The market for autonomous bus software is categorized based on functionality, which includes fleet management, autonomous driving, traffic management, passenger management, safety and security, and bus route design. In 2024, the fleet management software segment accounted for a 27.8% market share. This software is essential in enhancing the operational efficiency of self-driving buses. Through real-time remote monitoring, IoT-based maintenance forecasting, fuel consumption tracking, and route optimization, fleet management systems enable bus operators to boost productivity, minimize downtime, and ensure smoother operations.

Further, the autonomous bus software market is segmented by automation levels - Level 3, Level 4, and Level 5 automation. The Level 4 autonomous buses held 43% of the market share in 2024. These buses are fully autonomous within predefined areas, such as business districts or smart cities. They leverage advanced artificial intelligence (AI), machine learning, and predictive analytics to navigate through varying road conditions and traffic patterns, making them highly suitable for urban environments. With the continued refinement of AI technologies, the adoption of Level 4 autonomous buses is expected to surge, especially in densely populated metropolitan areas.

North America Autonomous Bus Software Market accounted for 38% of the global market share in 2024. The region's investments in autonomous technology, coupled with supportive government policies, are accelerating the development and deployment of self-driving buses. Several cities are already launching pilot projects with promising results, which are expected to fuel the wider adoption of autonomous bus systems. As these buses become more integrated into public transportation, they offer the potential to reduce emissions, alleviate traffic congestion, and improve overall efficiency in urban mobility, aligning with the broader trend toward more sustainable, smart transportation systems.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The major companies profiled in this Autonomous Bus Software market report include:- Aurora

- Baidu Apollo

- EasyMile

- Imagry

- ioki

- Karsan

- LILEE Systems

- May Mobility

- Mobileye

- Navya

- NVIDIA

- Oxa

- T-Hive

- Via Transportation

- Volvo Bus

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 139 |

| Published | March 2025 |

| Forecast Period | 2024 - 2034 |

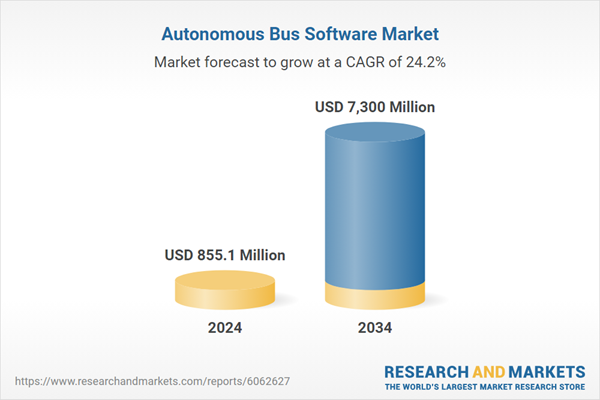

| Estimated Market Value ( USD | $ 855.1 Million |

| Forecasted Market Value ( USD | $ 7300 Million |

| Compound Annual Growth Rate | 24.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 16 |