This report comes with 10% free customization, enabling you to add data that meets your specific business needs.

1h Free Analyst TimeSpeak directly to the analyst to clarify any post sales queries you may have.

This trend has been supported by the growing concern regarding body odor and the desire for a spa-like experience in the comfort of one's home. The market is witnessing a shift towards premium and natural products, driven by consumer preferences for high-quality ingredients and eco-friendly formulations. Manufacturers are focusing on product innovation and development to cater to diverse consumer needs, such as sensitive skin care, anti-aging properties, and natural or organic ingredients. The rise of biotechnology-inspired formulations has further boosted product demand, with players utilizing biotechnology expertise to develop high-performance bath and shower products.

The growth of e-commerce platforms has expanded the market reach, enabling consumers to access a wider range of products from the comfort of their homes. Online retail offers convenience, a wide selection of products, and competitive pricing, making it increasingly popular among consumers. The ease of purchasing from home and the availability of product information and reviews contribute to the growing popularity of e-commerce in the bath and shower products market.

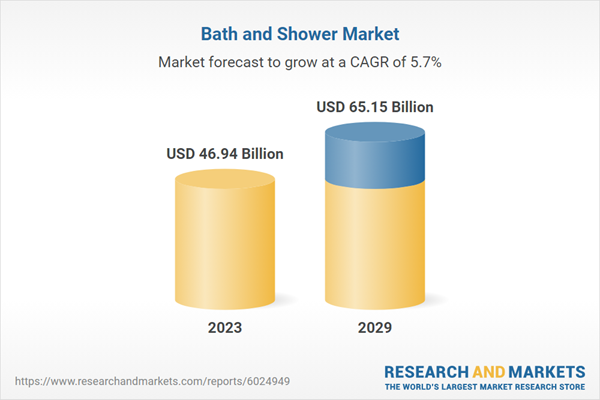

According to the research report, “Global Bath and Shower Products Market Outlook 2029” the market is anticipated to cross USD 65 Billion by 2029, increasing from USD 46.94 Billion in 2023. The market is expected to grow with a 5.73% CAGR from 2024 to 2029. One of the primary drivers of this market's expansion is the increasing focus on personal hygiene, particularly in the wake of global health concerns. Consumers are increasingly aware of the importance of effective cleansing products, leading to a surge in demand for items that offer antibacterial and therapeutic benefits.

Additionally, the trend towards aromatherapy and the use of fragranced products are gaining traction, as consumers seek spa-like experiences at home. This shift has led to innovations in product formulations, with manufacturers incorporating natural and organic ingredients to cater to health-conscious consumers. Furthermore, the increasing popularity of in-shower products that combine multiple benefits, such as moisturizing and sun protection, is enhancing market appeal. Key players in the bath and shower products market include major companies such as L’Oréal, Unilever, Johnson & Johnson, and Procter & Gamble.

These industry leaders are leveraging strategic initiatives, including product innovations and collaborations, to enhance their market presence and cater to evolving consumer demands. The competitive landscape is characterized by a mix of established brands and emerging players, with a focus on expanding product lines and improving sustainability practices. E-commerce has emerged as a significant distribution channel, providing consumers with convenient access to a wide array of products. The growth of online retail is reshaping consumer purchasing behaviors, allowing for increased product variety and competitive pricing.

Market Drivers

- Increasing Hygiene Awareness: The heightened awareness of personal hygiene, particularly in the aftermath of global health crises, has significantly boosted the demand for bath and shower products. Consumers are more conscious of the need to maintain cleanliness to prevent the spread of germs and diseases. This shift has led to a surge in demand for products that offer effective cleansing and refreshing benefits, such as antibacterial body washes and natural soaps. Manufacturers are responding by innovating and developing products that cater to these specific consumer needs, thus driving market growth.

- Rising Disposable Incomes: The increase in disposable incomes, especially in emerging markets, has transformed consumer spending patterns. As people gain more purchasing power, they are more inclined to invest in premium bath and shower products that offer enhanced benefits and luxurious experiences. This trend is particularly evident in regions with expanding middle classes, where consumers are willing to pay more for high-quality, branded products that promise better results and experiences.

Market Challenges

- Toxic Ingredients and Safety Concerns: Many bath and shower products contain potentially harmful substances such as parabens, sulfates, and synthetic fragrances, which can cause skin irritation and allergic reactions. The growing consumer awareness regarding product safety and the demand for transparency in ingredient sourcing pose challenges for manufacturers. Companies are under pressure to reformulate products to eliminate toxic ingredients, which can increase production costs and complicate product development.

- Market Saturation and Intense Competition: The bath and shower products market is highly competitive and fragmented, with numerous established and emerging brands vying for market share. This saturation can lead to price wars and reduced profit margins. Additionally, the rapid pace of innovation means that companies must continuously invest in research and development to keep up with consumer preferences and trends, which can strain resources and affect profitability.

