Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

However, the market encounters significant obstacles due to regulatory restrictions on autonomous operations, which limit the scalability of data collection. Data from the Association for Uncrewed Vehicle Systems International indicates that in 2024, the Federal Aviation Administration granted only 203 waivers for Beyond Visual Line of Sight operations. This figure emphasizes the slow rate at which advanced flight capabilities are being authorized, resulting in a compliance bottleneck that hinders the rapid implementation of drone-based lidar solutions for extensive commercial applications.

Market Drivers

The extensive use of corridor mapping within the utility sector acts as a major market stimulant, necessitated by the need to modernize power grids and reduce wildfire hazards. Utility operators increasingly utilize airborne lidar to oversee vegetation encroachment along transmission lines and verify structural integrity across extensive networks, allowing for the swift detection of clearance issues and accurate asset inventorying without the risks associated with ground patrols. This operational necessity drives substantial financial investment; for instance, NV5 Global, Inc. announced in a May 2024 press release that it secured $14 million in agreements dedicated to utility infrastructure hardening and vegetation management, highlighting the industry's dependence on lidar-based analytics.Concurrently, technological improvements in LiDAR sensors are redefining the market by enhancing data acquisition speed and resolution. Manufacturers are developing sensors with elevated pulse repetition rates and adjustable scan patterns, which allow aerial platforms to survey broader areas more quickly while generating denser point clouds, addressing requirements for high-fidelity models in complex terrains like dense forests or urban canyons. According to an April 2024 press release from RIEGL Laser Measurement Systems, their new VQ-1560 III-S system achieves a pulse repetition rate of up to 4 MHz, significantly increasing productivity. This progress supports wide-scale surveys, evidenced by the U.S. Geological Survey's 2024 report that high-resolution elevation data now covers approximately 94% of the nation.

Market Challenges

The restrictive regulatory framework governing autonomous operations serves as a major impediment to the Global Airborne Lidar Market. Existing aviation regulations, specifically regarding Beyond Visual Line of Sight (BVLOS) flights, require operators to keep the aircraft within direct visual range, which effectively undermines the efficiency of long-range autonomous scanning. This constraint compels companies to conduct numerous short-range flights or employ large ground crews to remain compliant, thereby inflating operational expenses and prolonging timelines for major infrastructure mapping projects. Consequently, service providers struggle to fully utilize the endurance of modern aerial platforms, resulting in diminished profit margins and a reduced capacity to accept projects necessitating wide-area coverage.This regulatory landscape causes a severe underutilization of compliant hardware, creating a disparity between market potential and operational feasibility. According to the Association for Uncrewed Vehicle Systems International, the total number of registered commercial drones in the United States reached 390,027 in 2024. This statistic highlights the vast number of commercial platforms available for data collection in contrast to the scarce approvals granted for complex missions. This regulatory bottleneck directly limits the scalability of lidar services, capping potential revenue generation and delaying the widespread adoption of autonomous aerial data acquisition.

Market Trends

The rise of lightweight topobathymetric systems is revolutionizing coastal surveying by allowing for the simultaneous collection of land and seafloor data from a single aerial platform. This trend is largely propelled by the urgent necessity for climate change resilience strategies, which demand precise nearshore models to track erosion, storm surges, and sea-level rise. In contrast to legacy deep-water systems that necessitated heavy aircraft, these modern, compact sensors are compatible with smaller planes, thereby enhancing operational flexibility and lowering mobilization costs for mapping complex coastlines. Highlighting public sector demand, Land Information New Zealand announced a tender in September 2024 to acquire airborne topographic and bathymetric LiDAR data spanning up to 40% of the country's coastline for hazard management and climate adaptation.Simultaneously, the market is shifting towards real-time data analysis and edge computing to overcome the logistical hurdles of processing immense datasets. Operators are increasingly abandoning exclusive post-mission processing in favor of systems capable of performing initial data classification and quality control directly onboard the aircraft. This integration minimizes the delay between data acquisition and actionable insights, a vital feature for time-critical applications like rapid disaster response or active infrastructure assessment. Reflecting this shift, Teledyne Geospatial announced in a July 2024 press release the launch of a new airborne system equipped with onboard edge computing capabilities, designed to streamline workflows and expedite the delivery of classified point clouds.

Key Players Profiled in the Airborne Lidar Market

- Teledyne Technologies Incorporated

- Saab AB

- Airborne Imaging Inc.

- FARO Technologies, Inc.

- Merrick & Company

- Trimble Inc.

- SBG Systems S.A.S

- Phoenix LiDAR Systems

- Fugro N.V.

- Firmatek, LLC

Report Scope

In this report, the Global Airborne Lidar Market has been segmented into the following categories:Airborne Lidar Market, by Solution Type:

- System

- Services

Airborne Lidar Market, by Type:

- Topographic

- Bathymetric

Airborne Lidar Market, by Platform Type:

- Fixed Wing Aircraft

- Rotary Wing Aircraft

- Unmanned Aerial Vehicles

Airborne Lidar Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Airborne Lidar Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Airborne Lidar market report include:- Teledyne Technologies Incorporated

- Saab AB

- Airborne Imaging Inc.

- FARO Technologies, Inc.

- Merrick & Company

- Trimble Inc.

- SBG Systems S.A.S

- Phoenix LiDAR Systems

- Fugro N.V.

- Firmatek, LLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

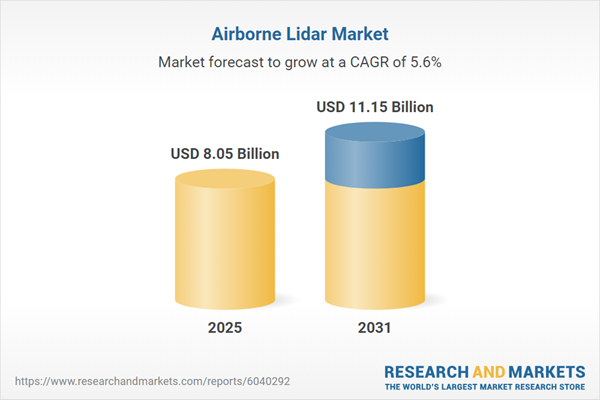

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 8.05 Billion |

| Forecasted Market Value ( USD | $ 11.15 Billion |

| Compound Annual Growth Rate | 5.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |