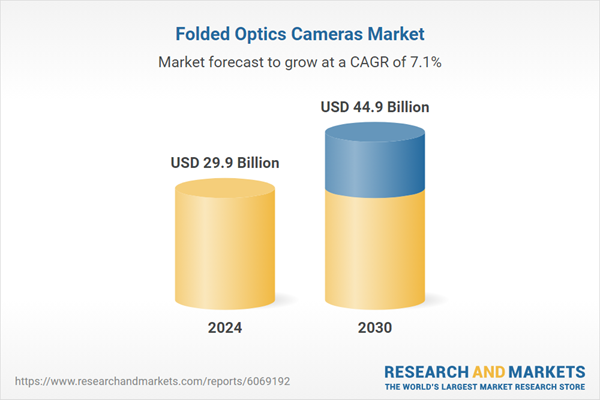

Global Folded Optics Camera Market - Key Trends & Drivers Summarized

Folded Optics Cameras: Engineering Breakthrough or Just Another Mobile Gimmick?

Folded optics camera technology - also known as periscope or telephoto folded lens systems - is rapidly gaining traction as a transformative innovation in compact imaging. This technology utilizes a prism or mirror to bend incoming light sideways within the camera module, allowing for significantly extended focal lengths without increasing the thickness of the device. Originally developed to overcome space constraints in smartphones, folded optics has now found broader application in miniaturized imaging systems across mobile devices, surveillance equipment, automotive systems, drones, and wearables. The core appeal lies in enabling high-quality optical zoom, deep focus range, and improved low-light performance in increasingly slimmer hardware designs.Smartphone manufacturers like Samsung, Huawei, Oppo, and Apple are at the forefront of incorporating folded optics into flagship devices, offering users up to 10x optical zoom and enhanced hybrid zoom capabilities. Unlike digital zoom, which relies on software interpolation, folded optics preserves detail and clarity by physically adjusting the lens position within the compact housing. Simultaneously, demand for better imaging performance - especially among content creators, remote workers, and mobile gamers - is driving innovation in lens alignment, sensor integration, and image stabilization. As a result, the folded optics camera market is expanding beyond mobile devices, with applications emerging in augmented reality (AR), robotics, and defense systems.

Can Folded Optics Match the Performance of Traditional Camera Lenses?

One of the most significant technical achievements of folded optics is the ability to mimic the capabilities of long telephoto lenses in a fraction of the space. By rerouting the optical path using prisms and mirror assemblies, manufacturers can incorporate multiple lens elements and variable apertures into ultra-thin modules. However, achieving high image quality within such constrained dimensions presents engineering challenges. These include maintaining sharpness across focal lengths, minimizing optical aberrations, and reducing light loss due to reflection and refraction within the folded structure. To address these, developers are leveraging advanced computational photography algorithms that fuse multiple exposures and apply real-time corrections for lens distortion, vignetting, and color fringing.Sensor miniaturization and signal processing have also improved considerably. Image sensors paired with folded optics now feature higher pixel density, wider dynamic range, and low-noise performance, compensating for the limited aperture size of the compact optical stack. Optical image stabilization (OIS) and laser autofocus technologies are increasingly being integrated to support handheld usage and motion-heavy environments. Moreover, improvements in prism coatings, mirror quality, and lens materials - such as aspherical and low-dispersion glass - are helping to enhance brightness and contrast in folded optical systems. This fusion of optics and computational imaging is critical in pushing folded optics toward performance parity with conventional zoom lenses, especially in prosumer applications.

Are Broader Applications and Production Scalability the Next Frontiers?

