Global FemTech Market - Key Trends & Drivers Summarized

Why Is FemTech Gaining Major Traction in the Global Healthcare Landscape?

FemTech, short for female technology, has emerged as a rapidly growing segment in the global healthcare landscape, focusing on technology and innovations that cater to women's health and wellness needs. This market includes digital health solutions, wearables, mobile apps, diagnostic tools, and products that specifically address issues such as reproductive health, pregnancy care, menopause, menstrual health, fertility, sexual health, and general wellness. With increasing awareness of women's unique healthcare needs, FemTech is becoming a critical player in providing solutions that have been historically underrepresented in healthcare innovation.One of the key reasons for the rise of FemTech is the increasing empowerment of women to take control of their health, supported by advancements in mobile technology, wearable devices, and access to digital health platforms. Women are increasingly turning to technology to track menstrual cycles, monitor fertility, manage pregnancy, and access telemedicine services, giving them greater autonomy over their healthcare decisions. Additionally, many women's health issues, such as menopause or menstrual disorders, have long been underserved by traditional healthcare providers, leaving a gap that FemTech solutions are now addressing. This surge in demand for personalized healthcare solutions that cater to women's unique biological needs is driving the rapid growth of FemTech.

Furthermore, societal shifts toward gender equality and increased focus on women's health issues have brought more attention to this market. Public health campaigns, greater representation of women in leadership positions, and the rise of women entrepreneurs have all contributed to the push for more innovative healthcare solutions for women. As governments, healthcare providers, and investors recognize the economic and social benefits of addressing women's health more effectively, FemTech is gaining significant traction worldwide, paving the way for more inclusive healthcare technologies.

How Are Technological Advancements Enhancing FemTech Solutions?

Technological advancements are revolutionizing FemTech by improving the functionality, accessibility, and personalization of women's health solutions. One of the most significant innovations in FemTech has been the rise of mobile health (mHealth) apps that allow women to track and manage various aspects of their reproductive health. Apps like Clue, Flo, and Natural Cycles enable users to monitor their menstrual cycles, predict ovulation, and track symptoms, offering insights into fertility and overall health. These apps use artificial intelligence (AI) and machine learning algorithms to analyze data and provide personalized recommendations, making it easier for women to understand their unique health patterns. Additionally, these digital platforms empower women to make informed decisions about contraception, fertility treatments, and general health by providing them with tailored health insights.Wearable technology is another major area of advancement within FemTech. Wearable devices, such as smart bracelets and patches, now come equipped with sensors that monitor vital signs, hormone levels, and other physiological metrics related to women's health. For example, wearables like Ava use physiological data to track fertility windows, offering non-invasive ways for women to manage fertility planning. These devices are becoming more sophisticated, with advancements in biosensing technologies that allow for real-time monitoring of hormone fluctuations, stress levels, and even sleep patterns - factors that directly impact reproductive and overall health. The integration of wearables with smartphone apps also enhances user experience by syncing data for comprehensive health tracking and analysis.

Advances in telemedicine and remote healthcare services are further expanding the FemTech market. Virtual healthcare platforms are making it easier for women to access medical consultations, especially in areas such as prenatal care, sexual health, and menopause management. Telemedicine services that specialize in women's health offer a convenient way for patients to receive expert advice, prescriptions, and treatment options without needing to visit a clinic in person. This accessibility is particularly valuable for women living in rural or underserved areas, where access to specialized healthcare may be limited. With the rise of telemedicine and AI-powered diagnostics, FemTech is improving the quality of care for women by making it more convenient, personalized, and readily available.

How Are Changing Consumer Preferences and Societal Trends Shaping the FemTech Market?

Changing consumer preferences and societal trends are playing a crucial role in shaping the global FemTech market, particularly as more women demand personalized, convenient, and accessible healthcare solutions. One of the key drivers of this trend is the increasing focus on self-care and preventive health. Women are becoming more proactive about managing their health, seeking tools that enable them to track, understand, and improve their physical and mental well-being. FemTech solutions, such as fertility tracking apps, period management tools, and menopause support devices, align with this trend by offering customized healthcare options that help women manage their unique needs without relying solely on traditional healthcare providers.The increasing awareness of gender-specific healthcare challenges is also influencing consumer behavior. For decades, women's health issues, such as menstrual disorders, endometriosis, and menopause, were either underdiagnosed or under-researched. This gap in healthcare services has led to a demand for specialized solutions that cater specifically to women's needs. Consumers are seeking products and services that provide real solutions to these issues, from hormone-monitoring wearables to pelvic floor trainers, which have opened up new avenues for FemTech innovation. These trends are also reflected in the demand for products that help manage sexual health, such as smart Kegel trainers or apps that provide sexual health education, all of which contribute to more comprehensive women's health management.

The societal push for gender equality and representation in all sectors, including healthcare, is another important trend shaping the FemTech market. Women entrepreneurs, innovators, and healthcare professionals are leading the charge in developing products and services that cater to women's health, ensuring that these needs are prioritized within the broader healthcare system. This has also resulted in more venture capital investment into FemTech startups, as investors recognize the untapped potential and profitability of the market. Additionally, discussions around reproductive rights, gender parity in healthcare, and the destigmatization of women's health issues have made it easier for FemTech companies to gain visibility and market their products more effectively.

