With the integration of electronic health records (EHRs), telemedicine, and other digital health solutions, the healthcare sector has become a prime target for cybercriminals seeking to exploit vulnerabilities. As healthcare organizations seek to enhance their cybersecurity posture, adoption of security analytics solutions is expected to continue to rise. Thus, the healthcare segment procured 14% revenue share in the security analytics market in 2023. This growth reflects the sector’s heightened awareness of the importance of data protection, especially as healthcare organizations increasingly adopt digital technologies.

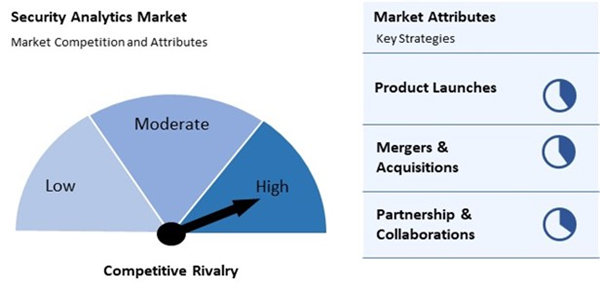

The major strategies followed by the market participants are Acquisitions as the key developmental strategy to keep pace with the changing demands of end users. For instance, In March, 2024, Cisco Systems Inc. took over Splunk Inc., boosting security and observability through a unified digital perspective. This merger ensures improved security, observability, networking, AI, and economic benefits, delivering transformative solutions for customers across diverse industries. Additionally, In January, 2024, Hewlett Packard Enterprise (HPE) announced its acquisition of Juniper Networks, aiming to enhance its networking portfolio with AI-native solutions. This move aligns with the growing demand for secure data management from edge to cloud, which is relevant to the security analytics market.

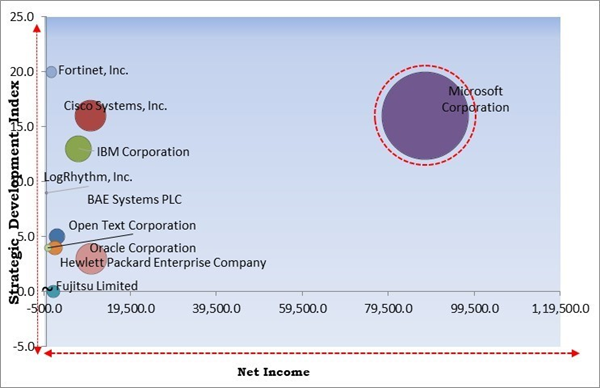

Cardinal Matrix - Market Competition Analysis

Based on the Analysis presented in the Cardinal matrix; Microsoft Corporation is the forerunners in the Security Analytics Market. Companies such as Fortinet, Inc., Cisco Systems, Inc. and IBM Corporation are some of the key innovators in the Security Analytics Market. In July, 2021, Microsoft Corporation acquired CloudKnox Security to enhance its privileged access and entitlement management capabilities, focusing on cloud security. This acquisition supports a Zero Trust approach by leveraging continuous analytics to prevent breaches, significantly contributing to the security analytics market.Market Growth Factors

Organizations are increasingly shifting from reactive to proactive security measures. Security analytics enables real-time monitoring and threat detection, allowing organizations to respond swiftly to potential breaches and mitigate risks before they escalate. Integrating threat intelligence into security analytics tools enhances the ability to predict, identify, and respond to cyber threats, making these solutions indispensable for modern security infrastructures. Thus, rising cybersecurity threats and data breaches worldwide hamper the market's growth.Additionally, Data breaches resulting from non-compliance can lead to loss of customer trust and long-term damage to brand reputation, further incentivizing investments in compliance-oriented security analytics. Hence, increasing regulatory compliance requirements mandating security measures propels the market's growth.

Market Restraining Factors

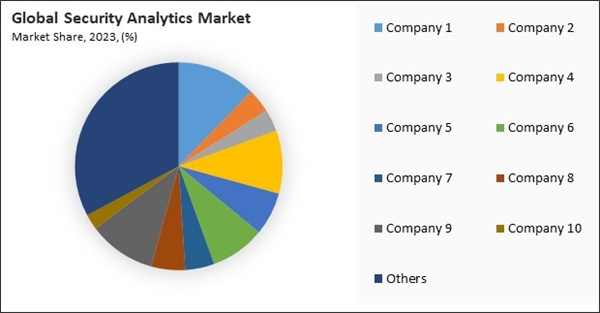

Deploying security analytics solutions often requires significant upfront investments in hardware (servers, storage, etc.) and software licenses. These initial capital expenditures can be prohibitive, especially for organizations with limited budgets. Integrating new security analytics tools with existing IT infrastructure can incur additional costs. Organizations may need to upgrade legacy systems, which adds to the overall implementation expenses. Hence, high implementation costs of security analytics solutions impede the market's growth.The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Mergers & Acquisition.

Driving and Restraining Factors

Drivers

- Rising cybersecurity threats and data breaches worldwide

- Increasing regulatory compliance requirements mandating security measures

- Expansion of the digital transformation across industries globally

Restraints

- High implementation costs associated with security analytics solutions

- Shortage of skilled security professionals

Opportunities

- Increasing awareness of security analytics importance among organizations

- Rising investment in cybersecurity infrastructure

Challenges

- Complexity challenges of integration with existing IT infrastructure

- Rapidly evolving cyber threat landscape outpacing security analytics solutions

Services Outlook

The services segment is further subdivided into professional services and managed services. In 2023, the managed services attained 57% revenue share in the market. Managed services offer comprehensive support, including continuous monitoring, threat detection, and incident response, allowing businesses to leverage specialized expertise without needing extensive in-house resources.Organization Outlook

