Technological advancements are reshaping the semiconductor industry, driving innovations in advanced packaging methodologies. The increasing integration of AI-driven applications and high-performance computing is prompting semiconductor manufacturers to develop highly efficient packaging solutions that support rapid data processing and enhanced connectivity. Rising investments in 5G, Internet of Things (IoT), and autonomous technologies are further propelling the demand for advanced semiconductor packaging, which plays a crucial role in improving device longevity, heat dissipation, and energy efficiency. As industries prioritize performance optimization, the need for customized, application-specific packaging solutions continues to grow, reinforcing the industry's upward trajectory.

The market is segmented by packaging type into flip-chip, fan-in wafer-level packaging, embedded-die, fan-out, and 2.5D/3D technologies. Flip-chip-based advanced packaging dominated the segment, accounting for USD 24 billion in 2023, due to its ability to provide high-density interconnections. This technique involves flipping the chip and connecting it directly to the substrate using solder bumps, effectively minimizing signal path length and resistance. Flip-chip packaging is extensively utilized in mobile devices and high-performance electronic components that require enhanced signal integrity, reduced power consumption, and improved performance. The continuous adoption of advanced semiconductor packaging solutions across various applications is accelerating growth in this segment.

By application, the advanced packaging market spans consumer electronics, automotive, industrial, healthcare, aerospace & defense, and other industries. The automotive segment accounted for an 11.1% market share in 2024, as the integration of advanced packaging solutions plays a crucial role in optimizing power efficiency and signal transmission in electronic control units. AI-driven computing advancements are revolutionizing automotive technologies, enabling real-time decision-making, enhancing sensor integration, and improving vehicle performance. With increasing demand for electric and autonomous vehicles, advanced packaging solutions are becoming essential for ensuring reliable electronic control systems and superior vehicle efficiency.

The US advanced packaging market reached USD 10.2 billion in 2024, driven by strong government initiatives aimed at reinforcing the nation’s leadership in semiconductor and advanced packaging technologies. The emphasis on domestic manufacturing and supply chain resilience is fueling market expansion with increased investments in next-generation packaging solutions. The presence of key semiconductor manufacturers and research institutions is accelerating technological advancements, solidifying the country’s status as a global hub for semiconductor innovation. Government-backed incentives and strategic collaborations are further strengthening the industry, ensuring long-term growth and competitiveness in the global semiconductor market.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this Advanced Packaging market report include:- Amkor Technology

- ASE Group

- China Wafer Level CSP Co. Ltd.

- Chipbond Technology Corporation

- ChipMOS Technologies Inc.

- Greatek Electronics Inc.

- JCET Group Co. Ltd.

- Powertech Technology Inc.

- Sanmina Corporation

- Taiwan Semiconductor Manufacturing Company Limited (TSMC)

- Tongfu Mikcroelectronics Co. Ltd.

- UTAC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 190 |

| Published | February 2025 |

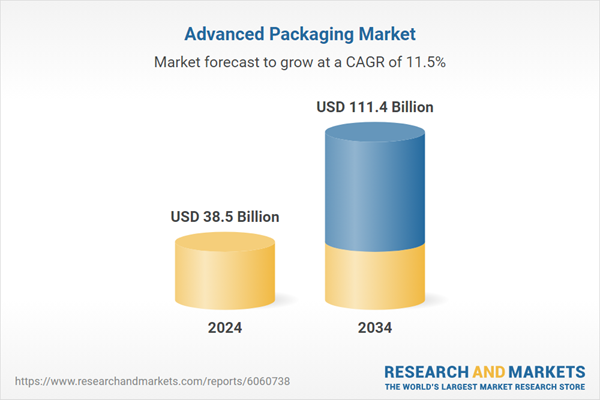

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 38.5 Billion |

| Forecasted Market Value ( USD | $ 111.4 Billion |

| Compound Annual Growth Rate | 11.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 13 |