The market is categorized by packaging type, including primary, secondary, and tertiary packaging. Primary packaging, which safeguards the product directly, dominated the market with a value of USD 35.4 billion in 2024. Consumers are showing increased interest in intricate and visually appealing containers, driving the demand for advanced designs and high-quality materials. Industry players are leveraging cutting-edge technologies to introduce creative packaging solutions that meet the ever-changing demands of beauty enthusiasts. Secondary and tertiary packaging solutions continue to play a crucial role in protecting cosmetic products during storage and transportation, ensuring they remain intact until they reach the end consumer.

Material selection plays a vital role in market dynamics, with plastic, glass, metal, paper cardboard, wood, and other materials being widely utilized for cosmetic packaging. The plastic segment led the market in 2024, holding a 60.4% share due to its lightweight properties, durability, and cost-effectiveness. Its versatility in being molded into various shapes makes it an ideal choice for mass production in the cosmetics industry. However, rising concerns about environmental pollution have prompted companies to explore bio-based plastic alternatives and Post-Consumer Recycled (PCR) materials. This shift reflects a growing trend toward sustainable packaging solutions that reduce the environmental impact while meeting consumer expectations for responsible practices.

North America Cosmetic Packaging Market reached USD 14.2 billion in 2024, driven by the increasing demand for beauty and personal care products. Consumers in the region are becoming more conscious of the materials used in packaging, encouraging brands to prioritize eco-friendly solutions. As sustainability becomes a top priority, industry players are responding with innovative designs that balance environmental responsibility with consumer appeal. The region’s strong market growth is expected to continue as brands adopt packaging solutions that align with these evolving preferences.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this Cosmetic Packaging market report include:- Albéa Group

- Amcor plc

- Anomatic Corporation

- AptarGroup Inc.

- AREXIM Packaging

- Berry Global Group Inc.

- Cosmopak

- Fusion Packaging

- Gerresheimer AG

- Graham Packaging Company

- HCP Packaging

- Libo Cosmetics Company Ltd.

- Lumson S.p.A.

- Quadpack

- Seidel GmbH & Co. KG

- Silgan Holdings Inc.

- Toly Group

- WWP Beauty

- Yonwoo Co. Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

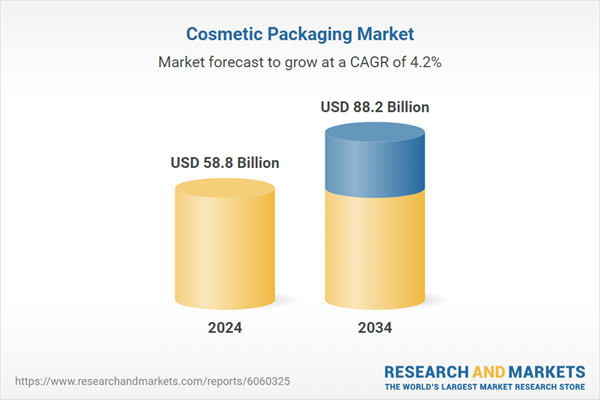

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 58.8 Billion |

| Forecasted Market Value ( USD | $ 88.2 Billion |

| Compound Annual Growth Rate | 4.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 20 |