Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

However, market growth is often obstructed by raw material supply limitations and subsequent price instability. Adverse weather in key agricultural regions can significantly lower crop yields, resulting in shortages that hamper consistent starch production. Data from Pulse Canada indicates that domestic pea stocks dropped to 716,000 metric tons in 2024, the lowest level in twenty years. This scarcity forces manufacturers to cope with unpredictable input costs, potentially influencing formulators to switch to more abundant and cheaper commodity starches like corn or tapioca.

Market Drivers

The primary engine reshaping the global pea starch market is the accelerating consumer transition toward plant-based and vegan diets. Manufacturers of meat and dairy alternatives are increasingly utilizing pea starch for its gelling and texturizing capabilities, which replicate the mouthfeel of animal-derived products without compromising dietary requirements. This growing demand is reflected in the sector's financial scale; the Good Food Institute's '2024 State of the Industry Report' notes that global retail sales for plant-based meat, seafood, dairy, and eggs reached $28.6 billion. To secure ingredient streams for this demand, major agribusinesses are expanding infrastructure, such as the Louis Dreyfus Company, which began constructing a facility in Yorkton, Saskatchewan in June 2024 to process over 70,000 tons of peas annually.Furthermore, the expansion of the clean label and non-GMO ingredient movement reinforces pea starch as a preferred industrial thickener. Unlike chemically modified potato or corn starches, pea starch enables brands to maintain "free-from" claims while delivering neutral taste and high shear stability in snacks, soups, and sauces. This functional appeal is driving significant commercial success; Ingredion reported in February 2025 that its Texture & Healthful Solutions segment, which includes clean-label starches, saw double-digit organic sales volume growth in the latter half of 2024. This trend highlights a broader industry pivot where formulators prioritize transparency and natural origins, leveraging the native functionality of pea starch to meet strict consumer expectations.

Market Challenges

Raw material supply constraints and the resulting price volatility significantly impede the growth trajectory of the global pea starch sector. Weather-induced yield reductions in primary cultivation regions disrupt the consistent flow of feedstock required for large-scale starch processing. This instability compels manufacturers to operate in a high-risk environment where input costs fluctuate unpredictably, making it difficult to maintain long-term pricing agreements. Consequently, industrial and food formulators who prioritize supply chain security often perceive pea starch as a financially risky ingredient compared to more stable commodities, restricting its integration into mass-market products.This unpredictability directly erodes market confidence and slows adoption rates in price-sensitive applications. When supply tightens, the escalating costs of pea starch diminish its appeal as a cost-effective clean-label alternative. For instance, the Saskatchewan Pulse Growers reported in late 2024 that Canadian pea production fell 163,000 tonnes short of earlier projections, signaling persistent output challenges. Such deficits force procurement managers to favor abundant alternatives like tapioca or corn starch to ensure production continuity, thereby limiting the potential market share expansion of pea-based derivatives.

Market Trends

Premium pet food brands are actively adopting pea starch as a non-GMO, grain-free carbohydrate source to bind kibble and improve digestibility, aligning with the "pet humanization" trend. This formulation shift is increasingly supported by the use of upcycled ingredients, where pea starch derived from protein processing serves as a sustainable, circular input. According to the Institute for Feed Education and Research's '2025 Pet Food Production and Ingredient Analysis' report, U.S. manufacturers utilized over 3 million tons of upcycled ingredients, including plant-based coproducts like starch, in dog food formulations during 2024. This volume highlights the sector's rapid pivot toward sustainable, functional fillers that replace conventional grains while meeting carbon reduction goals.Simultaneously, there is a growing shift toward using pea starch as a clean-label binder and gelling agent in plant-based meat formulations, specifically to replace synthetic additives like methylcellulose while maintaining texture. This transition is compelled by intensifying consumer scrutiny regarding ingredient transparency, which forces manufacturers to adopt native starch solutions that offer high functionality without chemical modification. According to Roquette's October 2025 press release regarding their next-generation label-friendly starch range, nearly one in three new food and beverage launches worldwide is now positioned as clean-label. This market pressure is driving the widespread substitution of artificial texturizers with recognizable, plant-derived alternatives in next-generation meat analogues.

Key Players Profiled in the Pea Starch Market

- Axiom Foods, Inc.

- Dakota Dry Beans Inc.

- AGT Food and Ingredients Inc.

- Puris

- Koninklijke DSM N.V

- Roquette Freres S.A.

- Sanstar Limited

- Emsland-Starke GmbH

- NutriPea

- Aminola B.V.

Report Scope

In this report, the Global Pea Starch Market has been segmented into the following categories:Pea Starch Market, by Product Type:

- Food

- Feed

- Industrial

Pea Starch Market, by Function:

- Gelling

- Thickeners

- Texturizing

- Film Forming

- Others

Pea Starch Market, by End Use:

- Food & Beverage

- Animal Feed

- Pharmaceuticals

- Others

Pea Starch Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Pea Starch Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Pea Starch market report include:- Axiom Foods, Inc.

- Dakota Dry Beans Inc

- AGT Food and Ingredients Inc.

- Puris

- Koninklijke DSM N.V

- Roquette Freres S.A.

- Sanstar Limited

- Emsland-Starke GmbH

- NutriPea

- Aminola B.V.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 181 |

| Published | January 2026 |

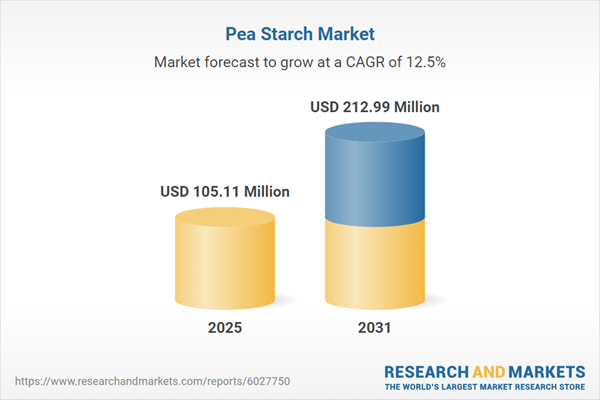

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 105.11 Million |

| Forecasted Market Value ( USD | $ 212.99 Million |

| Compound Annual Growth Rate | 12.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |