In the United States, the automotive logistics sector has witnessed a significant increase in demand, attributable to heightened vehicle production and rigorous safety regulations. The National Automobile Dealers Association (NADA) reported that in 2023, light vehicle sales reached nearly 15.5 million units, reflecting significant market growth. This rise in vehicle manufacturing directly translates into a higher demand for logistics services, ensuring that essential components such as bumpers, chassis, and electronic safety systems are efficiently transported to assembly plants and distribution centers. Thus, the North American segment procured 31% revenue share in the market in 2023. Advanced logistics infrastructure, strong automotive manufacturing capabilities, and increasing demand for electric and autonomous vehicles fuel it. The United States-Mexico-Canada Agreement (USMCA) has streamlined cross-border trade, strengthening regional supply chains. Additionally, investments in EV logistics, sustainable transportation solutions, and high-tech warehousing facilities have further boosted market growth, ensuring North America remains a key player in the global automotive logistics industry.

Supply chain efficiency is critical in reducing delays and production costs, especially in an industry as competitive as automotive manufacturing. With the increasing complexity of electric vehicle (EV) production, autonomous driving technology, and global component sourcing, the need for highly responsive and adaptive supply chains has never been greater. Additionally, the integration of smart warehouses is further revolutionizing logistics by leveraging AI-powered inventory systems, robotics, and automated guided vehicles (AGVs) to enhance storage and order fulfillment processes. These technologies reduce manual intervention, improve accuracy, and speed up operations, ensuring that automotive manufacturers receive parts quickly. Thus, as the automotive industry continues to evolve, the role of digitization and automation in logistics will only expand.

However, the automotive logistics industry faces increasing transportation and warehousing costs, significantly impacting overall profitability and operational efficiency. One of the primary contributors to high transportation costs is the fluctuation in fuel prices. Since fuel is a major operating expense in logistics, even a slight increase in global oil prices directly raises shipping and delivery costs. Another major challenge is the cost of warehousing, which has surged due to limited space availability in key logistics hubs. Thus, high transportation and warehousing costs pose significant hurdles for scalability and profitability in the market.

Driving and Restraining Factors

Drivers

- Rising Vehicle Production & Sales

- Advancements in Supply Chain Technologies

- Increasing Demand for Just-in-Time (JIT) and Lean Manufacturing

Restraints

- Stringent Regulatory Compliance

- High Transportation and Warehousing Costs

Opportunities

- Globalization & Expansion of Manufacturing Hubs

- Rising Demand for Third-Party Logistics (3PL)

Challenges

- Substantial Supply Chain Disruptions

- Significant Volatility in Fuel Prices

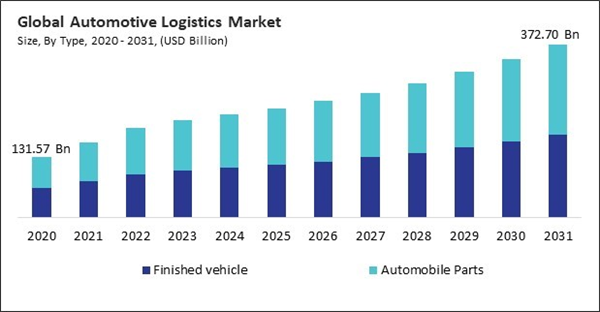

Type Outlook

On the basis of type, the market is classified into finished vehicle and automobile parts. The finished vehicle segment garnered 49% revenue share in the market in 2023. The escalating demand for electric vehicles (EVs) and prestige automobiles, which necessitate specialized transportation solutions, has further stimulated growth within this sector. Investments in multi-modal transportation, including specialized car carrier trucks, rail networks, and maritime shipping, have enhanced the efficiency of vehicle logistics.Transportation Segment Outlook

