Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

However, market expansion faces a significant hurdle due to the volatility of raw material prices, particularly for hydrocolloids and dairy derivatives, which introduces financial uncertainty and complicates pricing strategies. This instability often compels producers to compromise on margins or absorb costs, potentially hindering development in price-sensitive regions. Highlighting the scale of operations dependent on these supplies, the International Dairy Foods Association reported that the ice cream industry contributed 11.4 billion dollars to the United States economy in 2024. This substantial economic contribution underscores the critical necessity of a reliable supply of essential premix and stabilizer components.

Market Drivers

The proliferation of soft-serve outlets and Quick-Service Restaurants acts as a primary catalyst for the market, as these venues require standardized premixes to guarantee operational efficiency and product uniformity across franchises. Premixes enable operators to reduce preparation errors and time, while specialized stabilizers are crucial for maintaining the overrun and structural integrity of products dispensed from machines. This operational dependency is reinforced by industry optimism regarding physical expansion; the National Restaurant Association's '2024 State of the Restaurant Industry' report from February 2024 indicates that 29 percent of limited-service operators plan to add new locations, suggesting a sustained rise in ice cream dispensing equipment installations.Concurrently, the growing preference for clean-label and plant-based formulations is driving innovation, with manufacturers seeking stabilizers that replicate the creamy mouthfeel of dairy fats using vegan ingredients. Creating non-dairy ice cream presents significant textural challenges, such as rapid melting and ice crystal formation, which necessitates the use of advanced hydrocolloid systems to meet consumer quality standards. The magnitude of this shift is evident in retail data; the Plant Based Foods Association's '2024 State of the Marketplace' report from May 2024 noted U.S. retail sales of plant-based foods reached 8.1 billion dollars in 2023. Furthermore, Eurostat reported in 2024 that the European Union produced 3.2 billion liters of ice cream in 2023, highlighting the massive industrial baseline that supports demand for these critical ingredients.

Market Challenges

The volatility of raw material prices, particularly for dairy derivatives and hydrocolloids, constitutes a significant barrier to the stable expansion of the Global Ice-cream Premix And Stabilizers Market. Unpredictable fluctuations in the costs of essential inputs like stabilizing agents and milk solids make it difficult for manufacturers to forecast expenses and sustain competitive pricing strategies. This financial instability forces producers to either absorb rising costs, which deeply erodes profit margins, or pass expenses to clients, potentially reducing demand. Consequently, this uncertainty disrupts long-term production planning and can lead to a contraction in manufacturing output, directly lowering the volume of premixes and stabilizers required by the industry.The impact of these operational pressures is reflected in recent production data, which illustrates the industry's struggle to maintain growth amidst such instability. According to the International Institute of Refrigeration, ice cream production in the European Union fell by 1.4% in 2023 to approximately 3.2 billion liters. This decline in downstream product manufacturing underscores how a volatile input environment can suppress overall industry output, thereby limiting the market potential for standardized premix and stabilizer solutions that rely on consistent ice cream production volumes.

Market Trends

The market is being reshaped by the proliferation of functional and fortified ice cream premixes as consumers increasingly prioritize health benefits alongside indulgence. Manufacturers are reformulating premixes to include added vitamins, probiotics, and high-protein concentrates, which significantly alters the rheological properties of the base mix. These nutrient-dense formulations require advanced stabilizer systems to ensure smooth meltdown characteristics and prevent the gritty texture often associated with high protein content. This shift toward healthier options is validating the commercial viability of functional ingredients; Unilever’s 'H1 2025 Results' from July 2025 reported double-digit sales growth for its functional frozen Greek yogurt brand, Yasso, confirming strong consumer demand for nutrient-rich frozen treats necessitating specialized formulation solutions.Simultaneously, there is a distinct focus on premiumization and artisanal texture enhancement, particularly within the frozen novelty segment. Brands are expanding beyond simple flavor profiles to offer multi-sensory experiences featuring intricate inclusions, crunchy coatings, and complex layers, all of which demand robust stabilizer blends to maintain structural integrity. This trend is driving the development of stabilizers that manage moisture migration and prevent ice recrystallization in complex products. The economic impact of this shift is evident in sales performance; according to Dairy Foods' '2025 State of the Dairy Industry' report from November 2025, the frozen novelties category reached 8.9 billion dollars in sales, outpacing the 8.6 billion dollars generated by the traditional ice cream and sherbet category, underscoring the lucrative nature of structurally complex premium formats.

Key Players Profiled in the Ice-cream Premix And Stabilizers Market

- DuPont de Nemours, Inc.

- R.T. Vanderbilt Holding Company, Inc.

- Cargill, Incorporated

- J.M. Huber Corporation

- Ingredion Incorporated

- Palsgaard A/S

- Jungbunzlauer Suisse AG

- Infusions Ltd.

- Fufeng Group

- Hindustan Gum & Chemicals Ltd.

Report Scope

In this report, the Global Ice-cream Premix And Stabilizers Market has been segmented into the following categories:Ice-cream Premix And Stabilizers Market, by Product Type:

- Stabilizer

- Premix

Ice-cream Premix And Stabilizers Market, by Flavor:

- Vanilla

- Chocolate

- Fruit

- Others

Ice-cream Premix And Stabilizers Market, by Type:

- Agar

- Gelatin

- Xanthan Gum

- Carrageenan

- Guar Gum

- Others

Ice-cream Premix And Stabilizers Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Ice-cream Premix And Stabilizers Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Ice-cream Premix and Stabilizers market report include:- DuPont de Nemours, Inc.

- R.T. Vanderbilt Holding Company, Inc.

- Cargill, Incorporated

- J.M. Huber Corporation

- Ingredion Incorporated

- Palsgaard A/S

- Jungbunzlauer Suisse AG

- Infusions Ltd

- Fufeng Group

- Hindustan Gum & Chemicals Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 182 |

| Published | January 2026 |

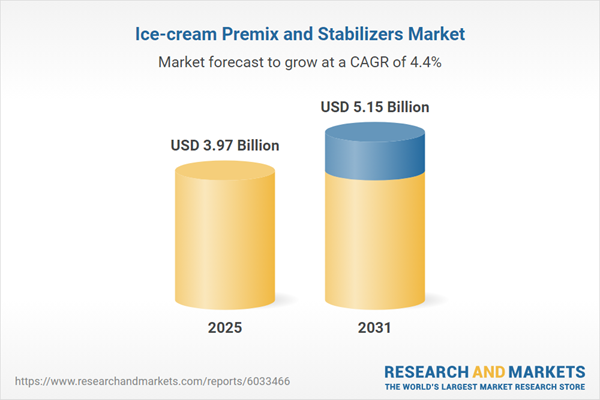

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 3.97 Billion |

| Forecasted Market Value ( USD | $ 5.15 Billion |

| Compound Annual Growth Rate | 4.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |