Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Efficient produced water treatment mitigates environmental impact and enables water reuse in operations such as reservoir injection or agricultural irrigation. The selection of treatment technologies depends on water composition, volume, and the targeted disposal or reuse application.

Key Market Drivers

Water Scarcity and the Imperative for Reuse

Water scarcity is one of the most pressing issues in the MENA region - one of the most water-stressed areas globally - due to its arid climate, limited freshwater sources, and rapidly expanding population. This has positioned water conservation as a strategic priority for both governments and industries.In this context, the treatment and reuse of produced water from oil and gas operations have emerged as a critical solution. According to the United Nations, 15 of the 22 Arab League nations fall below the water scarcity benchmark of 500 cubic meters per capita per year. Effectively treated produced water can be repurposed for various non-potable uses, including enhanced oil recovery (EOR), industrial crop irrigation, dust control, and municipal landscaping. This alleviates pressure on already scarce freshwater resources and supports sustainable water management.

In countries like Saudi Arabia and the United Arab Emirates - where groundwater reserves are dwindling and desalination is both energy-intensive and costly - the reuse of treated produced water presents not only an environmentally responsible option but also a cost-effective one. National strategic frameworks, such as Saudi Vision 2030 and Egypt Vision 2030, emphasize sustainable resource utilization and technological innovation in water treatment, thereby fostering a supportive policy environment for infrastructure investment. Governments are also promoting public-private partnerships and financial incentives to accelerate technology deployment.

On the technological front, innovations such as zero-liquid discharge (ZLD) systems, nanofiltration, and biologically integrated units have enhanced the feasibility and cost-efficiency of treating produced water to high standards. These advancements are instrumental in making large-scale water reuse more economically viable.

Key Market Challenges

High Capital and Operational Costs

A significant challenge for the MENA produced water treatment market lies in the high cost associated with installing and operating advanced treatment systems. Produced water typically contains a broad spectrum of contaminants - including dissolved solids, hydrocarbons, heavy metals, and chemical additives - that require complex, multi-stage treatment involving physical, chemical, and biological methods.These processes demand substantial capital investment and entail high operational costs, particularly in remote or offshore locations where infrastructure is limited. In many cases, the cost of treatment surpasses the economic value of the treated water, especially when it cannot be reused for high-value purposes. This makes it difficult for smaller or mid-sized oil producers to justify the capital outlay.

Additionally, advanced systems often require significant energy input, skilled personnel, and frequent replacement of components such as membranes or reagents - factors that drive up ongoing expenditures. In economically constrained markets, such as Iraq or Libya, or where oil production is heavily subsidized, environmental initiatives are often deprioritized in favor of maximizing output - particularly during periods of low oil prices. Volatility in global oil markets can further affect the availability of funding for water treatment investments, resulting in inconsistent project execution.

The scalability of pilot programs is also a limiting factor; technologies proven effective at a small scale often face cost and operational hurdles when deployed across larger oilfields. To address these challenges, stakeholders must pursue cost-optimization strategies including modular system designs, regional manufacturing, strategic technology alliances, and incentive-driven models. Public-private partnerships can play a pivotal role in distributing financial risk and accelerating implementation.

Key Market Trends

Increased Adoption of Advanced and Modular Treatment Technologies

A prominent trend shaping the MENA produced water treatment market is the growing shift toward advanced and modular treatment solutions. In response to increasingly complex water compositions and tightening environmental regulations, oil and gas companies are moving beyond conventional treatment approaches, investing instead in high-efficiency systems that offer enhanced operational flexibility and regulatory compliance.Technologies gaining momentum include membrane filtration (e.g., reverse osmosis, nanofiltration), electrocoagulation, advanced oxidation processes (AOPs), and zero-liquid discharge (ZLD) systems. These innovations are particularly suited to managing high levels of total dissolved solids (TDS), hydrocarbons, and other pollutants commonly found in produced water from mature or EOR-intensive fields.

The modular nature of modern systems offers distinct advantages in the MENA context, where oilfields often operate in remote, space-constrained, or offshore environments. These pre-fabricated, transportable units facilitate rapid deployment, reduce on-site installation times, and minimize operational disruptions.

Moreover, the integration of smart technologies - such as real-time monitoring systems, AI-powered process optimization, and digital twin models - is becoming increasingly common. These tools enhance system efficiency, enable predictive maintenance, and support real-time environmental compliance, making them invaluable in managing large volumes of complex wastewater.

As technological costs continue to decline due to innovation and the emergence of local manufacturing capabilities, these advanced systems are becoming more accessible to operators across various scales. Government-backed initiatives and policy support are further reinforcing the adoption of sustainable treatment solutions by incentivizing cleaner technologies and facilitating cross-sector collaboration.

Key Market Players

- Clean Water Treatment Water Cont (CWT)

- Rima Water Treatment Projects LLC

- Advanced Watertek

- Al Kafaah

- WaterTectonics Middle East

- Veolia Water Technologies Middle East

- PureLine

- ACWA Power

- Suez

- Siemens AG

Report Scope:

In this report, the Middle East & North Africa Produced Water Treatment Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Middle East & North Africa Produced Water Treatment Market, By Treatment Method:

- Physical

- Chemical

- Biological

Middle East & North Africa Produced Water Treatment Market, By Production Source:

- Crude Oil

- Natural Gas

Middle East & North Africa Produced Water Treatment Market, By Application:

- Onshore

- Offshore

Middle East & North Africa Produced Water Treatment Market, By End Use:

- Oil & Gas

- Industrial

- Power Generation

- Others

Middle East & North Africa Produced Water Treatment Market, By Country:

- Saudi Arabia

- Qatar

- Kuwait

- Bahrain

- Oman

- UAE

- Egypt

- Turkey

- Algeria

- Morocco

- Rest of Middle East & North Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Middle East & North Africa Produced Water Treatment Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Clean Water Treatment Water Cont (CWT)

- Rima Water Treatment Projects LLC

- Advanced Watertek

- Al Kafaah

- WaterTectonics Middle East

- Veolia Water Technologies Middle East

- PureLine

- ACWA Power

- Suez

- Siemens AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 123 |

| Published | April 2025 |

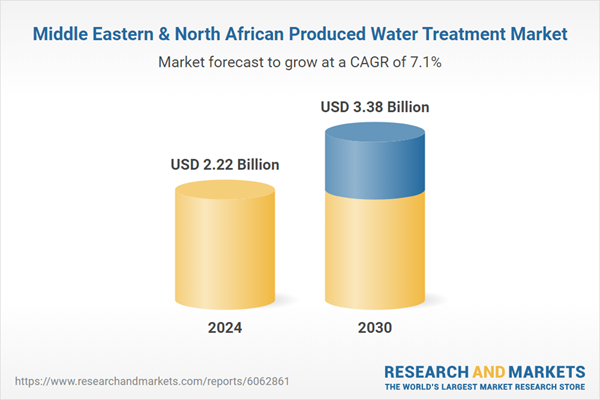

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 2.22 Billion |

| Forecasted Market Value ( USD | $ 3.38 Billion |

| Compound Annual Growth Rate | 7.1% |

| Regions Covered | Africa, Middle East |

| No. of Companies Mentioned | 10 |