Silk bras are a premium choice, valued for their soft feel, luxurious appearance, and hypoallergenic properties. Silk’s natural temperature-regulating capabilities make it suitable for year-round wear, offering comfort in both warm and cold climates. Known for its smooth texture, silk is particularly favored for sensitive skin, providing a gentle option for everyday or special-occasion wear. Hence, in India, 607.02 million units of silk bras are expected to be utilized by the year 2031.

The China market dominated the Asia Pacific Bra Market by Country in 2023, and is expected to continue to be a dominant market till 2031; thereby, achieving a market value of $13.83 billion by 2031. The Japan market is experiencing a CAGR of 14.5% during 2024-2031. Additionally, the India market is expected to exhibit a CAGR of 15.9% during 2024-2031.

Sustainability has also emerged as a defining aspect of the bra market, with increasing consumers prioritizing eco-friendly and ethically produced lingerie. This shift has led to eco-friendly bras from organic cotton, bamboo, and recycled fabrics and brands prioritizing ethical labor practices. The demand for sustainable lingerie is indicative of a more general trend toward conscious consumerism, in which individuals endeavor to minimize their environmental impact without compromising on quality or style. Brands that embrace sustainability are positioning themselves favorably in the market, attracting a segment of consumers who value environmental responsibility and transparency.

Inclusivity is another critical factor that has shaped the bra market, as brands increasingly recognize the importance of catering to diverse body types, skin tones, and gender identities. Traditional sizing conventions often fail to address the full spectrum of consumer needs, leaving many individuals underserved. There is a growing movement towards inclusivity today, with brands expanding their size ranges, offering customizable fits, and designing bras for various skin tones. This inclusive approach not only makes bras more accessible but also fosters a sense of acceptance and belonging among consumers. Brands promoting inclusivity are resonating with a diverse audience, expanding the market, and setting new standards for representation and accessibility in the lingerie industry.

In Japan, demand for bras is driven by a cultural emphasis on quality, comfort, and innovation. Japanese consumers prioritize products that provide excellent fit and are made with high-quality materials, which aligns with the meticulous design standards of brands like Wacoal. Additionally, the aging population in Japan has led to a demand for more supportive, ergonomically designed bras that offer both comfort and functionality. Japanese brands also quickly adopt advanced textile technologies, such as moisture-wicking fabrics and lightweight memory foam, catering to consumers who value sophisticated, comfortable options that blend traditional quality with modern design.

Likewise, the demand for bras has grown in Australia due to a strong consumer focus on health, sustainability, and ethical production. Australian consumers prioritize bras made from natural, eco-friendly materials, reflecting a broader cultural focus on environmental responsibility. Brands like Bonds and Berlei emphasize comfort and durability, highly valued traits in the Australian market. Additionally, the increasing popularity of athleisure has boosted demand for sports bras, with many Australian women choosing versatile options that support active lifestyles while also being comfortable for daily wear. Hence, the region will present lucrative growth opportunities for the market throughout the forecast period.

List of Key Companies Profiled

- Victoria’s Secret & Co.

- Agent Provocateur (Fourmarketing Limited)

- MAS Holdings Limited

- Ann Summers Ltd. (Gold Group International Ltd.)

- Bluebella Ltd.

- Felina GmbH (Lauma Lingerie.)

- Hanky Panky Ltd.

- La Perla Fashion Holding N.V.

- PVH Corp.,

- Stella McCartney Limited

Market Report Segmentation

By Material (Volume, Million Units, USD Billion, 2020-2031)

- Cotton

- Chiffon

- Silk

- Other Materials

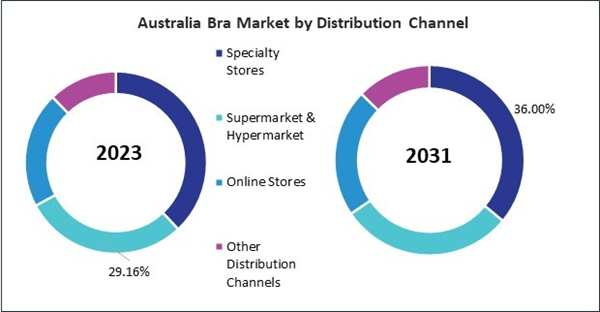

By Distribution Channel (Volume, Million Units, USD Billion, 2020-2031)

- Specialty Stores

- Supermarket & Hypermarket

- Online Stores

- Other Distribution Channels

By Product (Volume, Million Units, USD Billion, 2020-2031)

- T-shirt Bra

- Sports Bra

- Multi-Way Bra

- Adhesive Bra

- Other Products

By Country (Volume, Million Units, USD Billion, 2020-2031)

- China

- Japan

- India

- South Korea

- Australia

- Malaysia

- Rest of Asia Pacific

Table of Contents

Companies Mentioned

- Victoria’s Secret & Co.

- Agent Provocateur (Fourmarketing Limited)

- MAS Holdings Limited

- Ann Summers Ltd. (Gold Group International Ltd.)

- Bluebella Ltd.

- Felina GmbH (Lauma Lingerie.)

- Hanky Panky Ltd.

- La Perla Fashion Holding N.V.

- PVH Corp.,

- Stella McCartney Limited