Based on type, the Australia dirt bike market share is led by Enduro motorcycles as they offer benefits including the better capacity to handle the disturbances caused due to rough terrain

They are also ergonomic as compared to track-racing motorcycles as the seats can be adjusted to provide comfort to the riders. Moreover, they can be customised as per the user needs and thus can be integrated with the GPS systems, and luggage racks for providing better safety with higher efficiency. They are versatile as compared to the race-tracking motorcycles which are made to ride only on the racetracks.Various trends and innovations have driven the Australia dirt bike market growth including the introduction of the electric dirt bike which offers benefits including lowering air pollution due to the reduction in carbon emission and providing instant torque for smoother rides on rough terrain. Moreover, the integration of technologies into the dirt bike is also taking place including the smartphone connectivity which enhances the experience of the users. They are also being manufactured by using lightweight materials which are recyclable thus reducing carbon emissions and promoting sustainability.

In 2023, the LOSI introduced the new remote-controlled promoto-MX motorcycle which has higher efficiency with durability.

This report offers a detailed analysis of the market based on the following segments:

Market Breakup by Type

- Trail Motorcycle

- Motocross Motorcycle

- Track-racing Motorcycle

- Enduro Motorcycle

Market Breakup by Price Range

- Low to Mid

- High

Market Breakup by Propulsion Type

- Electric

- Gasoline

Market Breakup by Application

- Personal

- Commercial

- Others

Market Breakup by Region

- New South Wales

- Victoria

- Queensland

- Australian Capital Territory

- Western Australia

- Others

Table of Contents

Companies Mentioned

- Yamaha Motor Australia Pty. Ltd.

- Honda Australia Pty Ltd.

- KTM Sportmotorcycle GmbH

- Kawasaki Motors Pty Ltd.

- Hornet Industries Pty Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 113 |

| Published | October 2025 |

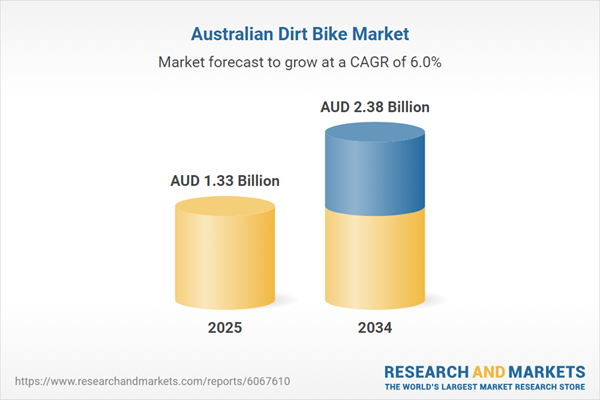

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( AUD | $ 1.33 Billion |

| Forecasted Market Value ( AUD | $ 2.38 Billion |

| Compound Annual Growth Rate | 6.0% |

| Regions Covered | Australia |

| No. of Companies Mentioned | 5 |