The North America segment recorded 36% revenue share in the market in 2023. The presence of key players such as NASA, SpaceX, Maxar Technologies, and Lockheed Martin has solidified North America’s leadership in satellite deployment and data services. The commercial sector in North America has also witnessed rapid growth, with industries such as agriculture, oil & gas, and logistics integrating satellite-based analytics into their operations.

The demand for Earth observation (EO) data is rising as governments, businesses, and research institutions use satellite imagery for climate monitoring, disaster management, agriculture, and urban planning. Satellites help track greenhouse gas emissions, deforestation, glacier melting, and rising sea levels, enabling scientists to assess climate change impacts. For instance, the Copernicus Sentinel-5P satellite monitors air pollution globally, while NASA’s OCO-2 provides high-resolution CO₂ data. Hence, these factors are propelling the growth of the market.

Additionally, the expansion of IoT and 5G networks is revolutionizing industries by enabling real-time connectivity, automation, and data-driven decision-making. According to the World Bank’s Digital Progress and Trends Report 2023, in 2022, more than 13 billion IoT devices were in use. Driven largely by the real-time connectivity of 5G technology, these devices are expected to more than double between 2023 and 2028. Satellite-enabled IoT solutions are crucial for maritime, agriculture, logistics, and energy sectors, where traditional networks have limitations. Thus, these developments will aid in the expansion of the market.

However, The cost of building a satellite can range from tens of millions to billions of dollars, depending on its size, functionality, and intended application. This financial burden extends beyond manufacturing, encompassing launch operations, insurance, and long-term maintenance expenses. The high entry costs make it difficult for new players to enter the market, limiting competition and innovation. Besides the initial investment, ongoing operational costs add to the financial strain. Hence, the high cost of these technologies may hamper the market's growth.

Driving and Restraining Factors

Drivers- Increasing Demand For Earth Observation Data

- Rapid Expansion Of Iot And 5G Networks

- Growing Commercial Applications Of Satellite Data

- High Cost Of Satellite Deployment & Maintenance

- Data Security & Privacy Concerns

- Growth In Climate Change Monitoring And Disaster Management

- Expanding Role In Smart Cities And Urban Planning

- Limited Bandwidth & Connectivity Issues

- Competition From Alternative Technologies

End Use Outlook

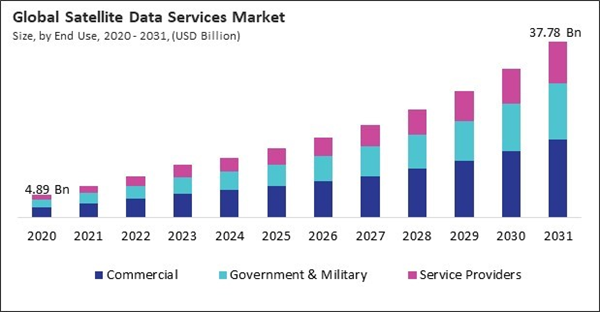

Based on end use, the market is segmented into commercial, government & military, and service providers. The government & military segment recorded 31% revenue share in the market in 2023. Satellite data is crucial in defense and intelligence operations, helping governments track troop movements, monitor international conflicts, and assess national security threats. Additionally, satellites support communication networks, weather forecasting, and early warning systems, which are critical for national security.Deployment Outlook

On the basis of deployment, the market is divided into private, public, and hybrid. The public segment witnessed 25% revenue share in the market in 2023. Public satellite deployments are essential for environmental monitoring, disaster management, national security, climate research, and urban planning. Governments invest heavily in Earth observation programs, climate change tracking, and global security initiatives, making public satellite services a crucial component of national and international projects.Service Outlook

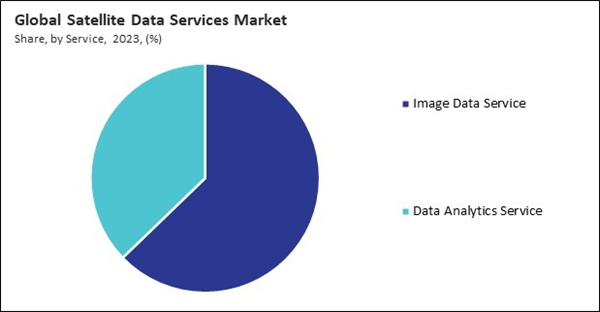

By service, the market is bifurcated into image data service and data analytics service. The data analytics service segment procured 37% revenue share in the market in 2023. Advanced AI-powered analytics, machine learning (ML) algorithms, and cloud-based geospatial platforms have transformed how organizations process and interpret satellite data. Instead of merely acquiring images, businesses now require sophisticated analytics to extract patterns, trends, and predictive insights for decision-making.Application Outlook

