribute to their pets’ overall health. Pet owners are becoming more conscious of what they feed their pets, leading to a higher demand for transparency in product labelling. Therefore, growing pet health and nutrition awareness drives the market's growth.E-commerce platforms have made it easier for consumers to access various snacks and treats from the comfort of their homes. Consumers can locate products that correspond to their canines' requirements through sophisticated search algorithms and personalized recommendations, which are frequently implemented by e-commerce platforms. In conclusion, the expansion of the global e-commerce industry is driving the market's growth.

Market Restraining Factors

Premium snacks and treats often use high-quality ingredients, such as organic, natural, or specially formulated components. The high cost of premium ingredients can limit the market reach of certain snacks and treats. Products priced significantly higher than standard alternatives may only appeal to a niche market segment willing to pay a premium for perceived quality or health benefits. Thus, premium ingredients and production costs hamper the market's growth.Driving and Restraining Factors

Drivers

- Growing awareness of pet health and nutrition

- Expansion of e-commerce industry globally

- Increasing pet ownership worldwide

Restraints

- High costs of premium ingredients and production

- Rising concerns about pet food safety and recalls

Opportunities

- Increased veterinary recommendations and professional endorsements

- Increasing disposable income globally

Challenges

- Adapting to rapidly changing consumer preferences

- Rising raw material costs

Product Outlook

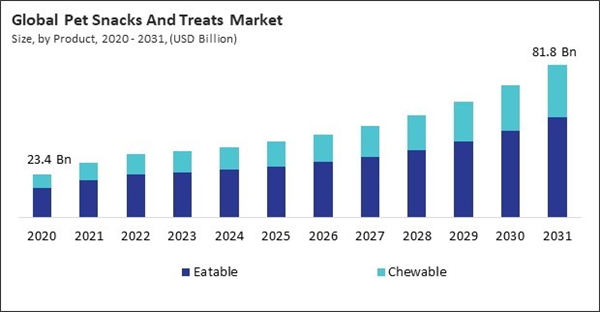

Based on product, the market is divided into eatable and chewable. The chewable segment attained 33% revenue share in the market in 2023. In terms of the volume, the segment registered 340.62 kilo tonnes in 2023. Chewable treats are specifically designed to promote dental hygiene in pets. These treats help reduce plaque and tartar buildup, freshen breath, and strengthen gums.Pet Type Outlook

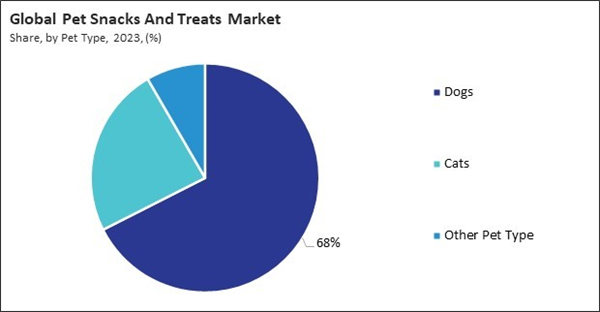

On the basis of pet type, the market is segmented into dogs, cats, and others. In 2023, the cats segment attained 24% revenue share in the market. There is increasing awareness and concern about specific cat health conditions, such as kidney disease, diabetes, and obesity. Treats formulated to address these conditions, such as low-calorie or high-moisture options, are becoming more popular as owners seek products that support their cats’ specific health needs.Distribution Channel Outlook

By distribution channel, the pet snacks and treats market is divided into supermarkets and hypermarkets, pet specialty stores, online, and others. The supermarkets and hypermarkets segment procured 33% revenue share in the pet snacks and treats market in 2023. In terms of volume, the segment registered 528.34 kilo tonnes in 2023. Supermarkets and hypermarkets offer a convenient one-stop shopping experience where consumers can purchase pet snacks and treats alongside regular groceries. This convenience encourages frequent purchases, increasing demand for these products.By Regional Analysis

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America region witnessed 49% revenue share in the market in 2023. There are some of the highest ownerships of pet’s rates globally in North America, particularly in the United States and Canada. With a significant proportion of households having pets, demand for pet snacks and treats is naturally high.Market Competition and Attributes

The pet snacks and treats market is highly competitive, driven by increasing pet humanization and premium product demand. Key players like Nestle Purina and Mars Petcare dominate, while new entrants focus on innovation and quality. E-commerce growth and consumer preference for natural ingredients further intensify the competition.

Recent Strategies Deployed in the Market

- Sep-2024: Mars, Inc. came into partnership with Big Idea Ventures and Bühler Group to unveil the Next Generation Pet Food Program, designed to advance innovation in sustainable pet food. This initiative will be held online, with participants showcasing their innovations at the International AgriFood Week in Singapore.

- Jun-2024: Hill's Pet Nutrition and Colgate-Palmolive have teamed up with The Street Dog Coalition to improve care for unhoused individuals and their pets. The collaboration offers free pet food, oral health products, and veterinary services, supported by a new RV for rural areas.

- May-2024: Mars, Inc. has announced a partnership with Tripadvisor to launch a Pet Travel Hub, aimed at improving travel experiences for pet owners. This collaboration supports pet-friendly businesses and introduces Tripadvisor’s Pet-Friendly Hotel Travelers’ Choice Awards, aligning with Mars' commitment to fostering a dog-friendly world.

- Sep-2023: Spectrum Brands Holdings, Inc. has reached an agreement to acquire Procter and Gamble’s European pet food business, which includes the IAMS® and Eukanuba® brands. this acquisition will strengthen Spectrum Brands' presence in the European pet food sector.

- Aug-2022: Colgate-Palmolive Company announced its acquisition of three pet food manufacturing plants from Red Collar Pet Foods. This strategic move is intended to support the expansion of Colgate-Palmolive's Hill's Pet Nutrition business and reinforce its commitment to global growth in the pet food industry.

List of Key Companies Profiled

- Archer Daniels Midland Company

- Mars, Inc.

- Nestlé S.A.

- The Colgate Palmolive Company

- General Mills, Inc.

- The Wellness Pet Company (Clearlake Capital Group, L.P.)

- Spectrum Brands Holdings, Inc.

- The J.M. Smucker Company

- Unicharm Corporation

- Diamond Pet Foods, Inc.

Market Report Segmentation

By Product (Volume, Kilo Tonnes, USD Billion, 2020-2031)

- Eatable

- Chewable

By Pet Type (Volume, Kilo Tonnes, USD Billion, 2020-2031)

- Dogs

- Cats

- Other Pet Type

By Distribution Channel (Volume, Kilo Tonnes, USD Billion, 2020-2031)

- Pet Specialty Stores

- Supermarkets and Hypermarkets

- Online

- Other Distribution Channel

By Geography (Volume, Kilo Tonnes, USD Billion, 2020-2031

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

Some of the key companies profiled in this Pet Snacks and Treats market report include:- Archer Daniels Midland Company

- Mars, Inc.

- Nestlé S.A.

- The Colgate Palmolive Company

- General Mills, Inc.

- The Wellness Pet Company (Clearlake Capital Group, L.P.)

- Spectrum Brands Holdings, Inc.

- The J.M. Smucker Company

- Unicharm Corporation

- Diamond Pet Foods, Inc.