Investments in port automation and smart infrastructure are increasing as the need for real-time monitoring, enhanced safety, and seamless logistics management continues to rise. Both government and private sectors are allocating substantial resources to upgrade ports, particularly in developing regions, where deep-water terminals and high-capacity storage systems are being developed. Demand for gantry cranes, ship-to-shore cranes, and automated guided vehicles is rising as ports aim to streamline operations and manage higher cargo volumes efficiently.

The market is segmented by equipment type, propulsion, and operation. Cargo handling equipment held over 45% of the market share and is projected to surpass USD 17.8 billion by 2034. The rapid growth of containerized cargo has increased the need for ship-to-shore cranes, rubber-tired gantry cranes, straddle carriers, and reach stackers. Efficient cargo handling equipment helps ports reduce berth occupation times and maximize ship turnaround rates. Automated solutions such as automatic stacking cranes and terminal tractors are gaining traction, improving productivity and minimizing delays.

By propulsion type, the market is categorized into diesel, electric, and hybrid. Diesel-powered port equipment accounted for 54% of the market share in 2024. Reach stackers, straddle carriers, and rubber-tired gantry cranes primarily rely on diesel engines due to their high torque and load-handling capabilities. Diesel-powered equipment remains the preferred choice for ports handling bulk materials and heavy cargo, as it ensures uninterrupted operations. While electrification is gaining attention, the transition to battery-powered systems faces challenges, including high costs, limited lifting capacity, and extended charging times. The availability of diesel fuel and well-established fueling infrastructure further supports its dominance. Many ports, particularly in developing economies, have yet to implement alternative fueling solutions such as LNG and hydrogen, keeping diesel equipment at the forefront.

Based on operation, the market is divided into manual, semi-automated, and fully automated segments. Manual port equipment held a 48% market share in 2024. Forklifts, mobile cranes, and manually operated reach stackers remain widely used, especially in small and medium-sized ports, due to lower initial investment and maintenance costs. Unlike automated systems, manual equipment offers greater flexibility in handling diverse cargo types, including irregularly shaped goods and breakbulk shipments. Developing regions prioritize trade infrastructure expansion over automation, leading to sustained demand for manual port equipment.

North America leads the global market, with the United States generating USD 3.5 billion in 2024. The region’s ongoing investments in port modernization and advanced cargo handling systems continue to fuel market growth.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this Port Equipment market report include:- Anhui Heli

- CVS Ferrari

- Doosan Industrial Vehicle

- Gottwald Port Technology

- Hyster-Yale Materials Handling

- Hyundai Heavy Industries

- JCB

- Kalmar

- Konecranes

- Liebherr Group

- Lonking Holdings Limited

- Manitou Group

- Marine Travelift

- Mitsubishi Logisnext

- Sany Heavy Industry

- Shanghai Zhenhua Heavy Industries (ZPMC)

- Terex

- Toyota Industries

- TTS Group ASA

- Zoomlion Heavy Industry Science & Technology

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 170 |

| Published | February 2025 |

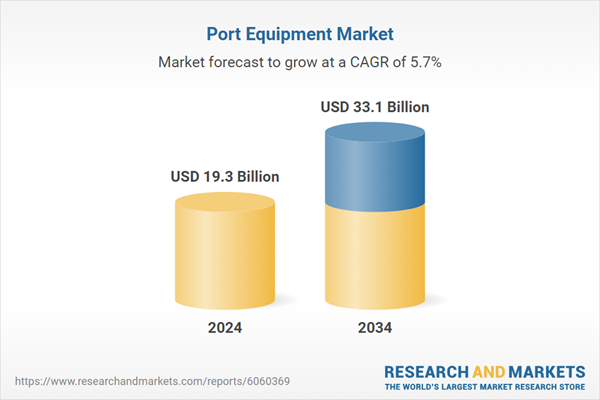

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 19.3 Billion |

| Forecasted Market Value ( USD | $ 33.1 Billion |

| Compound Annual Growth Rate | 5.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 21 |