Australia Feed Additives Market Trends

The growth of the Australia feed additives market is driven by their crucial role in improving animal health. By providing essential nutrients, vitamins, and minerals, feed additives help prevent diseases and enhance immune function. They also promote faster growth by improving digestion and feed efficiency. Additionally, feed additives improve meat quality by optimising muscle development and fat distribution, while lowering feed costs by increasing feed conversion efficiency. In 2022, the export value of Australian aquaculture products reached around AUD 1 billion, highlighting the global importance of the sector, according to ABARES, 2022.The demand of the Australia feed additives market is also growing as they help reduce antibiotic use by promoting gut health, contributing to more sustainable farming. They boost milk production in dairy cattle and improve reproductive health, enhancing fertility rates. Furthermore, feed additives support stronger immune systems and digestion, reducing feed waste and improving nutrient absorption. In September 2024, Meat & Livestock Australia (MLA) reported that the national cattle herd is expected to decrease by 1.4% in 2024 to about 30.2 million head due to high slaughter rates.

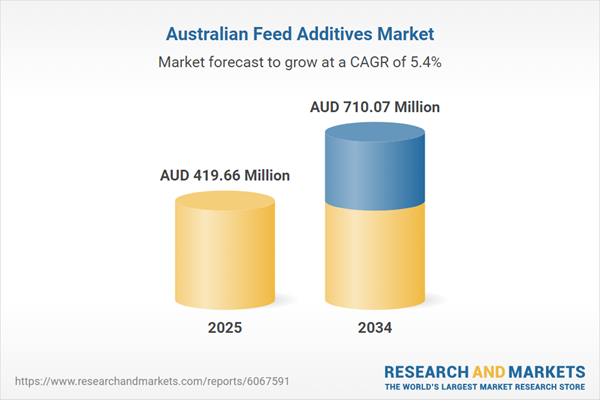

Australia Feed Additives Market Growth

The opportunities in the Australia feed additives market are increasing owing to the benefits of probiotics, which promote healthy gut microbiota, improving digestion and reducing gastrointestinal diseases. They also enhance feed palatability, encouraging higher intake. Feed additives contribute to sustainability by improving feed conversion rates and reducing antibiotic usage. Some additives also help reduce methane emissions and extend the shelf life of feed, benefiting both the environment and farm operations. According to ABARES (2024), pork exports from Australia are expected to rise by 5% in 2024, driven by increasing demand from Asian markets and strong domestic production.The Australia feed additives market revenue is boosted by improvements in animal health, which reduce livestock mortality rates and increase farm productivity. In poultry farming, feed additives can enhance egg production and quality. These products also help producers comply with regulatory standards and minimise environmental impact. Ultimately, feed additives improve productivity, cost-efficiency, and global competitiveness, contributing to the export quality of Australian livestock products. The Department of Agriculture, Fisheries, and Forestry (DAFF) predicts a 2% increase in poultry meat production, valued at USD 3.9 billion by 2024-25, strengthening the protein sector as poultry continues to provide vital nutrients.

Australia Feed Additives Market Insights

- In 2023, Australia's poultry production reached about 1.5 million tonnes, driven by strong domestic demand for chicken meat and eggs, as reported by ABARES.

- Australian pork production is projected to increase by 2% in 2024, continuing the robust growth trend observed in recent years, according to ABARES.

- Australia's aquaculture production totalled around 90,000 tonnes in 2023, with notable contributions from species such as barramundi and oysters, according to ABARES.

- The feed additives market in the Australian Capital Territory is set to experience significant growth, with a projected compound annual growth rate (CAGR) of 2.0% between 2024 and 2032.

- The feed additives market in the Australian Capital Territory region is anticipated to grow at a CAGR of 6.2% from 2024 to 2032.

Industry News

September 2024: Sydney-based Number 8 Bio raised AUD 7 million to further develop its methane-reducing technology, which uses engineered yeast to produce bromoform. The funds will support cattle trials and the creation of a scalable production facility in Sydney.July 2024: New Zealand startup Ruminant BioTech received a USD 3.5 million Australian Government grant for its slow-release bolus product, designed to reduce methane emissions from ruminants by more than 80%. The technology will be tested at the University of Sydney.

