Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

The retail sector has been increasingly adopting edge computing as it allows for quicker responses to customer needs, better inventory management, personalized shopping experiences, and improved operational efficiency. For example, real-time analytics from in-store cameras can optimize store layouts, predict consumer behavior, and even reduce theft through advanced security systems. Edge computing enhances supply chain management by providing near-instantaneous feedback on inventory levels and customer preferences.

The market for retail edge computing is expected to rise significantly due to several key drivers. The growing demand for hyper-personalized shopping experiences, driven by customer expectations for instant and tailored services, is pushing retailers to adopt technologies that can provide real-time insights. As the number of IoT devices and sensors in retail environments continues to increase, the need for decentralized computing grows to handle the massive volume of data these devices generate. The ongoing expansion of 5G networks further accelerates this shift, as 5G enables high-speed, low-latency communication, making edge computing more effective in handling real-time data processing.

The rise of omnichannel retail, where consumers interact with brands through both physical stores and digital platforms, demands seamless and responsive systems that edge computing can support. Security concerns and the need for reducing data latency in processing transactions also play a role in the adoption of edge computing, as retailers seek to ensure customer data is handled efficiently and securely.

The increasing importance of automation in retail operations, such as smart shelves, automated checkout, and personalized promotions, is another factor driving the market's growth. As edge computing enables faster, local processing, retailers can streamline operations and enhance customer engagement, leading to more competitive advantages in a crowded market. Therefore, the retail edge computing market is poised to grow rapidly, driven by advancements in technology, the need for operational efficiency, and the push for personalized, real-time customer experiences.

Key Market Drivers

Demand for Real-Time Data Processing and Decision Making

One of the primary drivers of the retail edge computing market is the increasing demand for real-time data processing and decision making within retail environments. The modern retail landscape is becoming increasingly data-driven, with retailers collecting vast amounts of information from in-store sensors, cameras, point-of-sale systems, and online interactions. These data points include customer behavior, inventory levels, and transaction details. For retail businesses, the ability to process this information as it is generated, without having to send it to a centralized cloud or data center, has become a critical factor in staying competitive.Retailers are under constant pressure to improve customer experiences, optimize operations, and stay ahead of market trends. Real-time data processing allows them to gain immediate insights into their operations, whether it is for analyzing customer foot traffic, adjusting pricing, or making stock replenishment decisions. Edge computing enables data to be processed closer to the point of origin, reducing latency and enabling quicker decision-making, which is especially crucial during peak hours or sales events.

For instance, by leveraging real-time data at the edge, a retailer can adjust promotions, manage store layouts, and even optimize staff allocation instantly based on customer behavior patterns, thereby enhancing operational efficiency and improving customer experience. This ability to make informed decisions promptly is a major factor driving the retail edge computing market’s growth. By the end of 2025, it is estimated that 80% of all enterprise data will need to be processed in real-time or near real-time to drive critical decision-making.

Key Market Challenges

Complexity of Integration with Existing Infrastructure

One of the primary challenges for the retail edge computing market is the complexity of integrating edge computing solutions with existing retail infrastructure. Many retailers, particularly legacy businesses, already have established systems in place for their operations, such as centralized data centers, cloud-based applications, and traditional point-of-sale systems. Implementing edge computing requires significant changes to this infrastructure, which can be costly, time-consuming, and technically challenging. Retailers must ensure that their edge computing solutions are seamlessly integrated with these legacy systems to maintain smooth operations and avoid disruptions.This can involve substantial investments in both hardware and software, as well as training personnel to manage and operate new systems. Many edge computing solutions require specialized hardware, such as local data processing units, sensors, or specialized network equipment, which may not be compatible with older retail technologies. Integrating such diverse systems can lead to compatibility issues, data silos, or inefficiencies that hinder the desired performance improvements. The process of integration may involve significant customization to align with the specific needs of a retail business.

