Global Dog Treats Market - Key Trends & Drivers Summarized

What Are Dog Treats, And Why Are They Important for Pet Health and Well-Being?

Dog treats are specialized food products designed specifically for dogs, serving as rewards, training aids, and nutritional supplements. These treats come in various forms, including biscuits, chews, jerky, and soft snacks, and are often formulated with ingredients that cater to dogs' tastes and nutritional needs. Dog treats are an integral part of pet care, playing a significant role in bonding between pets and their owners. They not only provide a source of enjoyment for dogs but also serve functional purposes, such as dental health, training reinforcement, and dietary supplementation.The importance of dog treats extends beyond mere indulgence; they contribute to the overall health and well-being of pets. Many dog treats are fortified with vitamins, minerals, and other beneficial ingredients designed to support specific health needs, such as joint health, skin and coat condition, and digestion. Additionally, dental chews are formulated to promote oral hygiene by reducing plaque and tartar buildup, thereby contributing to long-term dental health. As pet owners increasingly view their dogs as part of the family, the demand for high-quality, nutritious dog treats has surged, highlighting the significance of these products in enhancing pet health and enriching the pet-owner relationship.

What Are the Main Applications of Dog Treats, And How Do They Cater to Pet Owners' Needs?

Dog treats serve several key applications, catering to the diverse needs of pet owners and their dogs. One of the primary applications is as a training aid. Many dog owners use treats as positive reinforcement during training sessions, helping to encourage desired behaviors and commands. Training treats are typically small, low-calorie, and palatable, making them ideal for rewarding dogs without overloading them with calories. The effectiveness of treats in training is well-documented, and as more pet owners seek to train their dogs effectively, the demand for these products is growing.Another significant application of dog treats is in promoting health and wellness. Functional dog treats are formulated with specific ingredients aimed at addressing common health concerns in dogs. For instance, treats fortified with glucosamine and chondroitin support joint health, while others may include probiotics for digestive health or omega fatty acids for skin and coat condition. Pet owners are increasingly looking for treats that not only satisfy their dogs' cravings but also contribute to their overall health, driving demand for nutritionally balanced and functional treats.

In addition to health-focused treats, the market is seeing a rise in gourmet and premium dog treats that appeal to pet owners looking to pamper their dogs. These treats often feature high-quality ingredients, unique flavors, and artisanal production methods, catering to the growing trend of pet humanization. Pet owners are willing to invest in high-quality, premium products that enhance their dogs' quality of life and provide them with a sense of luxury. This trend is leading to the proliferation of specialty pet boutiques and online retailers offering a wide range of gourmet dog treats.

Dental treats are another important category within the dog treats market. These treats are specifically designed to promote oral hygiene by reducing plaque and tartar buildup while freshening breath. The focus on dental health in pets has led to an increased demand for products that combine treat enjoyment with dental care benefits. Pet owners are becoming more aware of the importance of dental hygiene for their dogs, leading to a growing market for dental chews and treats that contribute to maintaining oral health.

Additionally, the trend toward natural and organic ingredients in pet food is influencing the dog treats market. Many pet owners are seeking treats made from whole, natural ingredients without artificial additives or fillers. This shift towards clean label products is driving demand for treats that emphasize transparency in ingredient sourcing and production methods. As consumers become more health-conscious, the preference for natural dog treats is expected to continue to rise.

How Are Technological Advancements Impacting the Dog Treats Market?

Technological advancements are significantly transforming the dog treats market, improving product formulation, manufacturing processes, and supply chain management. One of the most notable developments is the introduction of advanced food processing technologies that enhance the quality and safety of dog treats. Techniques such as high-pressure processing (HPP) and extrusion are being used to produce treats that retain their nutritional value while extending shelf life. HPP, in particular, helps eliminate pathogens without the need for artificial preservatives, catering to the growing demand for safe and natural products.Additionally, innovations in ingredient sourcing and formulation are leading to the development of functional dog treats that address specific health needs. Advances in nutritional science and veterinary research are informing the creation of treats fortified with beneficial ingredients such as probiotics, omega fatty acids, and vitamins. Manufacturers are increasingly incorporating these ingredients to create treats that offer more than just taste, aligning with the health-conscious preferences of pet owners.

The rise of e-commerce and digital marketing is also impacting the dog treats market. Online platforms are enabling pet owners to access a wider range of products, including specialty and premium treats that may not be available in traditional retail settings. This accessibility allows consumers to explore various brands and options, fostering competition and innovation among manufacturers. Moreover, the ability to gather consumer feedback and preferences through online channels is helping companies tailor their product offerings to meet market demands more effectively.

Furthermore, advancements in packaging technology are enhancing the functionality and appeal of dog treats. Innovations such as resealable bags, portion control packaging, and environmentally friendly materials are becoming more common, providing convenience for pet owners and helping to reduce waste. As sustainability becomes a priority for consumers, manufacturers are exploring eco-friendly packaging options that align with their customers' values.

Finally, the trend toward transparency and traceability in the pet food industry is driving manufacturers to adopt technologies that enhance ingredient sourcing and production practices. Blockchain technology, for instance, is being explored as a means to provide consumers with verifiable information about the origins and quality of ingredients used in dog treats. This commitment to transparency is becoming increasingly important to pet owners who want assurance regarding the safety and quality of the products they choose for their pets.

