Increased financial capacity allows pet owners to prioritize their pets’ nutrition and well-being. The Ministry of Statistics & Programme Implementation has estimated the Gross National Disposable Income (GNDI) at current prices to be ₹236.07 lakh crore for 2021-22. Additionally, the estimate for 2020-21 is ₹201.15 lakh crore, indicating a 17.4 percent increase in 2021-22 compared to a 1.6 percent contraction in 2020-21. As disposable income rises, Indian pet owners are more willing to spend on premium and high-quality products for their pets. Hence, the Asia Pacific region would generate around 1/4th revenue share in the market by the year 2031. Pet ownership in Asia-Pacific countries is rising, driven by increasing disposable incomes and urbanization. As more people acquire pets, the demand for high-quality pet products, including natural dog treats, grows.

With the rise in pet ownership, there is also a growing awareness of the importance of pet nutrition. Pet owners are more informed about the impact of diet on health, leading them to seek natural dog treats that offer better nutritional benefits. As health and wellness trends become mainstream, pet owners apply these principles to their pets’ diets. Natural dog treats, which often emphasize high-quality, wholesome ingredients, align with this trend and cater to health-conscious consumers. Thus, increased pet ownership worldwide is driving the growth of the market.

Additionally, Premium brands often implement stringent quality control measures and adhere to higher manufacturing standards. This commitment to excellence ensures that the treats are safe, consistent, and high-quality, which resonates with discerning pet owners. Premium natural dog treats frequently emphasize ethical sourcing, sustainable production methods, and humane treatment of animals. Pet owners who value ethical considerations are likelier to select products from brands that reflect their principles. In conclusion, demand for premium and high-quality products drives the market's growth.

However, Natural dog treats often use high-quality, organic, or specialized ingredients. These ingredients are generally more expensive than those used in conventional treats. Numerous natural dog delights are packaged in biodegradable or eco-friendly materials to satisfy the sustainability needs of consumers. While this packaging can enhance brand image, it is often more costly than traditional packaging materials. High-quality packaging can improve shelf appeal but adds to overall production costs. In conclusion, high production costs are hindering the growth of the market.

Driving and Restraining Factors

Drivers

- Rising Awareness of Pet Health and Nutrition

- Demand For Premium and High-Quality Products

- Increased Pet Ownership Worldwide

Restraints

- High Production Costs of Natural Dog Treats

- Limited Shelf Life of Natural Dog Treats

Opportunities

- Economic Growth and Higher Disposable Incomes

- Influence of Pet Influencers and Social Media

Challenges

- Balancing nutritional claims with palatability

- Risk of Adverse Reactions or Allergies

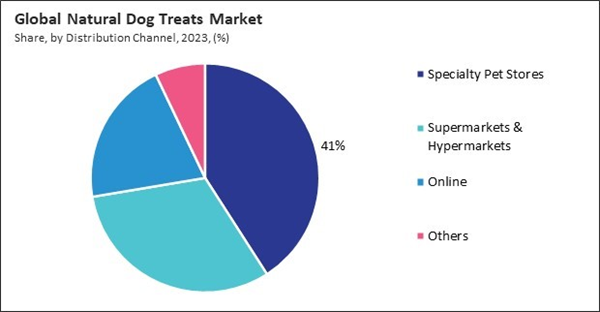

Distribution Channel Outlook

On the basis of distribution channels, the market is segmented into supermarkets & hypermarkets, specialty pet stores, online, and others. The specialty pet stores segment recorded 41% revenue share in the market in 2023. Specialty pet stores often have staff with in-depth pet nutrition and health knowledge. They can offer tailored advice and recommendations on natural dog treats, which appeal to pet owners seeking expert guidance. Specialty pet stores stock premium, high-quality products, including natural dog treats.Product Outlook

Regional Outlook

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America region witnessed 45% revenue share in the market in 2023. North America, particularly the U.S. and Canada, strongly focuses on health and wellness, which extends to pets. Pet owners are increasingly seeking natural and organic products for their pets, including treats perceived as healthier and more nutritious. North America has a high rate of pet ownership, with many households owning dogs. This large pet population drives substantial demand for various pet products, including natural dog treats.List of Key Companies Profiled

- Mars, Inc.

- Nestlé S.A.

- The J.M. Smucker Company

- General Mills, Inc.

- The Colgate Palmolive Company

- Off Leash Pet Treats

- The Wellness Pet Company (Clearlake Capital Group, L.P.)

- Spectrum Brands Holdings, Inc.

- The Dog Chew Company

Market Report Segmentation

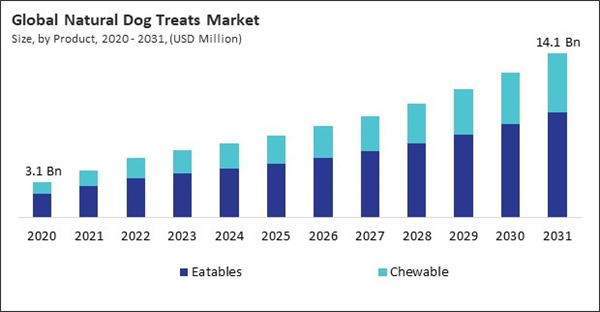

By Product

- Eatables

- Chewable

By Distribution Channel

- Specialty Pet Stores

- Supermarkets & Hypermarkets

- Online

- Others

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Mars, Inc.

- Nestlé S.A.

- The J.M. Smucker Company

- General Mills, Inc.

- The Colgate Palmolive Company

- Off Leash Pet Treats

- The Wellness Pet Company (Clearlake Capital Group, L.P.)

- Spectrum Brands Holdings, Inc.

- The Dog Chew Company