Retailers must work closely with technology vendors and service providers to ensure that edge computing solutions are tailored to their particular operational requirements, which can increase project timelines and costs. For businesses with a wide range of store formats or a diverse product offering, integrating edge computing at scale can be particularly challenging. A lack of standardized solutions or processes across different retail environments can create inconsistencies in performance and operational challenges, delaying the expected benefits of edge computing. Thus, retailers face considerable challenges in ensuring that edge computing solutions can be effectively incorporated into their existing infrastructure while maintaining operational continuity.

Key Market Trends

Increased Adoption of Artificial Intelligence and Machine Learning at the Edge

One of the significant trends in the retail edge computing market is the increasing integration of artificial intelligence and machine learning technologies directly at the edge. Traditionally, artificial intelligence and machine learning models required heavy processing power in centralized cloud environments, resulting in latency and bandwidth challenges. However, with the advancement of edge computing technologies, retailers are now able to deploy these advanced algorithms at the edge, closer to where data is generated. This enables real-time analysis of customer behavior, inventory management, and store operations.For example, edge devices equipped with artificial intelligence can instantly analyze video feeds from in-store cameras to recognize customer actions, detect patterns, and even predict future purchasing behavior. Retailers can leverage this data to offer personalized promotions, optimize store layouts, or detect shoplifting in real-time. Machine learning algorithms can be used to predict inventory needs based on in-store data, reducing stockouts and overstocking. The ability to run these sophisticated models locally ensures quicker response times and minimizes the need for constant cloud communication, which enhances overall system efficiency. The growing reliance on artificial intelligence and machine learning at the edge is transforming how retailers operate, providing them with enhanced insights and decision-making capabilities that drive business success.

Key Market Players

- Amazon.com, Inc.

- Microsoft Corporation

- IBM Corporation

- Intel Corporation

- Cisco Systems, Inc.

- Hewlett Packard Enterprise Company

- NVIDIA Corporation

- Google LLC

- Oracle Corporation

- Qualcomm Incorporated

Report Scope:

In this report, the Global Retail Edge Computing Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Retail Edge Computing Market, By Component:

- Hardware

- Software

- Services

Retail Edge Computing Market, By Application:

- Smart Cities

- Industrial Internet of Things

- Remote Monitoring

- Content Delivery

- Augmented Reality

- Virtual Reality

- Others

Retail Edge Computing Market, By Organization Size:

- Small & Medium Enterprises

- Large Enterprises

Retail Edge Computing Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Belgium

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- Indonesia

- Vietnam

- South America

- Brazil

- Colombia

- Argentina

- Chile

- Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Turkey

- Israel

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Retail Edge Computing Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Amazon.com, Inc.

- Microsoft Corporation

- IBM Corporation

- Intel Corporation

- Cisco Systems, Inc.

- Hewlett Packard Enterprise Company

- NVIDIA Corporation

- Google LLC

- Oracle Corporation

- Qualcomm Incorporated

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | March 2025 |

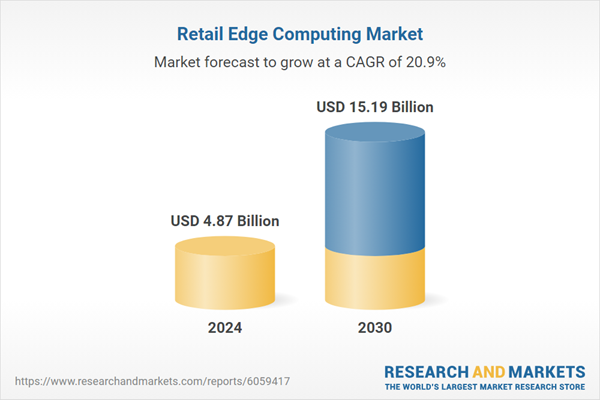

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 4.87 Billion |

| Forecasted Market Value ( USD | $ 15.19 Billion |

| Compound Annual Growth Rate | 20.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |