Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Simultaneously, the relentless surge in air passenger numbers globally further amplifies the urgency for robust and efficient passenger service management systems. As more individuals opt for air travel, the demand for streamlined processes, from booking to boarding, escalates. This necessitates the adoption of cutting-edge PSS technologies that can accommodate the increased volume of passengers without compromising on service quality.

Moreover, the democratization of air travel, propelled by the availability of budget-friendly options, has democratized access to flight tickets across a broader spectrum of consumers. This democratization, fueled by rising consumer incomes and the prevalence of affordable air travel alternatives, has engendered a more inclusive aviation landscape, where air travel is increasingly within reach for diverse socioeconomic segments. Consequently, the demand for robust PSS solutions becomes imperative, ensuring that airlines can cater to the diverse needs of this expanding passenger base while maintaining operational efficiency and service excellence.

Key Market Drivers

Technological Advancements

Technological advancements stand as a primary driver propelling the growth of the Global Passenger Service System (PSS) market. In an era of rapid digital transformation, airlines are increasingly relying on cutting-edge technologies to enhance their operations, streamline passenger services, and deliver a superior travel experience. One of the most significant impacts of technological progress on the PSS market is the integration of cloud computing. Cloud-based PSS solutions offer airlines scalability, flexibility, and cost-efficiency. They enable real-time data access, which is invaluable for managing passenger information, reservations, and flight schedules. Furthermore, cloud technology facilitates data analytics and the utilization of artificial intelligence (AI) and machine learning algorithms to enhance predictive analytics and decision-making.Mobile apps have also become indispensable in the airline industry, and PSS systems are at the heart of this trend. These apps enable passengers to easily book flights, check-in, access boarding passes, and receive real-time updates. Airlines utilize mobile apps to offer personalized services, such as seat selection and in-flight entertainment, increasing customer satisfaction and loyalty. Artificial intelligence and machine learning are revolutionizing PSS capabilities. These technologies are being used to predict passenger behavior, optimize pricing strategies, and even predict maintenance needs for aircraft. AI-driven chatbots and virtual assistants are becoming common for handling customer inquiries, improving response times, and reducing the workload on customer support teams.

Data analytics, another technological frontier, empowers airlines to gain insights into passenger preferences and travel patterns. By analyzing this data, airlines can refine their offerings and marketing strategies, ultimately increasing revenue and customer satisfaction. Furthermore, the utilization of biometrics and facial recognition technology at airports is enhancing security and expediting passenger processing. PSS systems play a central role in integrating these technologies seamlessly into the travel experience.

The COVID-19 pandemic has accelerated the adoption of contactless solutions and health screening technologies, and PSS systems have been instrumental in implementing these changes. Airlines have rapidly integrated health-related data and screening procedures into their passenger processing workflows. In conclusion, technological advancements are redefining the passenger service landscape, and PSS providers are at the forefront of this evolution. The ability to leverage cloud computing, mobile apps, AI, and data analytics is not only enhancing operational efficiency but is also significantly elevating the passenger experience. As the global PSS market continues to innovate, it is poised for substantial growth as airlines recognize the pivotal role of technology in meeting the evolving needs and expectations of travelers.

Rising Air Travel Demand

The rising demand for air travel is a pivotal factor that is expected to significantly drive the growth of the Global Passenger Service System (PSS) market. This increasing demand can be attributed to several factors, including a growing global middle class, urbanization, and a burgeoning tourism industry. As more people seek to explore new destinations, visit family and friends, or conduct business internationally, the aviation sector is experiencing a surge in passenger numbers. In response to this escalating demand, airlines are actively seeking ways to enhance their operational efficiency and passenger experience. PSS solutions are central to achieving these objectives. These systems offer airlines the tools needed to manage passenger bookings, check-ins, seat reservations, and other vital services efficiently and with a strong focus on customer satisfaction.Moreover, the modern traveler expects a seamless and personalized journey. PSS systems play a pivotal role in meeting these expectations by enabling airlines to tailor services to individual preferences. From offering personalized in-flight entertainment choices to ensuring special dietary requirements are met, PSS systems enhance the passenger experience, which can lead to increased customer loyalty and repeat business. As airlines grapple with the complexities of international travel, connecting flights, and adherence to stringent regulatory requirements, PSS systems prove indispensable. They streamline the booking process, handle the intricacies of multi-leg journeys, and ensure compliance with various laws, particularly in areas such as data protection and security.

