This rapid expansion is driven by China’s aggressive push toward renewable energy adoption and its commitment to achieving carbon neutrality. As the country continues to increase its reliance on solar and wind power, the need for advanced energy storage solutions becomes essential to manage intermittency and ensure grid stability. Government initiatives, including financial incentives and subsidies, are accelerating the adoption of energy storage systems across various sectors, including utility-scale applications, residential setups, and commercial establishments. This favorable regulatory environment is paving the way for substantial advancements in energy storage technologies, making them more accessible and efficient.

The market is segmented by technology, with key categories including pumped hydro, electrochemical, electromechanical, and thermal storage systems. Pumped hydro remains one of the most prominent technologies, where surplus electricity is used to pump water to an elevated reservoir, which is later released to generate power. This method is highly effective for long-duration storage, helping integrate renewable energy sources into the grid while ensuring supply stability. The growing emphasis on improving energy storage infrastructure, coupled with the government’s supportive policies, has contributed to the rising popularity of pumped hydro technology in China.

In terms of application, the market is categorized into electric energy time shifting, electric supply capacity, black start services, renewable capacity firming, and frequency regulation. The electric energy time-shifting segment accounted for a 43.9% share in 2024, playing a pivotal role in managing energy consumption patterns and balancing supply and demand. This application is critical for reducing peak load requirements and enhancing grid reliability. As China witnesses an increasing occurrence of power outages due to natural disasters, the need for dependable energy storage systems grows. Moreover, the country’s focus on promoting electric vehicles (EVs) has further fueled the demand for energy storage technologies. As EV adoption surges, reliable energy storage systems are essential to support charging infrastructure and ensure a seamless transition toward cleaner transportation solutions.

China’s ongoing advancements in energy storage are driven by a combination of factors, including technological innovation, government support, and a strong emphasis on environmental sustainability. These elements collectively create a favorable environment for the growth of the energy storage market, enabling the development of more efficient and cost-effective solutions that address the challenges associated with renewable energy integration. With the continued expansion of renewable energy capacity and the government’s unwavering commitment to achieving carbon neutrality, the energy storage market is poised to witness sustained growth over the next decade.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies profiled in this China Energy Storage market report include:- ABB

- Burns & McDonnell

- BYD Company

- CATL

- Durapower Group

- Exide Technologies

- General Electric

- Hitachi Energy

- Johnson Controls

- LG Energy Solution

- McDermott

- Narada Power Source

- Panasonic Corporation

- Samsung SDI

- Schmid Group

- Siemens

- Sinohydro Corporation

- Toshiba Corporation

- Voith

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 155 |

| Published | March 2025 |

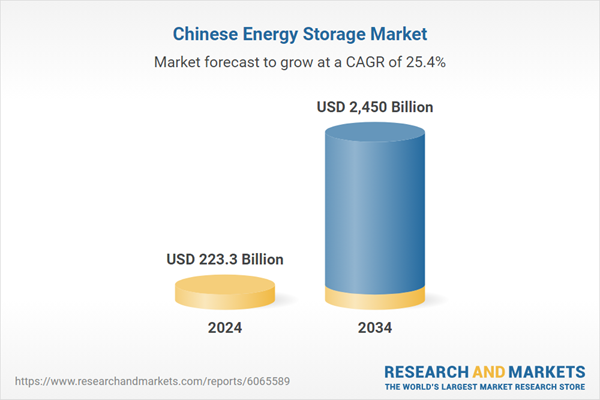

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 223.3 Billion |

| Forecasted Market Value ( USD | $ 2450 Billion |

| Compound Annual Growth Rate | 25.4% |

| Regions Covered | China |

| No. of Companies Mentioned | 20 |