By product, the market is divided into line pregnancy tests, digital devices, and other options. Line pregnancy tests led the market, generating USD 889.7 million in 2024. Their affordability, accessibility, and ease of use make them a top choice. These tests, available in pharmacies and online, provide instant results by detecting hCG in urine samples.

Based on test type, the market includes urine tests for hCG and blood tests for hCG. The urine test segment accounted for 63.5% of market revenue in 2024 and is anticipated to reach USD 1.8 billion by 2034. The preference for urine tests stems from their non-invasive nature, affordability, and ease of use. These tests come in strip, cassette, and midstream formats, allowing users to choose based on convenience. While strip tests require dipping in a urine sample, cassette and midstream versions eliminate this step, enhancing user experience.

By distribution channel, the market is segmented into online pharmacies, hospital pharmacies, and retail pharmacies. Hospital pharmacies generated the highest revenue of USD 917.3 million in 2024. Consumers often prefer purchasing pregnancy detection kits from hospital pharmacies due to the presence of trained medical professionals, ensuring guidance and reliability. The availability of additional hospital services, such as ultrasound imaging and blood tests, further drives demand.

Regionally, North America is a major contributor to market growth. The US pregnancy detection kits market is set to reach USD 1 billion by 2034. A high women literacy rate of 99% has increased awareness of pregnancy detection, boosting demand for home testing options. Additionally, the strong US healthcare system supports family planning initiatives and provides broad accessibility to pregnancy kits through retail and e-commerce channels, driving market expansion.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this Pregnancy Detection Kits market report include:- Abbott Laboratories

- Cardinal Health

- Church & Dwight

- Danaher Corporation

- McKesson Corporation

- Medline Industries

- LP.

- Meridian Bioscience Inc.

- QuidelOrtho Corporation

- Rapigen

- SEKISUI CHEMICAL CO. Ltd.

- SPD Swiss Precision Diagnostics GmbH

- Thermo Fisher Scientific

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 132 |

| Published | February 2025 |

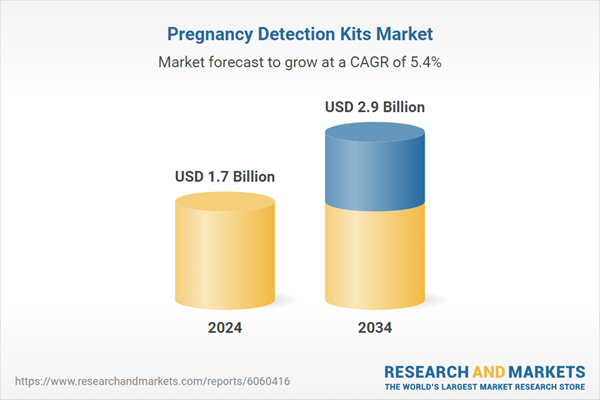

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 1.7 Billion |

| Forecasted Market Value ( USD | $ 2.9 Billion |

| Compound Annual Growth Rate | 5.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 14 |