The COVID-19 pandemic further underscored the importance of PSS solutions. The need for contactless check-in, health screening, and real-time updates became paramount for passenger safety. Airlines have turned to PSS systems to adapt and meet these new requirements, underlining the critical role these systems play in the industry's resilience and ability to respond to evolving challenges. In essence, the surge in air travel demand is not only boosting the profitability of airlines but is also creating a robust market for PSS providers. The ability to efficiently manage and cater to the needs of a growing number of passengers is a competitive advantage in the aviation industry, and PSS systems are at the forefront of this evolution. As the global passenger service system market continues to evolve and innovate, it is well-positioned to capitalize on the ever-increasing demand for air travel.

Key Market Challenges

Data Privacy and Security

Data privacy and security concerns represent a significant challenge for the Global Passenger Service System (PSS) market. While PSS systems are integral to the functioning of the airline industry, they handle vast amounts of sensitive passenger data, including personal information, payment details, travel itineraries, and more. As the digital landscape becomes increasingly complex and cyber threats more sophisticated, the need to safeguard this data from breaches and misuse has become paramount. Here's how data privacy and security challenges can potentially hamper the PSS market, Regulatory Compliance: PSS providers and airlines must adhere to a multitude of data protection regulations, including the European Union's General Data Protection Regulation (GDPR) and various national laws. The cost and effort required to maintain compliance can be substantial, and non-compliance can result in severe fines.Data Breaches: High-profile data breaches in various industries have highlighted the vulnerability of personal data. In the airline industry, a data breach involving passenger information can have far-reaching consequences, including financial losses, damage to reputation, and potential legal action. Cybersecurity Threats: The airline industry is an attractive target for cybercriminals due to the wealth of valuable information it holds. PSS systems are constantly under threat from hacking attempts, ransomware attacks, and other cybercrimes that can disrupt operations and compromise passenger data. Data Sharing and Integration: Airlines often rely on multiple systems and third-party providers to deliver a seamless passenger experience. This complexity increases the risk of data leaks or vulnerabilities at various points within the system.

Supply Chain Vulnerabilities: PSS providers may rely on third-party vendors for various components of their systems, and these vendors can introduce security risks if not adequately vetted. Insider Threats: Insider threats, whether deliberate or accidental, can pose a significant risk to data privacy. Employees with access to sensitive data may compromise it intentionally or unintentionally. Technical Challenges: Implementing robust security measures within PSS systems can be technically challenging. It requires ongoing investments in cybersecurity technology and expertise to stay ahead of evolving threats.

Impact on Passenger Trust: Breaches and data mishandling incidents can erode passenger trust. Passengers may be less inclined to share their data or engage with digital services if they are concerned about the security of their personal information. Operational Disruption: As airlines and PSS providers strive to enhance security, they may introduce measures that, if not carefully managed, could disrupt operations or lead to slower passenger processing times.

To address these challenges, PSS providers and airlines need to prioritize data security and privacy at every level of their operations. This includes implementing robust cybersecurity measures, regularly updating and patching systems, conducting employee training, and proactively monitoring for potential threats. Collaboration with regulators and cybersecurity experts is crucial to staying ahead of evolving threats and maintaining the trust of passengers. Failure to do so can not only hamper the growth of the PSS market but also result in severe consequences for the airline industry as a whole.

Integration Complexity

Integration complexity stands as a significant challenge that could potentially hamper the growth and efficiency of the Global Passenger Service System (PSS) market. PSS solutions are central to an airline's operations, encompassing a wide range of critical functions, from reservations and ticketing to check-in, boarding, baggage handling, and customer relationship management.The integration of these systems with various other components, both within the airline's infrastructure and with external stakeholders, is vital for a seamless passenger experience. However, this integration process can be fraught with difficulties that affect the PSS market in several ways, Legacy Systems and Heterogeneity: Many airlines operate with a mix of legacy and modern systems, creating a heterogeneous IT environment. Integrating these disparate systems can be time-consuming and expensive. Legacy systems are often inflexible and lack the application programming interfaces (APIs) necessary for seamless integration with new PSS solutions.