While the current spotlight remains on smartphone imaging, the potential applications of folded optics cameras are expanding across a variety of sectors. In autonomous vehicles and drones, folded optics enables compact and lightweight sensor arrays with long-range imaging capabilities, crucial for navigation, obstacle detection, and surveillance. Similarly, wearable devices like AR headsets and smart glasses are expected to benefit from micro-scale folded optical modules, enabling immersive visual experiences without bulky hardware. In medical imaging and endoscopy, miniaturized folded optics offer high-resolution visualization in minimally invasive procedures, aiding in diagnostics and surgical precision.On the manufacturing side, challenges remain in scaling production due to the complexity of aligning optical elements within tight tolerances and maintaining consistency in image quality across units. However, with rising demand and investments in optical MEMS, nanofabrication, and precision assembly robotics, production yields are improving. Major lens module suppliers like Sunny Optical, Largan Precision, and LG Innotek are expanding their R&D and fabrication capacities to meet the growing needs of OEMs across consumer electronics and industrial markets. Additionally, the integration of AI in manufacturing and quality control is helping to identify optical defects and optimize assembly processes, reducing costs over time.

What Is Driving the Growth of the Folded Optics Camera Market?

The growth in the folded optics camera market is driven by several factors tied to end-use innovation, miniaturization demand, and technological refinement. Chief among them is the unrelenting push in the smartphone industry for thinner devices with increasingly powerful cameras. Folded optics enables multi-lens, high-zoom configurations within slim profiles, offering competitive differentiation in an otherwise saturated market. This makes the technology especially attractive to OEMs targeting premium and flagship smartphone segments. Additionally, the growing prevalence of mobile content creation, vlogging, and live streaming is pushing consumer demand for versatile and high-performance camera systems that can function across zoom ranges and lighting conditions.Beyond consumer electronics, rising adoption of autonomous systems, UAVs, and AR/VR platforms is fueling the need for lightweight, space-efficient imaging modules. Folded optics offers an ideal solution for these use cases, balancing compactness with optical clarity. Another major driver is the advancement in AI-based image processing, which compensates for the physical limitations of small optics by enhancing sharpness, depth perception, and image fidelity through computational means. Furthermore, the ongoing development of custom chipsets with integrated ISP (Image Signal Processing) capabilities supports seamless optimization of folded optics cameras in real-time scenarios. These trends, coupled with increasing investments in optical R&D and precision manufacturing, are collectively accelerating the global uptake of folded optics camera systems across a diverse array of applications.

Report Scope

The report analyzes the Folded Optics Cameras market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Camera Type (Automotive cameras, Others); Lens Configuration (Single-lens configuration, Dual-lens configuration, Multi-lens configuration); Technology (Folded optics with prism-based systems, Folded optics with mirror-based systems, Hybrid systems); End-Use (Automotive, Healthcare, Aerospace & Defense, Others).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Automotive Cameras segment, which is expected to reach US$29.4 Billion by 2030 with a CAGR of a 8.5%. The Other Camera Types segment is also set to grow at 4.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $8.1 Billion in 2024, and China, forecasted to grow at an impressive 11.3% CAGR to reach $9.5 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Folded Optics Cameras Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Folded Optics Cameras Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Folded Optics Cameras Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AUO Corporation, BOE Technology Group Co., Ltd., Huawei Technologies Co., Ltd., LG Display Co., Ltd., Motorola Mobility LLC and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 48 companies featured in this Folded Optics Cameras market report include:

- Chicony Electronics Co., Ltd.

- Corephotonics Ltd.

- Guangdong OPPO Mobile Telecommunications Corp., Ltd.

- Huawei Technologies Co., Ltd.

- Jahwa Electronics

- Ofilm Group

- Ophir Optronics Solutions Ltd.

- Panasonic Corporation

- Samsung Electro-Mechanics

- Sunny Optical Technology (Group) Company Limited

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Chicony Electronics Co., Ltd.

- Corephotonics Ltd.

- Guangdong OPPO Mobile Telecommunications Corp., Ltd.

- Huawei Technologies Co., Ltd.

- Jahwa Electronics

- Ofilm Group

- Ophir Optronics Solutions Ltd.

- Panasonic Corporation

- Samsung Electro-Mechanics

- Sunny Optical Technology (Group) Company Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 477 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 29.9 Billion |

| Forecasted Market Value ( USD | $ 44.9 Billion |

| Compound Annual Growth Rate | 7.1% |

| Regions Covered | Global |