Global Milkfish Market - Key Trends & Drivers Summarized

What Is Milkfish and Why Is It a Staple in Aquaculture?

Milkfish (Chanos chanos) is a widely farmed and commercially significant fish species found in warm tropical and subtropical waters. It is one of the most important species in aquaculture, particularly in Southeast Asia, where it serves as a major source of protein. Milkfish is prized for its mild flavor, firm texture, and high adaptability to various farming conditions, making it a staple food in countries such as the Philippines, Indonesia, and Taiwan.The popularity of milkfish stems from its fast growth rate, high feed conversion efficiency, and tolerance to a wide range of salinity levels, allowing it to be cultivated in freshwater, brackish water, and marine environments. This versatility has made milkfish farming an economically viable industry, with production taking place in ponds, pens, and offshore cages. Additionally, milkfish has a high nutritional profile, being rich in omega-3 fatty acids, protein, and essential vitamins, contributing to its increasing demand among health-conscious consumers.

As global seafood consumption rises, milkfish aquaculture continues to expand, driven by the need for sustainable and cost-effective fish production. Technological advancements in breeding, feed formulation, and disease management are further enhancing the productivity and profitability of milkfish farming, ensuring a stable supply to meet growing consumer demand. Furthermore, the shift toward eco-friendly and responsible aquaculture practices is making milkfish a more attractive option for sustainable seafood sourcing.

How Are Technological Innovations Transforming Milkfish Aquaculture?

The milkfish industry has witnessed significant advancements in farming techniques, hatchery production, and feed development, leading to improved yields, reduced environmental impact, and enhanced product quality. One of the most important innovations is selective breeding programs, which focus on producing genetically superior milkfish with faster growth rates, better disease resistance, and higher survival rates. These programs help ensure a consistent and high-quality supply of milkfish to meet market demand.The introduction of recirculating aquaculture systems (RAS) and biofloc technology has also revolutionized milkfish farming by reducing dependency on natural water bodies and improving environmental sustainability. RAS systems allow for controlled rearing conditions, optimizing water quality and minimizing disease outbreaks, while biofloc technology enhances nutrient recycling and feed efficiency, reducing waste discharge and overall production costs. These innovations contribute to more sustainable and resource-efficient aquaculture practices.

Another major advancement is the development of cost-effective and nutritionally balanced formulated feeds. Traditional milkfish farming relied heavily on natural food sources such as algae and plankton, but modern formulated feeds provide precise nutritional requirements for optimal growth and health. The incorporation of alternative protein sources, such as insect-based and plant-based proteins, is also gaining traction to reduce reliance on fishmeal and fish oil, thereby addressing sustainability concerns in aquaculture feed production.

Additionally, digital monitoring systems and automation are enhancing farm management and efficiency. Smart aquaculture solutions, including IoT-based water quality monitoring, automated feeding systems, and AI-driven data analytics, allow farmers to optimize feeding schedules, detect disease outbreaks early, and improve overall production efficiency. These technologies are helping to reduce production losses, improve resource utilization, and enhance profitability for milkfish farmers.

What Are the Key Challenges Facing the Milkfish Industry?

Despite the growing market demand for milkfish, the industry faces several challenges, including disease outbreaks, environmental concerns, market competition, and fluctuating production costs. One of the primary concerns is disease management, as milkfish farms are vulnerable to bacterial, viral, and parasitic infections, particularly in high-density farming environments. Disease outbreaks can lead to significant economic losses, making biosecurity measures, vaccination programs, and advanced health management strategies essential for industry sustainability.Another pressing issue is environmental sustainability. While milkfish farming is considered relatively sustainable compared to other aquaculture species, concerns over water pollution, habitat destruction, and resource depletion remain. Traditional pond-based systems can lead to eutrophication and water quality degradation if not properly managed. Additionally, the expansion of milkfish farming into coastal areas has raised concerns about mangrove deforestation and its impact on marine ecosystems. To address these challenges, integrated multi-trophic aquaculture (IMTA) systems and mangrove-friendly aquaculture practices are being promoted to minimize environmental impact.

The volatility of feed prices and production costs also poses a challenge to milkfish farmers. Feed accounts for a significant portion of production expenses, and fluctuations in the price of key ingredients, such as fishmeal and soy protein, can impact profitability. The development of low-cost, sustainable feed alternatives is crucial to ensuring economic stability in the industry. Moreover, climate change and extreme weather events, such as typhoons and rising sea temperatures, can disrupt farming operations and lead to production losses.

Market competition

is another factor affecting the milkfish industry, as it competes with other widely farmed fish species, such as tilapia, catfish, and pangasius, which are often perceived as more affordable or easier to process. Expanding product differentiation, branding efforts, and value-added processing (such as boneless or pre-cooked milkfish products) are strategies being used to enhance market appeal and consumer demand.What Are the Key Growth Drivers for the Milkfish Market?

The growth in the milkfish market is driven by rising seafood consumption, increasing demand for sustainable aquaculture, expanding global trade, and advancements in farming technologies. As consumers shift toward healthier protein sources, milkfish is gaining traction due to its high nutritional value, mild taste, and versatility in various culinary applications.One of the most significant growth drivers is the increasing demand for sustainable and responsibly farmed seafood. With global concerns over overfishing and marine resource depletion, aquaculture is being recognized as a solution to meet the growing protein demand while reducing pressure on wild fish stocks. Milkfish, with its efficient feed conversion rate and adaptability to eco-friendly farming systems, is well-positioned as a sustainable seafood choice.

The expansion of value-added milkfish products is also fueling market growth. Processed and ready-to-cook milkfish, such as boneless fillets, smoked milkfish, and marinated products, are becoming increasingly popular in urban markets and international exports. These products cater to busy consumers seeking convenient and high-quality seafood options, driving demand in both retail and foodservice sectors.

Government initiatives and investment in aquaculture infrastructure are further boosting the market. Many countries are implementing policies to support sustainable fish farming, providing subsidies, training programs, and research funding for aquaculture development. For example, the Philippines has launched initiatives to improve milkfish seed production and encourage small-scale farmers to adopt modern farming techniques. These efforts are expected to enhance milkfish productivity and global market competitiveness.

The expansion of export markets presents another opportunity for milkfish producers. While traditionally consumed in Southeast Asia, milkfish is gaining recognition in regions such as the Middle East, North America, and Europe, particularly among Asian diaspora communities. Strengthening global supply chains, ensuring compliance with international food safety standards, and improving cold-chain logistics are key factors supporting milkfish export growth.

In conclusion, the milkfish market is experiencing steady growth due to its nutritional benefits, sustainability, and increasing consumer demand for high-quality aquaculture products. While challenges such as disease management, environmental concerns, and market competition persist, technological advancements, sustainable farming practices, and value-added product innovations are driving market expansion. As global seafood consumption continues to rise, milkfish is poised to remain a vital component of the aquaculture industry, offering economic opportunities for farmers and sustainable protein sources for consumers worldwide.

Report Scope

The report analyzes the Milkfish market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Frozen Milkfish, Canned Milkfish); Distribution Channel (Offline Distribution Channel, Online Distribution Channel).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Frozen Milkfish segment, which is expected to reach US$1.1 Billion by 2030 with a CAGR of a 2.7%. The Canned Milkfish segment is also set to grow at 4.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $353.9 Million in 2024, and China, forecasted to grow at an impressive 6.1% CAGR to reach $310.7 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Milkfish Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Milkfish Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Milkfish Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Alfa Laval, Amul, Arla Foods Ingredients, Bel Group, CORMACO and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Milkfish market report include:

- Alltech

- Alsons Aquaculture

- Archer Daniels Midland Co.

- Avanti Feeds Ltd.

- Cargill

- Century Pacific Food, Inc.

- Charoen Pokphand Group

- Coppens International Bv.

- Fisher Farms Inc

- Hanpel Tech Co. Ltd

- Inve Aquaculture Inc.

- Komira Group

- Land & Sea

- Liang Shing Frozen Seafoods Co. Ltd.

- Malalag Bay Aquaculture

- Nutreco NV

- Nutriad International NV

- PT Japfa Comfeed Indonesia Tbk

- Stehr Group

- W Fresh Supply Co. Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Alltech

- Alsons Aquaculture

- Archer Daniels Midland Co.

- Avanti Feeds Ltd.

- Cargill

- Century Pacific Food, Inc.

- Charoen Pokphand Group

- Coppens International Bv.

- Fisher Farms Inc

- Hanpel Tech Co. Ltd

- Inve Aquaculture Inc.

- Komira Group

- Land & Sea

- Liang Shing Frozen Seafoods Co. Ltd.

- Malalag Bay Aquaculture

- Nutreco NV

- Nutriad International NV

- PT Japfa Comfeed Indonesia Tbk

- Stehr Group

- W Fresh Supply Co. Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 273 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

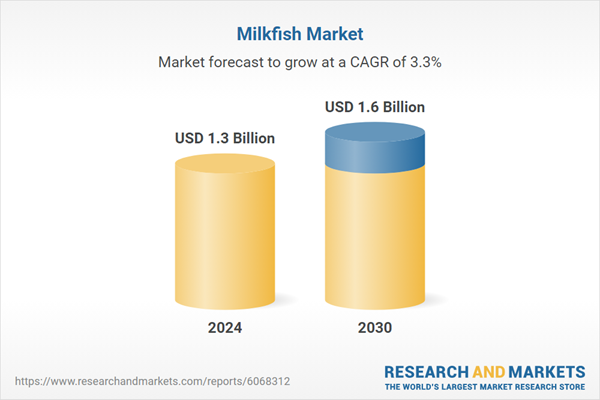

| Estimated Market Value ( USD | $ 1.3 Billion |

| Forecasted Market Value ( USD | $ 1.6 Billion |

| Compound Annual Growth Rate | 3.3% |

| Regions Covered | Global |