Australia Feed Additives Market Drivers

Rising Demand for Natural and Plant-Based Additives

The Australia feed additives market is witnessing significant growth, driven by a shift towards natural and plant-based additives. Producers and consumers are increasingly recognising the environmental and health benefits of plant-derived ingredients, such as herbal extracts, essential oils, and plant proteins. These additives help promote animal health, improve feed conversion, and reduce reliance on synthetic substances like antibiotics. Additionally, plant-based additives align with the global move towards sustainable farming practices, appealing to both local and international markets seeking natural products. In June 2024, MicroBioGen unveiled innovations in yeast-based feed additives aimed at boosting livestock health and productivity, supporting sustainable practices in Australian agriculture.Growing Use of Probiotics and Prebiotics

Probiotics and prebiotics are becoming a prominent trend in the Australia feed additives market due to their recognised benefits in supporting gut health in livestock and poultry. These additives enhance digestion, improve nutrient absorption, and boost immunity, resulting in better overall animal health and fewer disease outbreaks. With rising concerns over antibiotic resistance, probiotics and prebiotics offer an effective alternative to traditional antibiotics in maintaining animal health. This trend, driven by an increasing focus on animal welfare and sustainability, is expanding the use of these additives in both the dairy and meat production sectors. In June 2024, Adisseo introduced Alterion®, a probiotic solution designed to improve gut microbiota balance in poultry, enhancing performance and protecting against intestinal disorders.Opportunities in the Australia Feed Additives Market

Integration of Technology in Feed Additive Solutions

Technological advancements are increasingly shaping the Australia feed additives market dynamics and trends. Innovations such as microencapsulation are enhancing the stability and effectiveness of additives, ensuring they are more efficiently absorbed by animals' digestive systems. Additionally, data-driven technologies and smart monitoring systems are being utilised to track animal health and performance, allowing for more precise application of feed additives tailored to individual needs. These technological improvements are not only boosting the efficacy of feed additives but also optimising farm management, reducing waste, and fostering more sustainable and efficient agricultural practices. In August 2024, New Zealand startup Ruminant BioTech secured a USD 3.5 million Australian Government grant for its slow-release bolus product designed to reduce methane emissions from ruminants by over 80%. The technology will undergo trials at the University of Sydney.Market Restraints

The Australia feed additives market faces several restraints, including the high cost of natural or plant-based additives, which can limit adoption, especially among small farms. Regulatory challenges, such as lengthy approval processes and inconsistent state regulations, further hinder market growth. Limited awareness and education on the benefits of feed additives among farmers, particularly in traditional sectors, also impede widespread use.Additionally, the market's reliance on global supply chains makes it vulnerable to disruptions like geopolitical tensions and shipping delays. Environmental concerns over certain additives' sustainability and production processes raise further barriers to growth, as farmers remain sceptical about their eco-friendly credentials.

This report offers a detailed analysis of the market based on the following segments:

Market Breakup by Type

- Phosphates

- Vitamins

- Probiotics

- Minerals

- Others

Market Breakup by Source

- Natural

- Synthetic

Market Breakup by Livestock

- Poultry

- Swine

- Aquatic Animals

- Ruminants

- Others

Market Breakup by Region

- New South Wales

- Victoria

- Queensland

- Australian Capital Territory

- Western Australia

- Others

Australia Feed Additives Market Share

By Type Insights

According to the Australia feed additives market analysis, phosphates are key to animal growth, bone development, and metabolic functions. They improve feed efficiency, enhance reproductive performance, and boost livestock productivity, ensuring healthier animals and greater economic returns for Australian producers. In March 2024, Yara International launched PhosSure, a phosphate and trace mineral supplement for ruminants, designed to optimise phosphorus intake during critical growth stages, thereby improving livestock health and productivity.The growth of the Australia feed additives market is also supported by the importance of vitamins in maintaining animal health, supporting metabolic functions, and strengthening immune systems. They enhance feed conversion rates, improve growth, and reduce disease vulnerability, boosting productivity and profitability within Australian agriculture. In April 2024, Alltech introduced VitaFerm®, a new vitamin supplement for cattle that enhances reproductive performance and overall health by combining essential vitamins with probiotics to improve digestion and nutrient absorption in livestock.

By Source Analysis

According to the Australia feed additives market report, natural feed additives play a key role in improving animal health and productivity by supporting gut health, enhancing nutrient absorption, and reducing antibiotic dependency. This segment is anticipated to grow at a CAGR of 7.7% from 2024 to 2032. In August 2023, ProAgni launched ProTect, a natural prebiotic aimed at improving the ruminal microbiome health in cattle. This product reduces antibiotic use, enhances feed efficiency, and lowers methane emissions, supporting sustainable livestock production.Opportunities in the Australia feed additives market are also driven by synthetic feed additives, which provide precise nutritional formulations that promote growth, improve feed efficiency, and prevent diseases in livestock. These additives are essential for maximizing production yields and ensuring consistent quality in animal products, bolstering the economic viability of the Australian livestock industry. In March 2024, Boehringer Ingelheim introduced Vaxxinator, a synthetic vitamin-enriched feed additive for poultry that boosts immunity and optimizes growth during critical production phases, improving productivity in the poultry sector.

By Livestock Insights

The demand for the Australia feed additives market is driven by the poultry sector, where additives enhance growth performance, improve feed efficiency, and boost immunity in birds. This segment is anticipated to grow at a CAGR of 6.4% from 2024 to 2032. In 2023, Australia produced around 1.5 million tonnes of poultry meat, with feed additives playing a vital role in improving production efficiency and animal health. The growth of the poultry sector is further supported by rising consumer demand for chicken products, as reported by the Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES), in 2023.The growth of the Australia feed additives market is also supported by the swine sector, where feed additives enhance growth rates, feed conversion efficiency, and gut health in pigs. These additives help reduce disease occurrence, resulting in healthier animals and improved profitability for producers. In 2023, Australia’s pig herd was estimated at approximately 3 million head, with feed additives significantly contributing to better growth performance and overall health. The swine industry continues to play an essential role in meeting domestic meat demand and export opportunities, according to the Australian Bureau of Statistics (ABS), 2023.

Australia Feed Additives Market Regional Insights

New South Wales Feed Additives Market Regional Insights

The feed additives market in New South Wales benefits from the expanding poultry sector and growing demand for high-quality animal nutrition. Improved feed formulations enhance livestock health, productivity, and sustainability, supporting the state's agricultural economy and aligning with consumer preferences for premium meat products. In 2023, New South Wales held approximately 52.1% of the national feed additives market share, driven by poultry production exceeding 4.3 million metric tons, according to ABARES.Queensland Feed Additives Market Trends

In Queensland, the feed additives market is shaped by the rise in aquaculture production and the development of innovative feed formulations. These innovations improve growth rates and feed efficiency in livestock, supporting sustainable practices while addressing growing consumer demand for seafood and meat. Aquatic feed production in Queensland increased by 53.2% from 2002 to 2022, reaching 0.2 million metric tons, driven by the rising demand for seafood, according to the Queensland Department of Agriculture and Fisheries.Western Australia Feed Additives Market Dynamics

According to the Australia feed additives industry analysis, the feed additives market in Western Australia benefits from strong investments in livestock health and productivity. This segment is anticipated to grow at a CAGR of 6.0% from 2024 to 2032. Emphasis on innovative additives enhances the ruminant and swine sectors, improving animal welfare and promoting sustainable agricultural practices. In 2023, Western Australia produced approximately 1.7 million metric tons of livestock products, with feed additives playing a key role in improving production efficiency across various animal types, according to the Western Australia Department of Primary Industries and Regional Development (DPIRD).Competitive Landscape

The Australia feed additives market key players are essential to the supply and distribution of agricultural commodities, such as grains, oilseeds, and feed ingredients. These companies cater to the agricultural, food, and feed sectors nationwide, offering a diverse range of products that enhance food production, livestock health, and sustainability. They are dedicated to delivering innovative solutions that boost the efficiency and profitability of their customers while promoting sustainable agricultural practices. Their expertise in logistics, trading, and risk management further solidifies their position as prominent leaders in the market.Key Industry Players

ADM Trading Australia Pty Ltd.: Established in 2000, ADM Trading Australia Pty Ltd. is a subsidiary of the global agricultural and food processing giant, Archer Daniels Midland Company (ADM). Headquartered in Sydney, Australia, the company focuses on sourcing and distributing agricultural commodities, including feed ingredients, and providing innovative solutions to the food and feed industries.BASF SE: Founded in 1865, BASF SE is a leading global chemical company headquartered in Ludwigshafen, Germany. With a significant presence in Australia, BASF offers a range of products and solutions, including feed additives that enhance animal health, performance, and sustainability in the agricultural sector.

Koninklijke DSM N.V.: Royal DSM, founded in 1902 and headquartered in Heerlen, Netherlands, is a global science-based company with a strong focus on nutrition and health. In Australia, DSM provides feed additives that improve livestock performance and sustainability, offering innovative solutions for animal nutrition, health, and welfare.

Phibro Animal Health Corporation Australia: Established in 1946, Phibro Animal Health Corporation is a global leader in animal health products. With its Australian operations based in Sydney, the company develops and markets feed additives, vaccines, and health solutions that improve livestock productivity and support animal well-being across various industries.

Other key players in the Australia feed additives market report are Nutreco N.V., Solvay S.A., and Lonza Group Ltd., among others.

Recent Developments

April 2024: NutriQuest introduced a herbal blend feed additive for ruminants that promotes better digestion and nutrient absorption. This natural product is designed to improve animal health and productivity, while also supporting sustainable farming practices in Australia’s livestock industry.February 2024: Nutreco launched NutriVite, an all-encompassing vitamin supplement for swine that boosts growth performance and immune response. The product aims to optimise health outcomes and improve feed efficiency in pig production throughout Australia.

Table of Contents

Companies Mentioned

- ADM Trading Australia Pty Ltd.

- BASF SE

- Koninklijke DSM N.V.

- Phibro Animal Health Corporation Australia

- Nutreco N.V.

- Solvay S.A.

- Lonza Group Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 114 |

| Published | October 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( AUD | $ 419.66 Million |

| Forecasted Market Value ( AUD | $ 710.07 Million |

| Compound Annual Growth Rate | 5.4% |

| Regions Covered | Australia |

| No. of Companies Mentioned | 7 |