Moreover, the rise of digital platforms and social media has enabled FemTech companies to engage directly with consumers, creating a community-driven approach to healthcare. Many FemTech brands use social media to educate and empower women about their health, addressing topics that have historically been considered taboo, such as menstruation, fertility, and menopause. This open dialogue between companies and consumers is creating a more inclusive environment, where women feel more comfortable discussing their health needs and seeking solutions tailored specifically for them. These changing consumer preferences, coupled with societal trends toward gender equality and transparency, are driving growth in the FemTech market and creating a more personalized healthcare experience for women.

What Is Driving the Growth of the Global FemTech Market?

The growth of the global FemTech market is being driven by several key factors, including increased investment in women's health solutions, technological innovation, and rising consumer demand for personalized healthcare. One of the primary drivers of this growth is the increasing attention and funding from venture capitalists and healthcare investors who recognize the significant market potential in FemTech. Historically, women's health has been underfunded and underrepresented in healthcare innovation, but recent years have seen a surge in investment as the industry acknowledges the need for specialized products and services. FemTech startups focusing on reproductive health, maternal care, and menopause management have gained substantial traction, with several companies securing large rounds of funding to develop cutting-edge products and expand their market presence.Another significant driver of growth is the expanding awareness of women's health issues and the shift toward preventive care. With the rise of wearable technology and mHealth apps, women are increasingly able to take control of their health by tracking their menstrual cycles, monitoring fertility, and managing chronic conditions in real time. These technologies empower women to make informed healthcare decisions and seek early interventions when needed, reducing the burden on traditional healthcare systems and promoting long-term health outcomes. The demand for preventive health solutions, particularly in areas like fertility management and pregnancy care, is expected to drive further expansion of the FemTech market.

The growing global focus on improving women's health outcomes is also playing a key role in driving FemTech adoption. Governments and healthcare organizations worldwide are launching initiatives aimed at addressing women's health challenges, from improving access to reproductive healthcare to providing better maternal care services. This is particularly evident in developing regions where access to healthcare is limited, and FemTech solutions offer an efficient way to bridge the gap in women's healthcare. Mobile health platforms that provide access to telemedicine, educational resources, and health tracking tools are particularly valuable in these areas, driving market growth and improving health equity.

Lastly, societal trends toward wellness and personalized healthcare are significantly contributing to the growth of the FemTech market. As consumers increasingly prioritize self-care and personalized health solutions, FemTech products are becoming a key component of wellness routines for women of all ages. From fertility tracking devices and apps to hormone-monitoring wearables and pelvic health solutions, FemTech offers products that provide real-time insights and customized care, making it easier for women to manage their health on their own terms. This rising demand for personalized and tech-driven healthcare is encouraging innovation and investment in FemTech, positioning it for continued growth in the global market.

The combination of increased investment, technological advancements, growing consumer demand for preventive and personalized care, and a global focus on improving women's health outcomes is driving the rapid expansion of the global FemTech market. As the healthcare industry continues to prioritize women's health and address long-standing gaps in care, FemTech is poised to play a pivotal role in transforming the future of healthcare for women worldwide.

Report Scope

The report analyzes the FemTech market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Offering (Devices, Software, Consumer Products, Services); End-Use (Direct-to-Consumer End-Use, Hospitals End-Use, Ambulatory Surgery Centers End-Use, Fertility Clinics End-Use, Diagnostic Centers End-Use, Other End-Uses).

- Geographic Regions/Countries:World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Rest of Europe; Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the FemTech Devices segment, which is expected to reach US$38.8 Billion by 2030 with a CAGR of a 16.7%. The FemTech Software segment is also set to grow at 18% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $11.4 Billion in 2024, and China, forecasted to grow at an impressive 15.4% CAGR to reach $16.3 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global FemTech Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global FemTech Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global FemTech Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Aavia, Allara Health, Athena Feminine Technologies, Inc., BioWink GmbH (Clue), Bloomlife and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 39 companies featured in this FemTech market report include:

- Aavia

- Allara Health

- Athena Feminine Technologies, Inc.

- BioWink GmbH (Clue)

- Bloomlife

- Canopie Inc.

- Coroflo Limited

- Flo Health

- Glow Inc.

- LunaJoy

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aavia

- Allara Health

- Athena Feminine Technologies, Inc.

- BioWink GmbH (Clue)

- Bloomlife

- Canopie Inc.

- Coroflo Limited

- Flo Health

- Glow Inc.

- LunaJoy

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 186 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

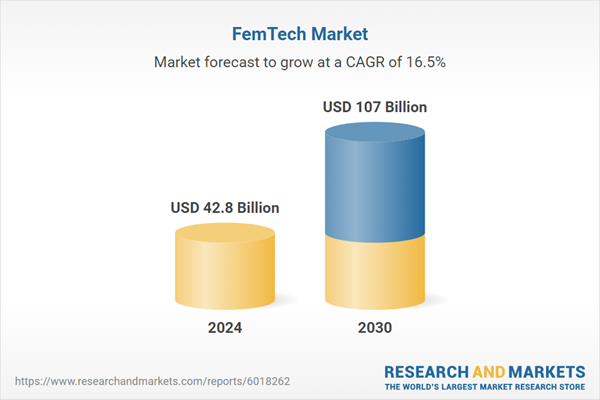

| Estimated Market Value ( USD | $ 42.8 Billion |

| Forecasted Market Value ( USD | $ 107 Billion |

| Compound Annual Growth Rate | 16.5% |

| Regions Covered | Global |