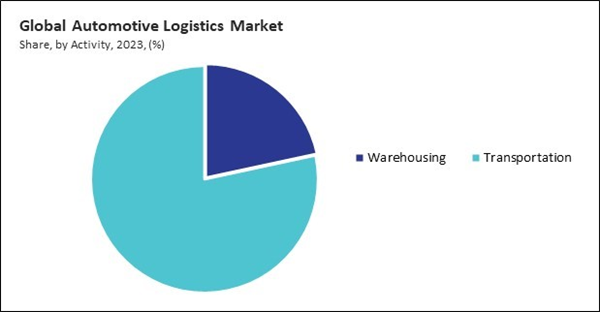

The transportation segment is divided into roadways, airways, maritime, and railways. The roadways segment acquired 51% revenue share in the market in 2023. The increasing demand for just-in-time (JIT) manufacturing, which requires frequent and timely deliveries of automotive components, has further propelled the need for efficient trucking services. Additionally, the rise of electric and autonomous trucks and investments in smart fleet management systems and fuel-efficient vehicles drive growth in this segment. Road transport is also highly adaptable, making it ideal for urban last-mile deliveries and long-haul transportation across regions, ensuring its continued expansion in logistics.Activity Outlook

Based on activity, the market is bifurcated into warehousing and transportation. The warehousing segment procured 22% revenue share in the market in 2023. The rise of e-commerce in the automotive sector, particularly for spare parts, aftermarket components, and accessories, has fueled the demand for smart warehouses with IoT-enabled tracking, robotics, and AI-driven logistics management. Additionally, manufacturers are investing in localized warehousing and distribution centers to mitigate supply chain disruptions and reduce dependency on long-haul transportation. As companies prioritize supply chain resilience and real-time inventory visibility, the warehousing segment continues to grow, offering improved storage solutions for an increasingly digital and fast-paced logistics environment.Distribution Outlook

By distribution, the market is divided into domestic and international. The domestic segment procured 67% revenue share in the market in 2023. The domestic automotive logistics segment is driven by the growing demand for locally manufactured vehicles and auto parts, supported by government initiatives to boost domestic production through policies such as local sourcing mandates and tax incentives. Expanding road infrastructure, improved warehousing facilities and adoption of digital tracking solutions have further streamlined intra-country logistics, making domestic distribution a key revenue-generating segment in the market.Solution Outlook

Based on solution, the market is segmented into inbound, outbound, reverse, and others. The inbound segment recorded 37% revenue share in the market in 2023. Automakers increasingly rely on just-in-time (JIT) and just-in-sequence (JIS) manufacturing models, requiring seamless coordination with suppliers to prevent production delays. Electric vehicles (EVs) growth has further intensified the need for specialized inbound logistics solutions, as automakers must manage the transportation of high-value components such as lithium-ion batteries, semiconductor chips, and advanced vehicle electronics.Regional Outlook

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific segment garnered 37% revenue share in the market in 2023. Countries such as China, Japan, South Korea, and India are major hubs for automobile manufacturing and exports, with China leading as the world's largest vehicle producer. The region's burgeoning development is propelled by the escalating adoption of electric vehicles (EVs), governmental initiatives that advocate for sustainable logistics, and a heightened demand for automotive components.List of Key Companies Profiled

- Kintetsu World Express, Inc.

- CMA CGM Group

- Deutsche Post DHL Group (The Deutsche Post AG)

- DSV A/S

- BLG LOGISTICS GROUP AG & Co. KG

- Imperial Brands PLC

- Nippon Express Co., Ltd.

- Hellmann Worldwide Logistics SE & Co. KG

- Schenker Storen AG

- Penske Automotive Group, Inc.

Market Report Segmentation

By Type

- Finished vehicle

- Automobile Parts

By Distribution

- Domestic

- International

By Activity

- Warehousing

- Transportation

- Roadways

- Maritime

- Railways

- Airways

By Solution

- Inbound

- Outbound

- Reverse

- Other Solution

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Kintetsu World Express, Inc.

- CMA CGM Group

- Deutsche Post DHL Group (The Deutsche Post AG)

- DSV A/S

- BLG LOGISTICS GROUP AG & Co. KG

- Imperial Brands PLC

- Nippon Express Co., Ltd.

- Hellmann Worldwide Logistics SE & Co. KG

- Schenker Storen AG

- Penske Automotive Group, Inc.