Third-Party Services: Airlines rely on third-party service providers for various functions, such as payment processing, customer relationship management, and baggage handling. Coordinating the integration of these services with the PSS can be challenging, as they may have different technology stacks and data formats. Data Transfer and Synchronization: Effective integration necessitates real-time data transfer and synchronization. Any delays or data discrepancies can result in operational disruptions, causing flight delays, missed connections, and passenger dissatisfaction.

Scalability and Performance: As airlines grow and expand their routes and services, the PSS must scale to accommodate increased demands. Ensuring that integrated systems can scale seamlessly while maintaining performance and reliability is a complex task. Regulatory Compliance: Integration efforts must also consider compliance with various aviation and data protection regulations. This adds layers of complexity as airlines must ensure that data transferred between systems adheres to these regulations. Vendor Dependencies: Airlines may become dependent on PSS vendors for ongoing integration and support. This can lead to vendor lock-in and limited flexibility in adapting to changing needs or technology trends.

Operational Disruptions: During the integration process or as a result of integration-related issues, airlines may experience operational disruptions, including flight delays and cancellations, which can have serious financial and reputational consequences.

Cost Implications: The cost of integration, including software development, testing, and training, can be substantial. Smaller airlines may struggle to invest in these efforts, potentially limiting their competitiveness and growth. Innovation Delays: The complexity of integration can slow down the implementation of innovative features and services that passengers increasingly expect. Airlines must balance the need for integration with the need to stay technologically competitive.

Addressing integration complexity is essential for the PSS market to thrive. Airlines and PSS providers must focus on developing robust APIs, embracing modern integration technologies like microservices, and ensuring that legacy systems are gradually phased out or updated. Collaborative industry efforts and standards can also streamline integration processes. By overcoming these challenges, the PSS market can continue to adapt and deliver the seamless passenger experience that modern traveler demand.

Legacy Systems

Legacy systems pose a significant hindrance to the growth and evolution of the Global Passenger Service System (PSS) market. These outdated, often decades-old, software and hardware components have proven to be a major bottleneck for airlines and PSS providers, impeding their ability to adapt to the rapidly changing demands of the modern aviation industry. Here are some ways in which legacy systems hamper the PSS market, Inflexibility and Outdated Technology: Legacy systems are typically inflexible and unable to accommodate the agility required in today's aviation landscape. They lack the modern technology and architecture necessary for efficiently managing passenger services, data, and other essential functions.High Maintenance Costs: Legacy systems are costly to maintain and repair. A significant portion of an airline's IT budget is often allocated to keeping these systems operational, leaving limited resources for innovation and technological advancements. Incompatibility with Modern Technologies: Legacy systems are incompatible with newer technologies and platforms. This hinders the integration of mobile apps, cloud computing, big data analytics, and artificial intelligence - all of which are integral for enhancing the passenger experience and operational efficiency. Data Silos and Fragmentation: Data in legacy systems is typically stored in isolated silos, making it difficult to access and analyze. This fragmentation hinders airlines' ability to gain insights into passenger behavior and preferences.

Slow Response to Market Changes: The aviation industry is dynamic, with changing passenger expectations, regulatory requirements, and market conditions. Legacy systems cannot keep up with these changes, slowing down an airline's ability to respond to new opportunities and challenges. Security Risks: Older systems are more susceptible to security vulnerabilities and breaches. They lack the robust security measures needed to protect passenger data from cyber threats.

Integration Challenges: Integrating legacy systems with modern components is a complex and costly endeavor. This can lead to operational disruptions, increased risk, and higher costs. Scalability Issues: As airlines expand and their passenger volumes grow, legacy systems may struggle to scale efficiently. This can lead to performance bottlenecks and operational difficulties.

Customer Dissatisfaction: Passengers now expect a seamless and personalized travel experience. Legacy systems may not support the level of personalization and real-time services that modern travelers demand, resulting in customer dissatisfaction. Competitive Disadvantage: Airlines burdened with legacy systems may find it challenging to compete with more technologically agile rivals. This can impact their market position and profitability.

