In the market, the utilization of Ashwagandha in dietary supplements has surged, driven by its reputation as a potent adaptogen with numerous health benefits. As consumers increasingly prioritize holistic approaches to wellness, dietary supplement manufacturers are incorporating Ashwagandha extract into their formulations to offer products aimed at supporting stress reduction, cognitive function, and overall vitality. Therefore, the US market consumed 4,605.53 thousand units in dietary supplements in 2022.

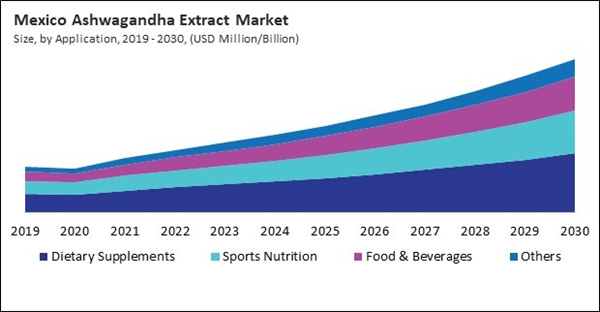

The US market dominated the North America Ashwagandha Extract Market by Country in 2022, and would continue to be a dominant market till 2030; thereby, achieving a market value of $381.7 Million by 2030. The Canada market is experiencing a CAGR of 12.9% during (2023 - 2030). Additionally, The Mexico market would exhibit a CAGR of 11.9% during (2023 - 2030).

Ayurvedic medicine frequently employs Withania somnifera, known as ashwagandha, as a plant. It’s a little shrub that belongs to the Solanaceae family. It may be effective for a range of illnesses mostly as a nervine tonic (nerve soothing). