Animal-based sources have been driving the Australia compound feed market growth due to their rich nutritional content, high digestibility, and palatability.

The Australia compound feed market expansion is driven by the shift towards sustainable animal feeding practices. Animal-based feed sources, including fishmeal, meat and bone meal, and poultry by-products, are rich in essential nutrients such as protein, amino acids, vitamins, and minerals. These nutrients are vital for animal growth, development, and overall health. The high digestibility of animal-based feeds ensures efficient nutrient absorption by animals, leading to improved growth performance and feed conversion ratios.

Many animal-based feed ingredients have a naturally palatable taste and aroma, which makes them attractive to animals. This palatability encourages consistent feed intake, which is essential for maintaining the health and productivity of livestock and poultry.

The incorporation of animal-based feed ingredients in compound feeds has been stimulating the Australia compound feed market growth while offering various performance benefits, including improved growth rates, higher feed efficiency, better reproductive performance, and overall health and well-being of animals.

GrainCorp is expanding its Animal Nutrition offerings in Australia by acquiring XF Australia's (XFA) Performance Feeds and Nutrition Services Australia (NSA) businesses. XFA specializes in providing top-notch feed supplement products and nutritional consulting services to the country's feedlot and grazing industries.

This report offers a detailed analysis of the market based on the following segments:

Market Breakup by Animal Type

- Poultry

- Ruminants

- Aquaculture

- Swine

- Others

Market Breakup by Source

- Plant-Based

- Animal-Based

Market Breakup by Region

- New South Wales

- Victoria

- Queensland

- Australian Capital Territory

- Western Australia

- Others

Australia Compound Feed Market Share

Supplements are added to compound feed to enhance its nutritional value. They provide essential vitamins, minerals, amino acids, and other nutrients that may be lacking in the primary ingredients of the feed. This ensures that animals receive a balanced diet that meets their nutritional requirements for growth, health, and productivity.Leading Companies in the Australia Compound Feed Market

The growth of the compound feed market is fuelled by increasing animal-based sources and the incorporation of animal-based feed ingredients.- Land O’Lakes, Inc.

- Archer Daniels Midland Company

- 4Farmers Australia Pty Ltd

- Others

Table of Contents

Companies Mentioned

- Land O’Lakes, Inc

- Archer Daniels Midland Company

- 4Farmers Australia Pty Ltd

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 106 |

| Published | October 2025 |

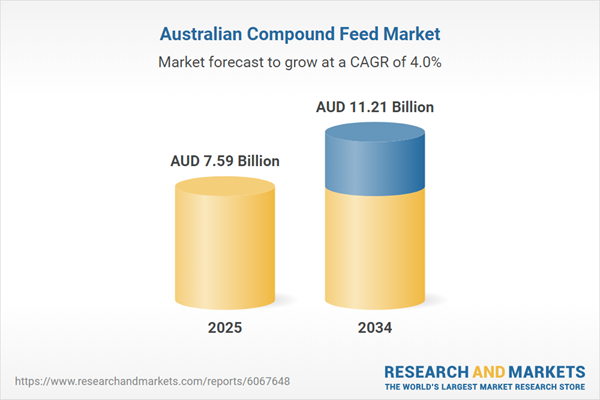

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( AUD | $ 7.59 Billion |

| Forecasted Market Value ( AUD | $ 11.21 Billion |

| Compound Annual Growth Rate | 3.9% |

| Regions Covered | Australia |

| No. of Companies Mentioned | 3 |