What Is Driving the Growth in the Dog Treats Market?

The growth in the dog treats market is driven by several key factors, including the rising pet ownership rates, increasing consumer awareness of pet health and nutrition, and the growing trend of pet humanization. One of the primary drivers is the increasing number of households owning pets, particularly dogs. As pet ownership continues to rise globally, the demand for dog-related products, including treats, has also grown. Pet owners are increasingly viewing their pets as family members, leading to a willingness to invest in high-quality products that enhance their dogs' well-being.Additionally, the growing awareness of pet health and nutrition is influencing consumer purchasing decisions. Pet owners are becoming more knowledgeable about the nutritional needs of their dogs and are seeking treats that provide health benefits. This trend is reflected in the increasing popularity of functional and fortified dog treats, which are designed to address specific health concerns such as joint support, dental care, and digestive health. As pet owners prioritize the well-being of their dogs, the demand for nutritionally balanced treats is expected to rise.

The trend of pet humanization is also a significant factor driving market growth. As consumers increasingly view their pets as integral family members, they are more inclined to purchase premium and gourmet dog treats that reflect their values and lifestyle. This trend has led to the emergence of boutique pet treat brands that focus on high-quality ingredients and artisanal production methods. Pet owners are willing to spend more on treats that provide a sense of luxury and cater to their dogs' taste preferences.

Moreover, the increasing availability of a diverse range of dog treats through various retail channels, including e-commerce, specialty pet stores, and supermarkets, is facilitating market growth. The convenience of online shopping allows pet owners to explore a wide array of products, from everyday treats to specialty items, boosting sales in the sector. Additionally, the rise of subscription services for pet products is contributing to the steady demand for dog treats, as consumers appreciate the convenience and variety offered through these platforms.

Lastly, the growing emphasis on sustainability and ethical sourcing is influencing consumer choices in the dog treats market. Pet owners are increasingly seeking treats made from natural, organic, and sustainably sourced ingredients. This shift towards clean label products is prompting manufacturers to develop treats that align with consumer preferences for transparency and environmental responsibility. As the demand for ethically produced dog treats continues to grow, brands that prioritize sustainability will likely gain a competitive advantage in the market.

In conclusion, the dog treats market is poised for significant growth driven by rising pet ownership rates, increasing consumer awareness of health and nutrition, and the trend of pet humanization. Technological advancements in production and formulation, along with the growing emphasis on sustainability, will further enhance the market's potential. As pet owners continue to prioritize their dogs' well-being and seek high-quality, enjoyable treats, the demand for innovative and functional dog treats is expected to flourish in the coming years.

Report Scope

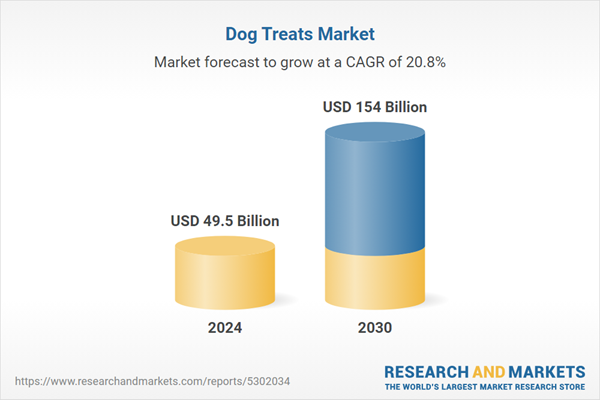

The report analyzes the Dog Treats market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Segment (Dog Treats).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Regional Analysis

Gain insights into the U.S. market, valued at $12.3 Billion in 2024, and China, forecasted to grow at an impressive 26.2% CAGR to reach $41.9 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Dog Treats Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Dog Treats Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Dog Treats Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Ani Brands, Blue Buffalo Co., Ltd., Champion Petfoods L.P., Colgate-Palmolive Company, Diamond Pet Care and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 21 companies featured in this Dog Treats market report include:

- Ani Brands

- Blue Buffalo Co., Ltd.

- Champion Petfoods L.P.

- Colgate-Palmolive Company

- Diamond Pet Care

- Dogswell

- GA Pet Food Partners

- Grandma Lucy's LLC

- Mars, Inc.

- Nestle SA

- Plato Pet Treats

- SmartCookieTreats.com

- Spectrum Brands Holdings, Inc.

- The J. M. Smucker Company

- TruDog

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Ani Brands

- Blue Buffalo Co., Ltd.

- Champion Petfoods L.P.

- Colgate-Palmolive Company

- Diamond Pet Care

- Dogswell

- GA Pet Food Partners

- Grandma Lucy's LLC

- Mars, Inc.

- Nestle SA

- Plato Pet Treats

- SmartCookieTreats.com

- Spectrum Brands Holdings, Inc.

- The J. M. Smucker Company

- TruDog

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 117 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 49.5 Billion |

| Forecasted Market Value ( USD | $ 154 Billion |

| Compound Annual Growth Rate | 20.8% |

| Regions Covered | Global |