Global Zero-Calorie Sweeteners Market - Key Trends & Drivers Summarized

Why Are Zero-Calorie Sweeteners Gaining Popularity in the Food and Beverage Industry?

Zero-calorie sweeteners have become a crucial component in the food and beverage industry as consumers shift towards healthier lifestyle choices. These sweeteners provide the sweetness of sugar without the associated caloric intake, making them popular among health-conscious individuals and those managing conditions like diabetes. With rising awareness of the negative impacts of excessive sugar consumption, such as obesity and metabolic diseases, zero-calorie sweeteners are increasingly used in a wide range of products, including soft drinks, snacks, and baked goods. Their ability to maintain the taste profile of traditional sweeteners while offering a healthier alternative has made them a favored ingredient in diet-friendly and low-sugar food formulations. As consumers seek healthier alternatives to sugary products, zero-calorie sweeteners are playing a pivotal role in reshaping product offerings across the food and beverage industry.What Technological Innovations Are Driving the Evolution of Zero-Calorie Sweeteners?

Technological advancements have significantly enhanced the taste and functionality of zero-calorie sweeteners, making them more palatable and adaptable to various food and beverage applications. Stevia, sucralose, and monk fruit extract are some of the key zero-calorie sweeteners benefiting from improved extraction and formulation technologies, resulting in sweeter, more sugar-like taste profiles without bitterness or aftertaste. Advances in flavor-masking technology have also enhanced the consumer experience, ensuring that zero-calorie sweeteners can be used in a wide range of products without compromising taste. Additionally, innovations in fermentation processes are allowing for the sustainable and scalable production of sweeteners like allulose, which closely mimics the texture and functionality of sugar. These technological strides have made zero-calorie sweeteners more appealing to manufacturers and consumers alike, expanding their use across both health-conscious and mainstream product lines.How Is Consumer Demand Influencing the Adoption of Zero-Calorie Sweeteners?

Consumer behavior, particularly the increasing focus on wellness and reducing sugar intake, is driving the adoption of zero-calorie sweeteners in everyday products. With growing concerns over weight management, diabetes, and other lifestyle-related health issues, consumers are actively seeking products with reduced sugar content. This shift in preference is influencing food and beverage manufacturers to reformulate their products using zero-calorie sweeteners, which allow them to retain sweetness without the negative health implications of sugar. Additionally, the rise of fitness and diet trends like keto and intermittent fasting has led to an increased demand for sweeteners that don't spike insulin levels or add unnecessary calories. As consumers become more health-conscious, the demand for sugar substitutes in beverages, snacks, and desserts continues to rise, reinforcing the importance of zero-calorie sweeteners in today's market.What Factors Are Driving Growth in the Zero-Calorie Sweeteners Market?

The growth in the zero-calorie sweeteners market is driven by several factors, including technological advancements, evolving consumer preferences, and expanding end-use applications. One of the key drivers is the growing awareness of the health risks associated with sugar consumption, which has led to increased demand for healthier alternatives. Technological innovations in the extraction and formulation of zero-calorie sweeteners have improved their taste profiles and broadened their applications in beverages, snacks, and processed foods. Additionally, regulatory approvals and the rising trend of sugar reduction programs by governments are encouraging manufacturers to adopt zero-calorie sweeteners in their products. The expanding end-use applications, particularly in low-calorie drinks, baked goods, and health-focused snacks, are also fueling market growth. These factors, combined with rising consumer demand for healthier, sugar-free options, are driving the rapid expansion of the zero-calorie sweeteners market worldwide.Report Scope

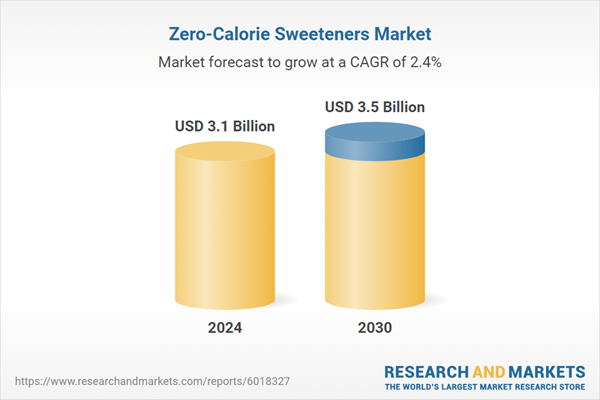

The report analyzes the Zero-Calorie Sweeteners market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Sucralose Sweetener, Aspartame Sweetener, Stevia Sweetener, Saccharin Sweetener, Cyclamate Sweetener, Other Types).

- Geographic Regions/Countries:World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Sucralose Sweetener segment, which is expected to reach US$1.2 Billion by 2030 with a CAGR of a 3.2%. The Aspartame Sweetener segment is also set to grow at 2.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $829.2 Million in 2024, and China, forecasted to grow at an impressive 5% CAGR to reach $707.2 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Zero-Calorie Sweeteners Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Zero-Calorie Sweeteners Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Zero-Calorie Sweeteners Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Ajinomoto Co., Inc., Cargill, Inc., Cumberland Packing Corporation, DOMINO FOODS, INC., GLG Life Tech Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 51 companies featured in this Zero-Calorie Sweeteners market report include:

- Ajinomoto Co., Inc.

- Cargill, Inc.

- Cumberland Packing Corporation

- DOMINO FOODS, INC.

- GLG Life Tech Corporation

- Ingredion, Inc.

- Janus Life Sciences

- Jungbunzlauer Suisse AG

- Now Health Group, Inc. (NOW Foods)

- PureCircle Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Ajinomoto Co., Inc.

- Cargill, Inc.

- Cumberland Packing Corporation

- DOMINO FOODS, INC.

- GLG Life Tech Corporation

- Ingredion, Inc.

- Janus Life Sciences

- Jungbunzlauer Suisse AG

- Now Health Group, Inc. (NOW Foods)

- PureCircle Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 201 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 3.1 Billion |

| Forecasted Market Value ( USD | $ 3.5 Billion |

| Compound Annual Growth Rate | 2.4% |

| Regions Covered | Global |