This report comes with 10% free customization, enabling you to add data that meets your specific business needs.

1h Free Analyst TimeSpeak directly to the analyst to clarify any post sales queries you may have.

From custom chocolates and gourmet cookies to artisanal cheese assortments and personalized wine or cocktail kits, the demand for food gifts that reflect the recipient’s tastes and preferences is on the rise. Technology has played a significant role in enabling personalization. Many companies now offer online platforms where customers can design their food gifts, selecting ingredients, packaging, and even including personalized messages. This level of customization allows food gifting to go beyond simple offerings and become an experience that shows thoughtfulness and care. As consumer awareness about health and sustainability increases, the food gifting industry has evolved to cater to more conscious choices.

There is a growing demand for healthy food gifts such as organic snack boxes, gluten-free treats, plant-based products, and low-sugar or keto-friendly options. These gifts not only cater to specific dietary needs but also appeal to recipients who are more mindful of their health and well-being. In addition to health-conscious options, ethical food gifting is becoming increasingly popular.

Eco-friendly packaging, fair-trade sourcing, and locally produced products are becoming important considerations for both consumers and businesses. Brands that focus on sustainability, such as those that prioritize zero-waste packaging or donate a portion of their proceeds to social causes, are attracting a loyal customer base that values ethical practices.

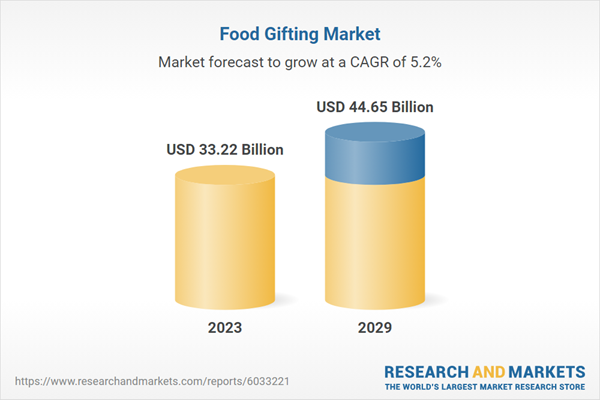

According to the research report, “Global Food Gifting Market Outlook, 2029” published, the market is anticipated to cross USD 44 Billion by 2029, increasing from USD 33.22 Billion in 2023. The market is expected to grow with a 5.16% CAGR from 2024 to 2029. Food gifting is no longer just about sending a box of goodies; it’s about creating an experience. A growing trend in the industry is the rise of experiential food gifts, such as cooking classes, wine tastings, or virtual cooking workshops. These types of gifts allow recipients to engage in the process of creating food, adding an interactive element to the gift-giving experience.

For instance, meal kit subscriptions or curated dinner parties delivered to the doorstep have gained traction, especially during the COVID-19 pandemic, when many sought out ways to connect with friends and family virtually. This trend continues to thrive as people seek novel and interactive experiences to enjoy together, even if miles apart. Luxury food gifting is another rapidly growing segment in the industry. High-end offerings, such as rare truffles, caviar, vintage wines, and premium chocolate assortments, appeal to affluent consumers looking for exclusive and indulgent gifts.

The presentation and packaging of luxury food gifts also play a crucial role in elevating the experience, with many brands focusing on elegant, sophisticated packaging that enhances the perceived value of the product. This segment has become popular for corporate gifting, where businesses often send premium food gifts to clients, partners, or employees as a token of appreciation. Customization and branding of these luxury gifts allow companies to reinforce their image and strengthen relationships.

Market Drivers

- Consumer Desire for Personalization: Personalization is a key driver in the food gifting industry. Modern consumers are increasingly looking for gifts that feel unique and tailored to the recipient. This desire for personalized experiences has shifted the focus from generic gift baskets to curated, bespoke food gifts. The ability to select specific ingredients, customize packaging, and include thoughtful messages adds emotional value to the gift, making it more meaningful. This trend is powered by online platforms that allow consumers to easily design and personalize their food gifts, contributing to the industry's growth.

- Growth of E-commerce and Online Shopping: The rise of e-commerce has revolutionized the food gifting industry, making it easier for consumers to shop for food gifts from the comfort of their homes. Online platforms provide easy access to a wide variety of food gift options, from local artisanal products to international delicacies. The convenience of online shopping, along with the ability to have gifts delivered directly to the recipient’s door, has increased the popularity of food gifting, particularly during holidays and special occasions. The global reach of e-commerce also enables companies to tap into international markets, expanding the scope of food gifting.

