Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Financial performance metrics underscore the industry's significant economic scale and resilience. Data from Cosmetics Europe indicates that the European cosmetics market achieved a total retail value of €103.9 billion in 2024. Despite this success, the sector encounters considerable hurdles due to complex and varying regulatory standards across international borders. These divergent requirements regarding ingredient safety protocols increase operational expenses and hinder rapid market entry, posing a persistent challenge to global expansion efforts.

Market Drivers

The widespread "skinification" of hair and body care has fundamentally transformed consumer expectations, pushing the market toward clinically validated, ingredient-driven formulations. This movement treats the scalp and body with the same level of care and active ingredients - such as hyaluronic acid and ceramides - that were traditionally limited to facial skincare. As consumers prioritize functional benefits and skin health over simple aesthetics, demand for science-backed products has risen sharply. This structural shift is reflected in the strong performance of specialized divisions; for instance, Beiersdorf's 2024 Annual Report, released in March 2025, noted that its Derma business unit, which includes brands like Aquaphor and Eucerin, secured 10.6% organic sales growth for the fiscal year.In parallel, the growing preference for luxury and premium cosmetic segments serves as a key value driver, showing notable resilience against broader economic instability. Consumers continue to view prestige beauty and high-end fragrances as essential investments in well-being and affordable luxuries. This momentum in the upper market tier is evident in the results of industry leaders; LVMH's 2024 Financial Results from January 2025 reported a 4% organic revenue increase for its Perfumes & Cosmetics group. Furthermore, the immense scale of top-tier companies reinforces the market's economic weight, with L'Oreal reporting full-year 2024 sales of 43.48 billion euros in February 2025.

Market Challenges

Divergent regulatory standards across nations act as a major non-tariff barrier, constraining the expansion of the Global Cosmetic Products Market. To achieve global distribution, companies must maneuver through a fragmented environment where different jurisdictions impose conflicting protocols on safety testing, labeling, and ingredient allowability. This lack of harmonization forces manufacturers to create multiple product variations to meet local requirements, undermining economies of scale and driving up research and development costs. As a result, the high cost of compliance siphons capital from innovation, squeezing profit margins and retarding new market entry.The consequences of these regulatory obstacles are intensified by the industry's dependence on international trade. Delays in obtaining pre-market approvals caused by inconsistent compliance hurdles can strip manufacturers of competitive advantages in fast-paced consumer markets. The economic implications of navigating these strict inspections are significant; Cosmetics Europe reported that total exports of personal care and cosmetic products from Europe amounted to €29.4 billion in 2024. These massive export volumes illustrate how regulatory bottlenecks add operational complexity and endanger global supply chain efficiency, ultimately impeding broader market growth.

Market Trends

The integration of AI-powered diagnostics and hyper-personalization is revolutionizing the industry, allowing brands to provide customized product recommendations derived from granular consumer data. By utilizing augmented reality and machine learning algorithms to assess individual skin conditions, companies are moving away from generic products toward scientifically tailored regimens that enhance customer engagement and conversion. This transition from mass production to data-led curation enables scalable personalization, which improves user experience and lowers return rates for digital-first players. For example, Oddity Tech’s Third Quarter 2025 Financial Results, released in November 2025, revealed that its AI-driven beauty platform generated $148 million in net revenue, marking a 24% year-over-year increase.Concurrently, the move toward biotechnology-derived and lab-grown ingredients is accelerating as manufacturers look for sustainable substitutes for resource-heavy natural raw materials. Through cellular agriculture and fermentation, suppliers are creating high-purity active ingredients that avoid biodiversity depletion and the supply chain instability linked to harvesting cycles and climate change. These scientific advancements guarantee consistent safety and efficacy while attracting environmentally conscious consumers, thereby fueling demand for bio-engineered components. Highlighting this trend, Givaudan’s 2024 Full Year Results in January 2025 reported an 11.1% like-for-like sales increase in its Fragrance Ingredients and Active Beauty unit, driven by these innovations.

Key Players Profiled in the Cosmetic Products Market

- Coty Inc.

- L'Oreal S.A.

- The Estee Lauder Companies Inc.

- Revlon Consumer Products LLC

- The Avon Company

- Unilever PLC

- Shiseido Company, Limited

- Godrej & Boyce Manufacturing Company Limited

- The Procter & Gamble Company

- Beiersdorf AG

Report Scope

In this report, the Global Cosmetic Products Market has been segmented into the following categories:Cosmetic Products Market, by Product Type:

- Skin Care

- Hair Care

- Makeup

- Fragrance

Cosmetic Products Market, by End User:

- Men

- Women

Cosmetic Products Market, by Distribution Channel:

- Offline

- Online

Cosmetic Products Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Cosmetic Products Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Cosmetic Products market report include:- Coty Inc.

- L'Oreal S.A.

- The Estee Lauder Companies Inc.

- Revlon Consumer Products LLC

- The Avon Company

- Unilever PLC

- Shiseido Company, Limited

- Godrej & Boyce Manufacturing Company Limited

- The Procter & Gamble Company

- Beiersdorf AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

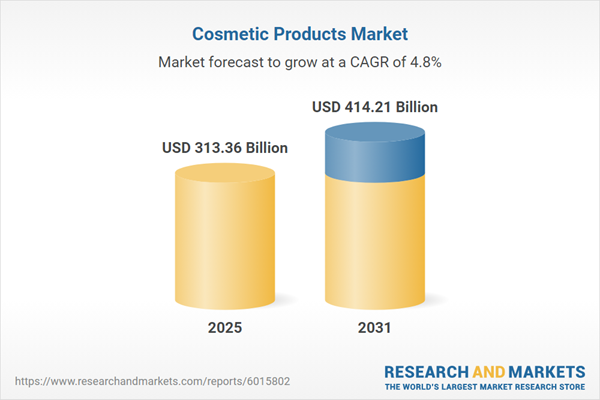

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 313.36 Billion |

| Forecasted Market Value ( USD | $ 414.21 Billion |

| Compound Annual Growth Rate | 4.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |