Cutting-edge advancements in medical technology are revolutionizing cardiovascular care. The introduction of AI-powered diagnostics, robotic-assisted surgeries, and minimally invasive procedures is enhancing patient outcomes while reducing recovery time. The industry is witnessing a surge in regulatory approvals, expanding access to state-of-the-art cardiovascular devices. Governments and private healthcare entities are heavily investing in research and development to introduce next-generation solutions that cater to evolving patient needs. Rising healthcare expenditures, particularly in developed economies, are facilitating the widespread availability of advanced cardiac devices, further propelling market growth. Moreover, the increasing number of outpatient cardiovascular interventions and home-based monitoring systems is making treatments more accessible and convenient for patients.

The market is categorized by device type into cardiac ablation devices, left atrial appendage closure devices, and endoscopic vessel harvesting devices. Among these, cardiac ablation devices led the market with a valuation of USD 5.1 billion in 2024 and are projected to witness a CAGR of 13.7% over the forecast period. The rising prevalence of atrial fibrillation is a key driver behind the demand for these devices. With more individuals diagnosed with irregular heart rhythms, the adoption of minimally invasive ablation techniques is on the rise. Additionally, growing awareness about effective treatment options, coupled with continuous advancements in ablation technology, is fostering market expansion.

By end use, the cardiovascular devices market is segmented into hospitals, ambulatory surgical centers, cardiac centers, and other healthcare facilities. Hospitals dominated the sector, generating USD 4.4 billion in 2024 and accounting for 58.3% of the total revenue. A higher patient influx for complex cardiac interventions, including bypass surgeries, catheterizations, and device implantations, is solidifying hospitals' leadership in this space. Equipped with advanced imaging technologies, specialized cardiac units, and multidisciplinary teams, hospitals remain the primary treatment hubs for critical cardiovascular cases. Additionally, their ability to handle emergency and inpatient procedures makes them a preferred choice among both patients and healthcare providers.

The U.S. cardiovascular devices market stood at USD 2.5 billion in 2023 and is projected to grow to USD 9.7 billion by 2034. The country benefits from a well-established healthcare infrastructure, rapid adoption of cutting-edge cardiovascular technologies, and a strong network of skilled professionals, including cardiac surgeons, interventional cardiologists, and electrophysiologists. Continuous innovation in treatment methodologies and supportive regulatory policies are accelerating market penetration. Favorable reimbursement frameworks are further encouraging the adoption of advanced cardiovascular devices, positioning the U.S. as a leading market for cardiac care solutions.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this Cardiovascular Devices market report include:- Abbott Laboratories

- AngioDynamics

- AtriCure

- Biosense Webster

- Boston Scientific Corporation

- Biotronik

- CardioFocus

- Getinge

- Japan Lifeline

- Karl Storz

- Lepu Medical Technology

- Lifetech Scientific

- Livanova

- Microport Scientific Corporation

- Medical Instruments

- Medtronic

- Occlutech

- Saphena Medical

- Stereotaxis

- Terumo Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 130 |

| Published | February 2025 |

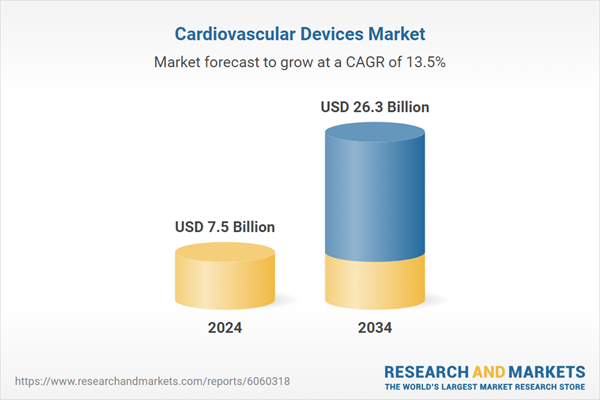

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 7.5 Billion |

| Forecasted Market Value ( USD | $ 26.3 Billion |

| Compound Annual Growth Rate | 13.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 21 |