Market Challenges

- Logistical and Delivery Complexities: One of the most significant challenges in the food gifting industry is the logistics of transporting perishable goods. Food items, especially fresh products, have a limited shelf life and require temperature-controlled packaging and quick delivery to maintain quality. Delays in shipping, incorrect handling, or poor packaging can result in spoiled products, leading to customer dissatisfaction. Ensuring timely and safe delivery without compromising product integrity is an ongoing challenge for businesses in this sector.

- Regulatory and Health Standards Compliance: Food gifting companies must adhere to various local and international regulations, especially concerning food safety, packaging standards, and labeling requirements. These regulations can vary significantly across regions, making it difficult for businesses to operate internationally. Additionally, ensuring that the food products meet health and safety standards is crucial to maintaining consumer trust and brand reputation. Compliance with these regulations adds complexity to sourcing, manufacturing, and packaging, especially for companies expanding their reach into new markets.

Market Trends

- Sustainability and Ethical Sourcing: Sustainability is becoming a central focus in the food gifting industry. Consumers are increasingly seeking gifts that align with their values, including ethical sourcing, eco-friendly packaging, and support for local or small-scale producers. Brands that prioritize sustainable practices are gaining favor among environmentally-conscious consumers. This trend has prompted many companies to use biodegradable or recyclable packaging, offer organic or fair-trade products, and ensure that their food items are sourced responsibly, reducing their environmental footprint.

- Experiential Food Gifting: The trend of experiential food gifting is gaining momentum, where the focus is on giving recipients an experience rather than just a physical product. This can include meal kits, cooking classes, virtual tastings, or even 'gifting' experiences such as a personalized dinner party. The idea is to offer an immersive experience that goes beyond taste, creating lasting memories. This trend is particularly popular during times of social distancing or virtual gatherings, where people seek ways to connect and engage through shared food experiences.

Confectionery, particularly chocolates, candies, and baked goods, has long been a favored choice in the food gifting market because it strikes a perfect balance between indulgence and affordability. Its universal appeal makes it suitable for any occasion, whether it's a birthday, holiday, corporate gift, or celebratory event. The sweet and comforting nature of confectionery is emotionally resonant, often symbolizing care and thoughtfulness. Additionally, confectionery items are highly versatile, easily customized to fit different tastes, preferences, and dietary needs - whether it's vegan, gluten-free, or sugar-free options.

Many companies in the food gifting industry offer customizable packaging, allowing consumers to design personalized candy boxes or chocolate assortments with messages, logos, or specific themes, making these gifts more unique and meaningful. The wide range of confectionery products also allows businesses to cater to various price points, making them accessible to a broad demographic. Moreover, the ever-evolving trends in flavor profiles, seasonal collections, and limited-edition offerings further drive demand, keeping confectionery products fresh and exciting. Its convenience in packaging and transportation, combined with the sensory pleasure it offers, cements confectionery's leadership in the food gifting market.

Festive and seasonal gifting leads the food gifting market due to the strong cultural and emotional connections tied to celebrations and the tradition of giving during holidays.

Festive and seasonal gifting, especially during major holidays such as Christmas, New Year, Diwali, and Valentine's Day, dominates the food gifting market because these occasions are inherently linked to the tradition of giving, where food plays a central role in celebrations. During these times, people are eager to share special treats and festive foods with loved ones, colleagues, and clients, reinforcing bonds and expressing appreciation. The emotional value of giving food during these moments is enhanced by the association of certain foods with specific seasons such as chocolates and cakes during Christmas or sweets and dry fruits during Diwali making them highly sought after.

Additionally, the seasonal nature of these gifts creates urgency, driving consumers to purchase and send food gifts as part of the festivities. Food items are often specially packaged or themed for holidays, making them not only a thoughtful gesture but also a visually appealing gift that aligns with the aesthetics and spirit of the season. This combination of tradition, cultural significance, and the joy of sharing indulgent treats with others makes seasonal gifting a dominant force in the food gifting market. The widespread marketing campaigns and promotions around these seasons further amplify the demand, as consumers anticipate exclusive and limited-edition food items, ensuring a continual spike in sales during these peak gifting periods.

Offline sales lead the food gifting market due to the tactile and immediate nature of in-store shopping, allowing consumers to experience the products firsthand and make spontaneous decisions.

Despite the rise of e-commerce, offline sales continue to dominate the food gifting market because many consumers prefer the hands-on experience of shopping in physical stores. When purchasing food gifts, especially for occasions where presentation and quality are crucial, being able to see, touch, and even taste the products in-store offers a level of reassurance that online shopping cannot match. This is particularly true for confectionery and gourmet food items, where packaging, freshness, and presentation play a significant role in the decision-making process. Shoppers can assess the texture, look, and appeal of chocolates, cookies, or gift baskets, ensuring that the quality meets their expectations before purchase.