Addressing the challenges posed by legacy systems is a complex and costly process, but it is essential for the PSS market's growth and the continued competitiveness of airlines. Modernization efforts often involve gradual transitions, system updates, and migrating to cloud-based solutions. Collaboration between airlines and PSS providers, industry-wide standards, and government incentives can play a crucial role in facilitating the necessary upgrades, ultimately ensuring the PSS market can adapt to meet the ever-evolving demands of the aviation industry.

Key Market Trends

Data-Driven Decision Making

Data-driven decision making is emerging as a key driver behind the growth of the Global Passenger Service System (PSS) market. As the airline industry becomes increasingly competitive and dynamic, harnessing data for strategic and operational insights has become crucial for airlines to enhance passenger experiences and optimize operational efficiency.PSS systems play a pivotal role in this shift toward data-driven decision making by collecting, storing, and analyzing vast amounts of passenger-related information. Here's how this trend is driving the PSS market Optimized Operations: PSS systems use data analytics and AI to optimize flight schedules, improve crew management, and enhance resource allocation. This results in streamlined operations, reduced costs, and improved on-time performance.

Demand Forecasting: Airlines use PSS data to forecast demand accurately. This ensures they can adjust capacity, pricing, and services to meet passenger needs, thereby maximizing revenue. Personalization: Data-driven insights enable airlines to tailor services to individual passenger preferences. From seat selections to in-flight entertainment and meal choices, personalization leads to higher customer satisfaction and loyalty. Pricing Strategies: PSS systems leverage data analytics to fine-tune pricing strategies. Airlines can adjust ticket prices dynamically, ensuring competitive fares while maximizing revenue.

Route Optimization: By analyzing historical flight data, PSS systems help airlines optimize routes, minimizing fuel consumption and environmental impact. Resource Management: Data-driven insights enhance the management of aircraft, crew, and ground operations. This leads to more efficient use of resources and cost reductions.

Safety and Compliance: PSS systems assist airlines in adhering to safety and regulatory requirements by providing real-time data and alerts for compliance issues, ensuring passenger safety and regulatory adherence. Competitive Advantage: Airlines that effectively leverage data-driven decision making are gaining a competitive edge. They can adapt to market changes more quickly, anticipate passenger trends, and offer innovative services. As the demand for enhanced passenger experiences, cost savings, and operational efficiency continues to rise, PSS providers are focusing on developing and enhancing their data analytics capabilities. The ability to effectively collect, process, and apply data-driven insights is becoming a pivotal feature for PSS systems, making them integral to the future of the airline industry.

Segmental Insights

Type Insights

Services segment held the largest market share of Global Passenger Service System market in 2023, driven by several critical factors. Passenger service systems encompass a range of services including reservation management, inventory control, departure control systems, and customer care, which are essential for the smooth operation of airlines and the overall enhancement of passenger experience.One of the primary drivers of this segment's growth is the increasing demand for seamless and efficient travel experiences. Airlines are increasingly outsourcing their PSS operations to specialized service providers to streamline their processes and focus on core business activities. These services ensure that airlines can manage their passenger-related operations effectively, from booking and check-in to boarding and baggage handling, thus enhancing operational efficiency and customer satisfaction.

Technological advancements and the rising adoption of cloud-based solutions are also propelling the growth of the services segment. Cloud-based PSS services offer scalability, flexibility, and cost-efficiency, allowing airlines to adapt quickly to changing market dynamics and passenger demands. These solutions enable real-time data access and integration, facilitating better decision-making and personalized passenger services. The shift towards digitalization and the use of advanced analytics and artificial intelligence further enhance the capabilities of PSS services, driving their adoption.

The growing emphasis on improving passenger engagement and loyalty programs is contributing to the increased demand for comprehensive PSS services. Airlines are investing in sophisticated systems that provide personalized services, frequent flyer programs, and targeted marketing, which help in building stronger relationships with passengers and enhancing brand loyalty.

The competitive landscape of the airline industry also necessitates the adoption of advanced PSS services. Airlines are constantly seeking innovative ways to differentiate themselves and offer superior passenger experiences. By leveraging specialized PSS services, airlines can ensure operational excellence, meet regulatory requirements, and provide a seamless travel experience, which are crucial for maintaining a competitive edge. Services segment is expected to dominate the Passenger Service System market due to the increasing demand for efficient operations, technological advancements, the shift towards cloud-based solutions, and the need for enhanced passenger engagement. These factors collectively ensure that PSS services remain integral to the airline industry's growth and evolution during the forecast period.

Regional Insights

Asia Pacific dominated the Global Passenger Service System Market in 2023. This growth trajectory is underpinned by several key factors, including the region's burgeoning air travel industry, driven by rising disposable incomes, expanding middle-class populations, and increasing urbanization across countries like China, India, and Southeast Asian nations. As more people take to the skies for both business and leisure purposes, airlines in the region are compelled to invest in advanced PSS solutions to meet evolving passenger demands and ensure seamless operations.Technological advancements and digital transformation initiatives are rapidly reshaping the aviation landscape in the Asia Pacific region. Airlines are leveraging cutting-edge PSS platforms to enhance passenger experiences, optimize operational efficiency, and gain competitive advantages in a crowded market. The integration of innovative features such as mobile check-in, self-service kiosks, personalized services, and real-time updates further enriches the travel journey, fostering customer loyalty and satisfaction.

Government initiatives aimed at modernizing airport infrastructure and streamlining air travel processes are driving the adoption of PSS solutions across the Asia Pacific region. Strategic investments in airport expansions, upgrades, and digitalization efforts are facilitating smoother passenger flows, reducing congestion, and elevating overall travel experiences. As airports increasingly prioritize enhancing service quality and efficiency, demand for comprehensive PSS offerings, including reservation systems, check-in solutions, baggage handling, and passenger analytics, is set to soar.

Overall, with its dynamic aviation landscape, rapid technological advancements, and proactive government support, the Asia Pacific region is poised to emerge as a powerhouse in the Passenger Service System Market during the forecast period. As airlines and airports continue to invest in innovative PSS solutions to cater to the evolving needs of travelers, the region is positioned for sustained growth, driving transformative changes in the way air travel is managed and experienced across Asia Pacific.

Key Market Players

- SITA Group

- Amadeus IT Group, S.A.

- Sabre Corporation

- Takeflite Solutions Ltd

- GO7

- Bravo Passenger Solutions Pte. Ltd.

- RTX Corporation

- InteliSys Aviation Systems Inc.

Report Scope:

In this report, the Global Passenger Service System Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Passenger Service System Market, By Type:

- Software

- Services

Passenger Service System Market, By Deployment:

- On-premise

- Cloud

Passenger Service System Market, By Region:

- North America

- United States

- Canada

- Mexico

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Europe

- Germany

- United Kingdom

- France

- Russia

- Spain

- South America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa

- Egypt

- UAE

- Israel

Competitive Landscape

Company Profiles: Detailed analysis of the major companies presents in the Global Passenger Service System Market.Available Customizations:

Global Passenger Service System Market report with the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- SITA Group

- Amadeus IT Group, S.A.

- Sabre Corporation

- Takeflite Solutions Ltd

- GO7

- Bravo Passenger Solutions Pte. Ltd.

- RTX Corporation

- InteliSys Aviation Systems Inc.

Table Information

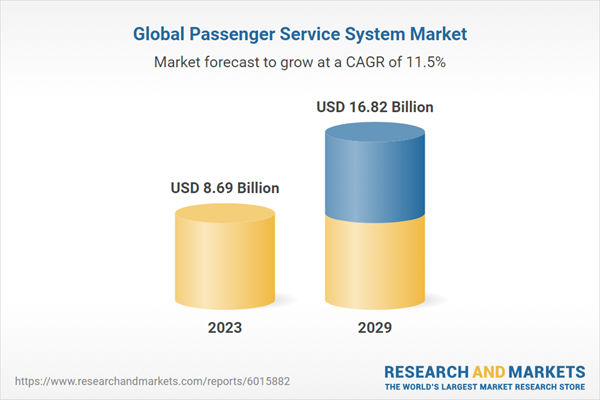

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | October 2024 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 8.69 Billion |

| Forecasted Market Value ( USD | $ 16.82 Billion |

| Compound Annual Growth Rate | 11.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 8 |