Global Filtration and Separation Equipment Market - Key Trends & Drivers Summarized

Why Is Filtration and Separation Technology Becoming a Backbone of Modern Industry?

Filtration and separation equipment has evolved from a process necessity to a strategic asset in industries where purity, safety, and sustainability are paramount. From oil & gas, power generation, and chemicals to food & beverage, pharmaceuticals, water treatment, and mining, these systems are crucial for removing contaminants, recovering valuable resources, and ensuring operational efficiency. As processes become more complex and demand tighter tolerances, businesses are increasingly reliant on advanced filtration and separation systems to meet both quality and regulatory expectations. These systems, which include membrane filters, centrifuges, cyclones, vacuum filters, pressure-driven separators, and electrostatic precipitators, are essential for maintaining product integrity, optimizing fluid handling, and minimizing waste generation. The growing awareness of cross-contamination risks, coupled with the global push for sustainable production, is accelerating the transition from conventional systems to highly automated and specialized filtration and separation technologies that support clean operations, reduce emissions, and facilitate water and energy reuse.How Are Technological Advancements and Smart Integration Enhancing Equipment Utility?

The integration of cutting-edge technologies is revolutionizing the performance and adaptability of filtration and separation equipment. Automation, AI, and IoT are being embedded into these systems to enable real-time monitoring, remote control, predictive maintenance, and performance analytics. This not only reduces downtime and operational risk but also ensures that separation processes remain consistent and optimized across varying operating conditions. Membrane technologies are advancing rapidly, with innovations in nanofiltration, reverse osmosis, and ultrafiltration now offering higher selectivity and throughput with lower fouling rates. In parallel, modular and skid-mounted systems are gaining popularity for their ease of installation, scalability, and mobility across industrial plants. In high-stakes sectors such as pharmaceuticals and electronics manufacturing, single-use filtration systems and high-efficiency particulate air (HEPA) filters are becoming more common due to their sterility and minimal cross-contamination risk. These technology-driven upgrades are not just improving equipment performance - they are reshaping entire production lines to be more resilient, sustainable, and compliant with increasingly stringent global standards.Is Environmental Regulation Accelerating Investment in Separation Solutions?

Heightened environmental regulation and the global transition toward cleaner, circular industrial practices are driving significant investment in filtration and separation solutions. Governments across the globe are tightening discharge norms, emissions thresholds, and resource usage caps - particularly in industries that handle hazardous chemicals, produce wastewater, or rely on intensive energy use. As a result, companies are prioritizing equipment that enables closed-loop systems, reduces water consumption, and captures or reuses solvents, gases, and other by-products. For example, in the mining and metallurgy sectors, filtration equipment is being used not only to dewater tailings but also to recover precious metals and rare earth elements from waste streams. The demand for desalination and wastewater reuse in water-scarce regions is further pushing the boundaries of filtration efficiency. In the food and beverage industry, natural clarification and cold sterilization techniques powered by membrane filtration are enabling producers to meet clean-label demands without compromising shelf life. These regulations are not simply challenges - they are shaping a market where environmental performance and regulatory compliance are key differentiators.What Is Fueling the Growth of the Filtration and Separation Equipment Market Globally?

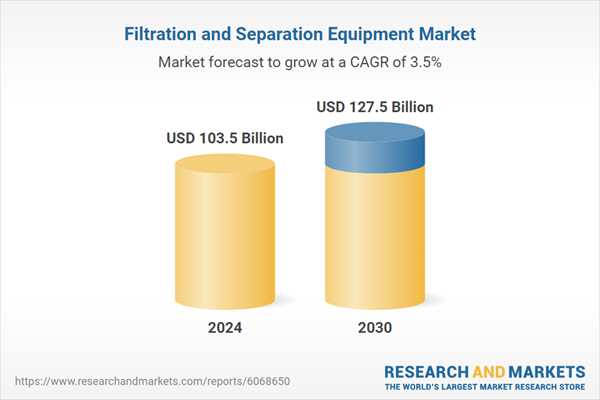

The growth in the filtration and separation equipment market is driven by several factors rooted in industrial transformation, environmental awareness, and end-user demands. The rapid industrialization of emerging economies is expanding the user base for filtration systems in energy, chemicals, and manufacturing. Simultaneously, the rise of health-focused sectors such as pharmaceuticals, biotechnology, and food processing is increasing the demand for highly controlled, high-purity filtration environments. Water scarcity and the need for wastewater management solutions are also major contributors to market growth, prompting municipalities and industries alike to invest in advanced separation equipment for water recovery, desalination, and effluent treatment. Moreover, the global movement toward energy transition and decarbonization is driving the use of filtration in clean energy technologies such as hydrogen production, battery recycling, and carbon capture. Increasing R&D activity, along with supportive government incentives for green infrastructure and process efficiency, is creating favorable conditions for innovation and capital investment. The emergence of turnkey filtration-as-a-service models and rising demand for maintenance-free, intelligent systems are further expanding adoption. As these forces converge, the global market for filtration and separation equipment is poised for sustained and diversified growth across geographies and industry verticals.Report Scope

The report analyzes the Filtration and Separation Equipment market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Liquid & Gas Filtration Type, Air Filtration Type); Technology (Membrane Filtration, Mechanical Filtration, Centrifugal Filtration, Electrostatic Filtration, Magnetic Filtration); Distribution Channel (Direct Sales Distribution Channel, Indirect Sales Distribution Channel); Application (Water / Wastewater Application, Life Sciences Application, Transportation Application, HVAC / AP Control Application, Industrial Process Application).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Liquid & Gas Filtration Equipment segment, which is expected to reach US$87.9 Billion by 2030 with a CAGR of a 4.2%. The Air Filtration Equipment segment is also set to grow at 2.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $28.2 Billion in 2024, and China, forecasted to grow at an impressive 6.7% CAGR to reach $25.7 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Filtration and Separation Equipment Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Filtration and Separation Equipment Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Filtration and Separation Equipment Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Alfa Laval Corporate AB, Amar Equipment Pvt. Ltd., amixon GmbH, BHS-Sonthofen GmbH, De Dietrich Process Systems Group and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 44 companies featured in this Filtration and Separation Equipment market report include:

- Ahlstrom-Munksjö

- Alfa Laval AB

- Andritz AG

- Camfil AB

- Clarcor Inc.

- Donaldson Company, Inc.

- Eaton Corporation

- Filtra Systems

- Flottweg SE

- GEA Group AG

- Koch Membrane Systems

- Lydall, Inc.

- MANN+HUMMEL Group

- Pall Corporation

- Parker Hannifin Corporation

- Pentair plc

- Porvair Filtration Group

- Rotex Global, LLC

- SPX FLOW, Inc.

- Xylem Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Ahlstrom-Munksjö

- Alfa Laval AB

- Andritz AG

- Camfil AB

- Clarcor Inc.

- Donaldson Company, Inc.

- Eaton Corporation

- Filtra Systems

- Flottweg SE

- GEA Group AG

- Koch Membrane Systems

- Lydall, Inc.

- MANN+HUMMEL Group

- Pall Corporation

- Parker Hannifin Corporation

- Pentair plc

- Porvair Filtration Group

- Rotex Global, LLC

- SPX FLOW, Inc.

- Xylem Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 479 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 103.5 Billion |

| Forecasted Market Value ( USD | $ 127.5 Billion |

| Compound Annual Growth Rate | 3.5% |

| Regions Covered | Global |