Additionally, during peak seasons such as holidays, many consumers appreciate the convenience of picking up gifts in person to avoid the stress of delivery times, shipping costs, or potential delays that come with online orders. The immediate gratification of purchasing and handing over the gift right away also adds to the appeal of offline shopping.

In physical stores, food gifting products are often displayed in creative and eye-catching ways, encouraging impulse buys, and giving shoppers ideas for gifts they may not have considered online. The human interaction in stores also helps foster a sense of trust and allows customers to receive expert advice, which is especially important for those purchasing specialty food items or looking for last-minute gifts.

North America leads the food gifting market due to its strong cultural tradition of gift-giving during major holidays, coupled with a diverse consumer base and a robust e-commerce infrastructure.

North America has established itself as a dominant player in the food gifting market because gift-giving is deeply ingrained in the cultural fabric, particularly during holidays such as Christmas, Thanksgiving, Valentine’s Day, and corporate events. These occasions often center on sharing food, with many consumers choosing to gift specialty foods like chocolates, cookies, and gourmet baskets to friends, family, and colleagues. The growing trend of personalized food gifts also aligns well with North American consumers' desire for unique and tailored experiences, further fueling market demand.

Additionally, the region benefits from a highly diverse consumer base, allowing for a broad range of preferences and tastes to be catered to, from health-conscious, organic options to luxury and indulgent foods. The strong presence of major food gifting retailers, both online and offline, enhances the availability and accessibility of food gifts across the region.

E-commerce has played a significant role in expanding the food gifting market in North America, with robust shipping infrastructure and efficient logistics making it easy for consumers to send food gifts across long distances. The convenience of ordering food gifts online, coupled with seasonal promotions and easy access to high-quality, curated products, makes North America a key leader in the global food gifting market.

- One significant merger in the food gifting space is the formation of UpSnack Brands, created through the combination of Pipcorn and Spudsy Snack Brands. This new entity focuses on providing healthier, more sustainable snack options, which are increasingly popular in the food gifting market as consumers demand more eco-conscious products. Additionally, Schuman Cheese's acquisition of Trugman-Nash, the parent company of the Old Croc Cheddar Cheese brand, expands its portfolio with premium cheese products, further diversifying the gourmet options available in food gifting.

- Brands like Mouth are revolutionizing the artisanal food gifting market by creating an online marketplace for small-batch, organic, and gluten-free foods. This model, similar to Etsy for food, gives small independent food creators a platform to reach a wider audience, offering unique and high-quality products that cater to personalized gifting needs. Moreover, companies are tapping into plant-based innovations with products like Jellatech's animal-free collagen and Oobli's plant-derived sweet proteins, providing healthier and more ethical food gifting options that appeal to the growing demand for sustainable and health-conscious choices.

Considered in this report

- Historic Year: 2018

- Base year: 2023

- Estimated year: 2024

- Forecast year: 2029

Aspects covered in this report

- Food Gifting Market with its value and forecast along with its segments

- Region & country wise Food Gifting market analysis

- Application wise Food Gifting distribution

- Various drivers and challenges

- On-going trends and developments

- Top profiled companies

- Strategic recommendation

By Product type

- Confectionery

- Fresh & Dried Fruits (Healthy and Organic Foods)

- Bakery & Pastry/sweets Products

- Beverages (Wines, Tea, Coffee, etc)

- Others

By Occasion

- Festive/seasonal Gifting

- Corporate Gifting

- Birthday & Anniversaries

- Others

By Distribution Channel

- Offline

- Online

The approach of the report:

This report consists of a combined approach of primary as well as secondary research. Initially, secondary research was used to get an understanding of the market and listing out the companies that are present in the market. The secondary research consists of third-party sources such as press releases, annual report of companies, analyzing the government generated reports and databases.After gathering the data from secondary sources primary research was conducted by making telephonic interviews with the leading players about how the market is functioning and then conducted trade calls with dealers and distributors of the market. Post this we have started doing primary calls to consumers by equally segmenting consumers in regional aspects, tier aspects, age group, and gender. Once we have primary data with us we have started verifying the details obtained from secondary sources.

Intended audience

This report can be useful to industry consultants, manufacturers, suppliers, associations & organizations related to agriculture industry, government bodies and other stakeholders to align their market-centric strategies. In addition to marketing & presentations, it will also increase competitive knowledge about the industry.This product will be delivered within 2 business days.

Table of Contents

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 166 |

| Published | November 2024 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 33.22 Billion |

| Forecasted Market Value ( USD | $ 44.65 Billion |

| Compound Annual Growth Rate | 5.1% |

| Regions Covered | Global |