Market Trends

- Eco-Friendly and Sustainable Products: There is a growing trend towards eco-friendly and sustainable bath and shower products. Consumers are increasingly seeking products that are not only effective but also environmentally friendly. This includes biodegradable packaging, natural ingredients, and cruelty-free testing practices. Brands that prioritize sustainability are likely to attract a segment of consumers who prioritize ethical consumption, thereby creating new growth opportunities in the market.

- E-Commerce Growth: The rise of e-commerce has transformed the way consumers purchase bath and shower products. Online shopping offers convenience and access to a broader range of products, often at competitive prices. The COVID-19 pandemic accelerated this trend, as consumers became more accustomed to shopping online. Companies are increasingly investing in digital marketing strategies and enhancing their online presence to capture this growing market segment.

Leading the market for bath and shower products basically because of affordability and widespread usability, bath soaps remain the greatest preference for consumers in developing economies.

Bath soaps come cheaper than the other bathing products such as body washes and shower gels; a factor that makes it accessible to a higher income group, especially in developing economies where price is going to be the primary factor. Solid soap bars are perceived to dominate the global market share, and this is likely to be the case in the future because value for money appears to be the key driver for most customers. More importantly, solid soap bars happen to be simple and effective at fulfilling consumers' basic hygiene needs. A continuing trend is thus observed.Increased awareness over personal hygiene, particularly in the wake of global health issues, has also been stimulating demand for bathing products. Many bathroom soaps now carry extra benefits in the form of essential oils and moisturizers to enhance their beauty credentials both on health grounds for the skin and freshness. Another reason why bar soap is solid is that this characteristic makes it easier to transport and use, particularly for those who are always on the go, such as commuters.

Among the bath and shower products, it is the solid bath products that are experiencing high market demand mainly because of their variety, convenience, and consumer preference for traditional forms.

The solid range has gained much momentum in the recent years. A number of factors have boosted sales, factors that the consumer can relate to with their purchasing and lifestyle decisions. For example, solid products provide a wide selection that can cater to the needs of varied consumers. For example, bath bombs and handmade soaps have a functional purpose but also exist as indulgent self-care products that promote the ritual of bathing. Another aspect is a less environmental burden because there is much less packaging waste than with liquid products. Their solid natures make for easier travel and storage-a convenient portability to consumers looking for practicality in how they go about personal care.Beyond that, the feel and sensory nature of solid products be it how shampoo forms lather or vibrant colors of bath bombs. With rising health awareness among consumers, many are shifting to solid products utilizing natural and organic ingredients, thus further fuelling the demand for this category. Despite the negative repercussions of the economic crisis, solid bath products enjoy the trend of DIY beauty activities wherein consumers are now trying to make soaps and other add-ins at home.

Supermarkets and hypermarkets are the major retailers in the bath and shower products market, capturing a major share due to their diversified product lines and one-stop-shop advantage.

Supermarkets and hypermarkets have a dominating share in this market segment. There are a few very important reasons that present the opportunity in line with consumer preferences. First, these are retail formats that provide ample choice of bath and shower products, from popular brands to niche players, from one location. Thus, this will be easy for the consumer to compare products, prices, and formulation while on the shelves and in stores. Another benefit of supermarkets is the one-stop shopping opportunity from where one can purchase multiple household items in a single trip. For consumers who are always busy and look for efficiency in their shopping routines, it presents a significant reason to opt for such venues.Most supermarkets use promotional strategies such as discounts on bulk purchases or loyalty programs, among others, as motivators for more shoppers to go there rather than opt for small stores or internet-based options. The physical environment presented by these retailing forms also enables customers to touch and smell fragrances, feel textures, and read the labels of merchandise before buying anything.

Moreover, supermarkets and hypermarkets have matured supply chains that guarantee prompt availability of goods, which translates into a guarantee on the part of consumers. This demand will be further enhanced due to the increasing awareness of health and hygiene all over the world. The role will be emphasized even more for supermarkets and hypermarkets as key players in this market segment.

Offline retail is the market leader for bath and shower products because of the massive trust the consumers bear for this kind of product in the offline channel, and the offline format allows the consumer to experience the physical interaction with the product.

Offline continues to lead the market for several compelling reasons. Physical stores allow consumers to engage directly with the products so they get to assess the texture, the fragrance, and the packaging before making a buy. This sensory experience is crucial in the bath and shower category, where scent and feel often become very compelling triggers for the buying decision.In addition, because personal care products are bought from reputed retail chains or convenient local stores with whom customers feel comfortable, customers tend to buy such items from retailers where they can see the product and ask questions relating to it, because these retailers, as a matter of rule, usually sell only a small range of known brands.

