Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

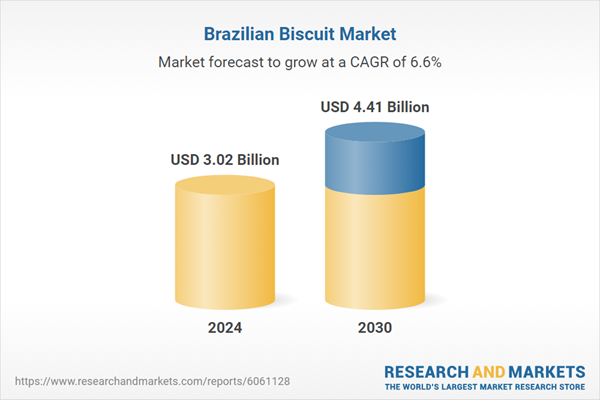

The Brazil Biscuit Market was valued at USD 3.02 Billion in 2024, and is expected to reach USD 4.41 Billion by 2030, rising at a CAGR of 6.57%. The demand for biscuits has risen due to urbanization and the global increase in the working population, leading to a higher need for ready-to-eat food products. Additionally, the growth of the retail sector, including the rise in hypermarkets, supermarkets, and retail stores, has further driven the biscuit market in the country.

In the first half of 2024, Brazil exported 31,000 tons of biscuits, valued at USD 71.2 million, to 115 countries. The United States, Paraguay, and Uruguay were the leading destinations, accounting for 51% of the total exports. Brazil is the primary supplier of biscuits to Paraguay, making up almost 60% of its imports, and ranks second in Uruguay with 50%. Wafers were the most significant export, with 12,100 tons worth USD 36.8 million, reflecting a 4% increase in value compared to the previous year. Traditional biscuits like cream crackers and filled varieties contributed USD 31.1 million, with 17,400 tons exported.

Key Market Drivers

Rising Disposable Income

The rising disposable income in Brazil is one of the primary drivers of the biscuit market. As the economy improves and the middle class expands, Brazilian consumers have more purchasing power to spend on processed and packaged food products, such as biscuits. A growing number of people can afford to buy snacks as part of their regular consumption, contributing to the increased demand for biscuits. Furthermore, biscuits are seen as an affordable snack option that appeals to people of all age groups. In urban areas, where lifestyle changes and hectic work schedules prevail, people often prefer convenient and ready-to-eat snacks like biscuits, driving up their consumption.

With more disposable income, consumers are willing to spend on premium or innovative biscuit variants, such as organic, low-sugar, or gluten-free options, which are gaining popularity among health-conscious individuals. As Brazil continues to see improvements in the economic conditions, the demand for biscuits is expected to grow, encouraging both local and international brands to innovate and introduce new products into the market. This trend has been further accelerated by rising retail access and online shopping, where people can conveniently purchase a variety of biscuit products, increasing market reach and consumer consumption.

Key Market Challenges

Health Concerns and Increasing Health Consciousness

One of the major challenges facing the Brazil Biscuit Market is the growing awareness of health issues associated with the consumption of processed foods, including biscuits. Many traditional biscuits are high in sugar, fats, and preservatives, which has led to concerns about obesity, diabetes, and other health-related problems among consumers. As the Brazilian population becomes more health-conscious, especially among younger generations, there is a rising demand for healthier alternatives to traditional snacks. In response to these concerns, many consumers are shifting toward low-sugar, low-fat, gluten-free, organic, and high-protein options, which require biscuit manufacturers to invest in reformulation and product innovation.

However, this comes with its own set of challenges, including higher production costs and the complexity of ensuring that healthier versions of biscuits still maintain the taste and texture that consumers expect. For companies that produce traditional biscuits, meeting this demand for healthier options while maintaining their current consumer base can be difficult. Additionally, regulations around food labeling and nutritional content have become stricter, meaning manufacturers must stay compliant with evolving health and safety standards. The challenge is balancing consumer preferences for indulgent snacks with the growing need for healthier products, which requires constant innovation, marketing, and investment in R&D.

Key Market Trends

Growing Demand for Healthier Biscuits

A major trend in the Brazil Biscuit Market is the growing consumer preference for healthier biscuit options. As awareness of the health risks associated with high sugar, fat, and artificial additives rises, Brazilian consumers are increasingly looking for alternatives that offer better nutritional profiles. Health-conscious consumers, particularly millennials and Gen Z, are opting for biscuits that are lower in sugar, high in fiber, organic, or gluten-free, as part of a broader shift towards healthier eating habits. Manufacturers are responding to this trend by reformulating existing products and launching new lines of biscuits that cater to the demand for healthier ingredients.

For instance, biscuits made with whole grains, oats, quinoa, or even functional ingredients like chia seeds and protein are becoming more prevalent. Additionally, products with reduced sugar content or those that utilize natural sweeteners like stevia are gaining traction among health-focused individuals. The rise of gluten-free and vegan biscuits also reflects the increasing number of people with dietary restrictions or those choosing plant-based diets. This trend is not only driven by consumer preferences but also by regulatory pressures and the increasing focus on health and wellness in Brazil. As more consumers become aware of the negative effects of traditional, heavily processed biscuits, they are seeking options that are perceived as more aligned with their health goals.

Key Market Players

- Mondelez Brasil LTDA

- Nestlé Brasil Ltd.

- M. Dias Branco S.A.

- Marilan Alimentos S/A

- PepsiCo, Inc.

- Bauducco Foods, Inc.

- Germani Alimentos LTDA

- Biscobom Alimentos LTDA

- Bagley do Brasil Alimentos LTDA

- Casa Bauducco

Report Scope:

In this report, the Brazil Biscuit Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:

Brazil Biscuit Market, By Type:

- Crackers & Savory Biscuits

- Sweet Biscuits

- Wafers

- Functional/Energetic Biscuits

- Others

Brazil Biscuit Market, By Packaging:

- Pouches/Packets

- Boxes

- Cans/Jars

- Others

Brazil Biscuit Market, By Sales Channel:

- Supermarkets/Hypermarkets

- Convenience Stores

- Specialist Retailers

- Online

- Others

Brazil Biscuit Market, By Region:

- North

- North-East

- South

- Central-West

- South-East

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Brazil Biscuit Market.

Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.

Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Mondelez Brasil LTDA

- Nestlé Brasil Ltd.

- M. Dias Branco S.A.

- Marilan Alimentos S/A

- PepsiCo, Inc.

- Bauducco Foods, Inc.

- Germani Alimentos LTDA

- Biscobom Alimentos LTDA

- Bagley do Brasil Alimentos LTDA

- Casa Bauducco

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 88 |

| Published | March 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 3.02 Billion |

| Forecasted Market Value ( USD | $ 4.41 Billion |

| Compound Annual Growth Rate | 6.5% |

| Regions Covered | Brazil |

| No. of Companies Mentioned | 10 |