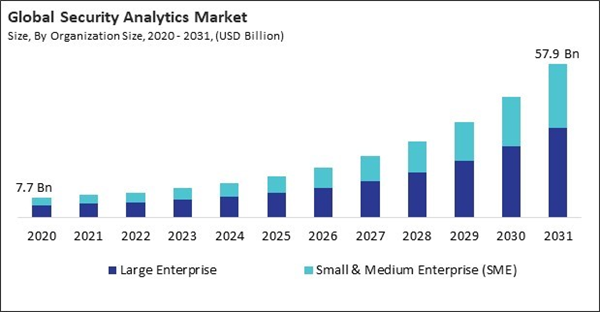

On the basis of organization size, the market is segmented into large enterprises and small & medium enterprise (SME). In 2023, the small & medium enterprise (SME) segment attained 39% revenue share in the market. While SMEs may lack the extensive resources of larger enterprises, they face significant cybersecurity challenges and are increasingly aware of the potential risks posed by cyber threats.Application Outlook

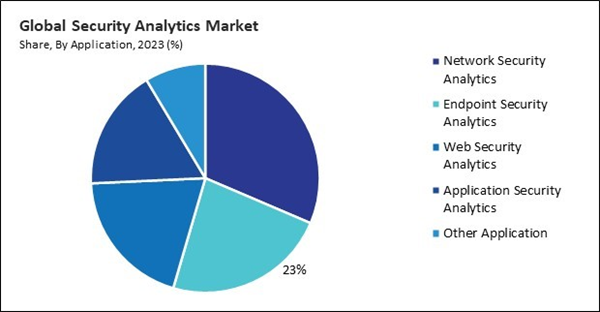

Based on application, the market is categorized into web security analytics, network security analytics, endpoint security analytics, application security analytics, and others. In 2023, the network security analytics segment registered 31% revenue share in the market. As businesses increasingly rely on digital communication and data exchange, the potential vulnerabilities within network infrastructures have become a major concern.Vertical Outlook

By vertical, the market is divided into government & defense, BFSI, retail, telecom & IT, healthcare, manufacturing, and others. In 2023, the BFSI segment registered 23% revenue share in the security analytics market. This dominance can be attributed to the increasing need for robust security measures to protect sensitive financial data and mitigate cyber threats.By Outlook

Based on component, the market is divided into solutions and services. In 2023, the services segment procured 34% revenue share in the market. Given the complexity of the threat landscape, organizations are increasingly turning to service providers to enhance their cybersecurity capabilities.Regional Outlook

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific region generated 28% revenue share in the market in 2023. Rapid digital transformation, increased internet penetration, and the proliferation of smart devices have led to a surge in cyber threats, prompting regional organizations to invest significantly in security analytics solutions.Market Competition and Attributes

The Security Analytics market is intensely competitive, fueled by rising cyber threats and the demand for advanced threat detection solutions. Competition is driven by the need for AI-powered analytics, machine learning, and big data capabilities to manage complex security environments. Key factors include the growing volume of cyberattacks, regulatory compliance requirements, and cloud adoption. Vendors are focusing on real-time threat detection, innovation, and seamless integration with existing security infrastructures, while newer players leverage specialized solutions and agility to gain market share.

Recent Strategies Deployed in the Market

- Aug-2024: Fortinet announced the acquisition of Lacework, a cloud security leader. This enhances Fortinet's commitment to delivering unified security across on-premises and cloud environments. Integrating Lacework’s cloud-native platform strengthens Fortinet's AI-driven, full-stack security offerings.

- Aug-2024: Fortinet announced the acquisition of Next DLP, a leader in insider risk and data protection, enhancing its data loss prevention (DLP) capabilities. This acquisition aligns with Fortinet's strategy to provide top-tier security solutions across SASE (Secure Access Service Edge) and endpoint deployments.

- Aug-2024: Microsoft Corporation has partnered with Palantir to enhance analytics and AI services for U.S. national security. This collaboration integrates advanced AI models and secure data management, improving decision-making, risk assessment, and threat detection in classified environments, thus bolstering the security analytics market.

- May-2024: Fortinet unveiled updates to its generative AI portfolio, introducing the first AI-powered IoT security assistant. FortiAI helps SecOps and NetOps teams manage networks and respond to threats more efficiently through a user-friendly natural language interface, addressing the cybersecurity skills gap.

- May-2024: Fortinet introduced the FortiGate 200G series, a next-generation firewall (NGFW) appliance that enhances firewall throughput and supports FortiGuard AI-powered security services. This product is aimed at securing modern campus networking environments.

- May-2024: IBM Corporation partnered with Palo Alto Networks. This partnership aims to enhance cybersecurity with AI, leveraging Cortex XSIAM and Watsonx to deliver advanced threat protection and automation.

List of Key Companies Profiled

- Microsoft Corporation

- Fujitsu Limited

- BAE Systems PLC

- Cisco Systems, Inc.

- Fortinet, Inc.

- Hewlett Packard Enterprise Company

- LogRhythm, Inc.

- Oracle Corporation

- IBM Corporation

- Open Text Corporation

Market Report Segmentation

By Organization Size

- Large Enterprise

- Small & Medium Enterprise (SME)

By Application

- Network Security Analytics

- Endpoint Security Analytics

- Web Security Analytics

- Application Security Analytics

- Other Application

By Component

- Solutions

- Service

- Managed Services

- Professional

By Vertical

- BFSI

- Telecom & IT

- Healthcare

- Retail

- Government & Defense

- Manufacturing

- Other Vertical

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Microsoft Corporation

- Fujitsu Limited

- BAE Systems PLC

- Cisco Systems, Inc.

- Fortinet, Inc.

- Hewlett Packard Enterprise Company

- LogRhythm, Inc.

- Oracle Corporation

- IBM Corporation

- Open Text Corporation