Industrial packaging plays a vital role in supporting various sectors such as chemicals, pharmaceuticals, food & beverages, construction, automotive, and oil & gas, where bulk shipments require durable and high-strength containers to avoid damage and ensure seamless transport. Furthermore, the increasing trend of automation in warehousing and logistics operations is pushing manufacturers to adopt packaging that is compatible with advanced handling equipment, thus enhancing operational efficiency. With industries focusing on optimizing supply chain costs while adhering to safety and environmental standards, the industrial packaging market is poised to witness consistent growth throughout the forecast period.

The industrial packaging market is segmented based on material types, including paperboard, plastic, metal, wood, and others. Among these, the plastic materials segment generated USD 28.3 billion in 2024, driven by its versatility, flexibility, and cost-effectiveness. Plastic packaging solutions are widely adopted in industries such as chemicals, food & beverages, and automotive due to their ability to accommodate a wide range of product types, including liquids, solids, and semi-solids. Plastic remains a top choice for rigid containers, flexible films, drums, and bulk containers, offering lightweight and durable options that support efficient handling and storage. As global trade continues to expand and the e-commerce sector accelerates demand for reliable packaging solutions, plastic packaging is expected to maintain its dominance, fueled by its adaptability and functional performance in safeguarding products during transit.

In terms of application, the industrial packaging market serves key sectors like construction, chemicals & pharmaceuticals, food & beverages, automotive, agriculture, oil & gas, and others. The food & beverage segment is expected to grow at a CAGR of 5.7% during 2025-2034, largely due to the need for specialized packaging solutions that comply with stringent regulations aimed at preserving product integrity, preventing contamination, and ensuring food safety. Packaging options such as aseptic containers, food-grade intermediate bulk containers (IBCs), and bulk bags are essential for extending shelf life and maintaining product quality during storage and transportation.

North America held a 27.4% share of the industrial packaging market in 2024, driven by the robust growth of e-commerce logistics and the rapid adoption of advanced packaging solutions across various industries. The region’s growing inclination toward lightweight, durable packaging, combined with the automation of packaging processes, continues to propel demand for industrial packaging containers that optimize efficiency and reduce overall shipping costs.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The major companies profiled in this Industrial Packaging market report include:- C.L. Smith

- Denios

- East India Drums and Barrels

- Greif

- International Paper

- LC Packaging

- Mauser Packaging Solutions

- Mitchell Container Services

- Mondi

- Myers Industries

- North Coast Container

- Orlando Drum and Container

- Peninsula Drums

- Rahway Steel Drum

- Schoeller Allibert

- Schutz

- Smurfit Kappa

- Snyder Industries

- Time Technoplast

- Werit Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | March 2025 |

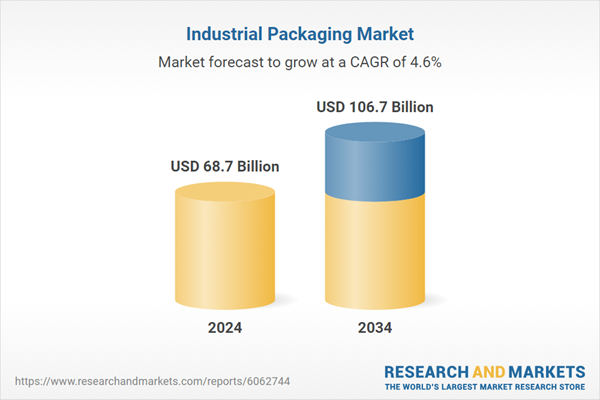

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 68.7 Billion |

| Forecasted Market Value ( USD | $ 106.7 Billion |

| Compound Annual Growth Rate | 4.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 21 |