Availability and consultation facilities online create an added attraction to offline purchase. In addition, most customers get attracted to the ability to visit once and purchase many different products from just one visit. Furthermore, there are many forms and sizes that cannot be easily purchased over the internet. That aside, more awareness about health has led to increased foot traffic, especially in stores that ensure hygiene and safety for customers. The type of promotions in a store, such as discounts on merchandise, loyalty programmes, and seasonal sales, have made shopping highly attractive and rather easily induce impulse buying.

The primary reason North America leads in the bath and shower industry is the high consumer demand for premium and innovative personal care products, driven by rising disposable incomes and a focus on health and wellness.

This growth is primarily fuelled by the increasing demand for premium products, particularly body washes and shower gels, which are favored by consumers due to their perceived quality and effectiveness. The United States and Canada are significant contributors to this trend, with high-income levels enabling consumers to spend more on personal care products.The market is highly competitive and fragmented, featuring a mix of international giants such as Johnson & Johnson, Unilever, and Estée Lauder, alongside numerous regional and domestic players. These companies are actively engaging in product innovation, expanding their portfolios to include natural and organic options, which have garnered significant consumer interest.

This shift towards cleaner, eco-friendly products aligns with growing health consciousness among consumers, who are increasingly aware of the ingredients in their personal care items. Furthermore, the COVID-19 pandemic has heightened the focus on hygiene, leading to a surge in demand for cleansing products. Consumers have prioritized personal hygiene more than ever, resulting in increased sales of soaps, body washes, and other bath products.

The trend towards aromatherapy and spa-like experiences at home has also influenced consumer preferences, with many opting for fragranced products that enhance their bathing rituals. The distribution channels are equally varied, encompassing supermarkets, online stores, and specialty retailers, which cater to different shopping habits and preferences. The rise of e-commerce has further facilitated access to a broader range of products, allowing consumers to explore and purchase premium brands with ease.

- In July 2022, CLEANO2 has announced the launch of body bar soap. The launch will help the company in increasing its product line and revenue of the company.

- In April 2021, Procter & Gamble brand Olay Body, has introduced three new body care collections Olay Premium Exfoliating Body Wash Collection, Olay Cleansing & Renewing Body Care Duo with Retinol, and the Olay Dermatologist Designed Collection. The new launch will help the company in increasing its customer reach and product depth.

- In July 2021, Procter & Gamble launched its new personal care brand, Quiet & Roar. The brand consist multi-sensorial body care collection such as gentle body washes, lotions, and scrubs.

Considered in this report

- Historic year: 2018

- Base year: 2023

- Estimated year: 2024

- Forecast year: 2029

Aspects covered in this report

- Bath & Shower market Outlook with its value and forecast along with its segments

- Various drivers and challenges

- On-going trends and developments

- Top profiled companies

- Strategic recommendation

By Activity

- By Product Type

- Bath Soaps

- Body Wash/Shower Gel

- Bath Additives

By Form

- Solids

- Liquids

- Gel/Jellies

By Distribution Channel

- Supermarkets

- Convenience Stores

- Online Stores

- Others

By End User

- Women

- Men

The approach of the report:

This report consists of a combined approach of primary and secondary research. Initially, secondary research was used to get an understanding of the market and list the companies that are present in it. The secondary research consists of third-party sources such as press releases, annual reports of companies, and government-generated reports and databases.After gathering the data from secondary sources, primary research was conducted by conducting telephone interviews with the leading players about how the market is functioning and then conducting trade calls with dealers and distributors of the market. Post this; we have started making primary calls to consumers by equally segmenting them in regional aspects, tier aspects, age group, and gender. Once we have primary data with us, we can start verifying the details obtained from secondary sources.

Intended audience

This report can be useful to industry consultants, manufacturers, suppliers, associations, and organizations related to the Bath & Shower industry, government bodies, and other stakeholders to align their market-centric strategies. In addition to marketing and presentations, it will also increase competitive knowledge about the industry.Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Unilever PLC

- The Procter & Gamble Company

- Johnson & Johnson

- Beiersdorf AG

- Colgate-Palmolive Company

- L'Oréal S.A.

- Kao Corporation

- The Estée Lauder Companies Inc

- L’Occitane International S.A

- Reckitt Benckiser Group plc

- Henkel AG & Co. KGaA

- Hugo Boss AG

- ITC Limited

- Puig Brands, S.A.

- Bath & Body Works, Inc

- Bioderma Laboratories

- Adidas AG

- Cetaphil

- Marico Ltd

- The Clorox Company

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | October 2024 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 46.94 Billion |

| Forecasted Market Value ( USD | $ 65.15 Billion |

| Compound Annual Growth Rate | 5.7% |

| Regions Covered | Global |