Based on application, the market is classified into defense & security, energy & utilities, agriculture & forestry, environmental & climate monitoring, engineering & infrastructure development, marine, and others. The defense & security segment procured 21% revenue share in the market in 2023. The increasing geopolitical tensions and security threats have fueled investments in geospatial intelligence (GEOINT), reconnaissance satellites, and remote sensing technologies. Satellite imagery is crucial in monitoring troop movements, detecting potential threats, tracking illicit activities such as smuggling and terrorism, and supporting military operations.Regional Outlook

Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. The Europe segment witnessed 31% revenue share in the market in 2023. The European Space Agency (ESA), Airbus Defence & Space, and Thales Alenia Space have pivotal roles in advancing Earth observation programs, satellite communications, and space-based research. Countries like Germany, the United Kingdom, and France are at the forefront of satellite technology adoption, utilizing satellite data for urban planning, environmental monitoring, defense intelligence, and disaster response.Recent Strategies Deployed in the Market

- Jan-2025: Telstra Corporation Limited teamed up with SpaceX’s Starlink, a satellite internet constellation operated to launch direct-to-device satellite messaging in Australia, improving remote connectivity. This collaboration offers SMS, future plans include voice, data, and IoT services. Currently in testing, this aligns with global telecom trends, as companies like T-Mobile and Amazon advance satellite-based mobile solutions.

- Sep-2024: ICEYE announced a partnership with NASA, a science and technology agency, to provide synthetic aperture radar data for the latter’s Commercial Smallsat Data Acquisition Program. This program aims to leverage commercial sources to identify, evaluate, and acquire data to support NASA's Earth Science Division in its scientific research and application objectives.

- Sep-2024: Planet Labs, Inc. announced the partnership with the German Space Agency at the German Aerospace Center. The Partnership would enable Planet to offer its Earth observation data services and products to the German Space Agency, as well as German researchers to aid in their research and development activities. Researchers will be able to access the company’s PlanetScope products, which include their advanced monitoring capabilities and a comprehensive archive of PlanetScope data. The German Space Agency will also receive Planet’s complete archive of RapidEye imagery over Germany.

- Jul-2023: Airbus SE teamed up with Astrocast, a satellite communication company to enhance Satellite IoT (SatIoT) technology, boosting network capacity and service quality. This collaboration strengthens Astrocast’s position as a leading SatIoT provider, improving connectivity, efficiency, and data security while supporting future 5G NTN IoT standards for various industries worldwide.

- Jan-2020: L3Harris Technologies, Inc. announced the partnership with exactEarth Ltd., a leading provider of Satellite-AIS data services. The partnership aimed to provide exactEarth with a reduced and simplified cost structure for L3Harris' satellite-AIS data services. The partnership also provides additional growth opportunities to both parties and further strengthens the latter company's alliance with L3Harris in delivering advanced high-performance satellite maritime service capabilities to customers around the world.

List of Key Companies Profiled

- Telstra Corporation Limited

- Planet Labs, Inc.

- Airbus SE

- ICEYE

- L3Harris Technologies, Inc.

- Earth-i Ltd.

- Geocento

- NV5 Global, Inc.

- Satellite Imaging Corporation

- SATPALDA

Market Report Segmentation

By End Use- Commercial

- Government & Military

- Service Providers

- Private

- Public

- Hybrid

- Image Data Service

- Data Analytics Service

- Environmental & Climate Monitoring

- Defense & Security

- Energy & Utilities

- Agriculture & Forestry

- Engineering & Infrastructure Development

- Marine

- Other Application

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia-Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Telstra Corporation Limited

- Planet Labs, Inc.

- Airbus SE

- ICEYE

- L3Harris Technologies, Inc.

- Earth-i Ltd.

- Geocento

- NV5 Global, Inc.

- Satellite Imaging Corporation

- SATPALDA