Global Truck Axle Market - Key Trends and Drivers Summarized

What Are Truck Axles, and How Do They Support Vehicle Load and Functionality?

Truck axles are essential components in heavy-duty vehicles, serving as central structures that bear the weight of the truck, support cargo loads, and facilitate smooth and safe wheel rotation, steering, and stability. Acting as robust shafts between the wheels, truck axles come in various types tailored to the needs of different trucks and applications, including front axles, rear axles, and lift axles. Front axles play a vital role in steering and, in some configurations, carry a portion of the vehicle's load, while rear axles bear the bulk of the cargo weight, transferring engine power to the wheels to drive the truck forward. Lift axles, commonly found on multi-axle trucks, can be raised or lowered based on load requirements, offering extra support when transporting heavy cargo or reducing wear on tires when the truck is empty. Constructed from durable materials like high-strength steel alloys, these axles are engineered to withstand immense forces and are designed to function reliably under heavy loads and harsh conditions. By distributing weight evenly across the vehicle's structure, truck axles help maintain balance, reduce road wear, and improve control, which are all essential for the safe and efficient operation of heavy trucks on highways, rough terrains, and industrial work sites.How Have Technological Advancements Improved the Efficiency and Durability of Truck Axles?

Recent technological advancements have significantly enhanced the durability, efficiency, and performance of truck axles, enabling them to support greater loads and endure rugged conditions. Modern truck axles are constructed from advanced steel alloys and, in some cases, composite materials that provide superior load-bearing capacity while reducing overall axle weight. This weight reduction not only increases fuel efficiency but also enhances payload capacity, allowing trucks to transport heavier loads without compromising performance. Enhanced manufacturing techniques, such as advanced forging and heat-treatment processes, increase axle resistance to stress and impact, minimizing wear and extending the axle's lifespan. Additionally, innovations in axle design, such as the integration of hub reduction technology, improve torque distribution and reduce mechanical strain on other vehicle components, contributing to smoother operations and prolonged service intervals. The introduction of lightweight drive axles, self-lubricating systems, and suspension-integrated axle designs further improve ride quality, reduce noise, and optimize fuel consumption. Moreover, sensors and IoT technology are now being embedded into axle systems to provide real-time monitoring of load distribution, wear levels, and overall performance, giving fleet managers the ability to proactively address maintenance needs. These technological advancements have made truck axles more resilient and adaptable, ensuring that they can meet the rigorous demands of modern heavy-duty applications while reducing operational costs for fleet owners.Why Are Truck Axles Crucial for Different Commercial and Industrial Applications?

Truck axles play a crucial role across various commercial and industrial applications, enabling trucks to handle significant and sometimes irregular loads while maintaining safety and stability on diverse terrains. In industries like logistics, construction, mining, and agriculture, trucks regularly transport dense, bulky materials that impose intense pressure on the vehicle's structure. Multi-axle configurations - such as tandem, tri-axle, and quad-axle setups - distribute weight effectively across multiple points, enhancing traction and balance while reducing wear on road infrastructure. For example, in construction and mining, where trucks are often required to navigate uneven, off-road conditions, robust and flexible axle systems are essential for managing load shifts and maintaining vehicle stability, which is crucial for safely transporting heavy materials like gravel, sand, and minerals. In long-haul logistics, efficient weight distribution through advanced axle designs helps improve fuel economy and load optimization, which are critical factors for cost-effective transportation. Additionally, lift axles enable truck operators to adjust the configuration based on load requirements, allowing an axle to be raised to conserve fuel and reduce tire wear when the truck is not fully loaded, or lowered to provide additional support for heavy cargo. The adaptability and resilience of truck axles across various applications highlight their importance in heavy-duty transport, allowing trucks to operate safely and efficiently across sectors that demand durability and reliable performance.What's Fueling the Expansion of the Truck Axle Market?

The growth in the truck axle market is driven by a convergence of factors, including advancements in axle technology, increased demand from logistics and construction industries, and evolving regulatory standards around vehicle efficiency and load distribution. Technological innovations in materials and design - such as the use of high-strength steel alloys, composite materials, and automated load-sensing systems - have made truck axles more durable, resilient, and efficient, attracting the interest of fleet operators and trucking companies seeking enhanced performance and lower operational costs. The rise of e-commerce and the associated demand for efficient goods transportation has further fueled the need for trucks equipped with robust, high-performance axles that support reliable delivery within vast logistics networks. In industries such as construction and mining, where trucks frequently carry heavy and irregular loads across rough terrains, multi-axle configurations with advanced weight distribution capabilities are essential for maintaining safety and stability. Regulatory standards focused on reducing road wear and promoting fuel efficiency are also shaping the market, as governments worldwide introduce requirements for axle systems that optimize load distribution and enhance energy efficiency. These standards have encouraged the adoption of advanced axle designs that comply with environmental and safety guidelines, further driving demand for technologically sophisticated solutions. Together, these factors - technological innovation, increased demand across industrial sectors, regulatory incentives, and the growth of e-commerce - are propelling the truck axle market forward, establishing it as a critical component in the heavy-duty vehicle industry and a focal point for ongoing innovation.Report Scope

The report analyzes the Truck Axle market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Application (Light-Duty Trucks Application, Medium-Duty Trucks Application, Heavy-Duty Trucks Application).

- Geographic Regions/Countries:World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Light-Duty Trucks Application segment, which is expected to reach US$9.6 Billion by 2030 with a CAGR of a 3.9%. The Medium-Duty Trucks Application segment is also set to grow at 2.7% CAGR over the analysis period.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Truck Axle Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Truck Axle Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Truck Axle Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as All Truck Parts Limited, American Axle & Manufacturing, Inc., Automotive Axles Ltd., Cummins, Inc., Daimler Truck AG and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 36 companies featured in this Truck Axle market report include:

- All Truck Parts Limited

- American Axle & Manufacturing, Inc.

- Automotive Axles Ltd.

- Cummins, Inc.

- Daimler Truck AG

- Dana Inc.

- GNA Axles Ltd.

- Guangdong Fuhua Machinery Group Co., Ltd.

- Hendrickson USA, L.L.C.

- HYUNDAI TRANSYS

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- All Truck Parts Limited

- American Axle & Manufacturing, Inc.

- Automotive Axles Ltd.

- Cummins, Inc.

- Daimler Truck AG

- Dana Inc.

- GNA Axles Ltd.

- Guangdong Fuhua Machinery Group Co., Ltd.

- Hendrickson USA, L.L.C.

- HYUNDAI TRANSYS

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 177 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

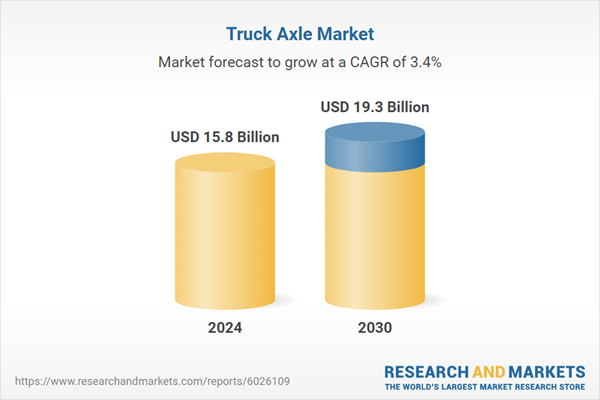

| Estimated Market Value ( USD | $ 15.8 Billion |

| Forecasted Market Value ( USD | $ 19.3 Billion |

| Compound Annual Growth Rate | 3.4% |

| Regions Covered | Global |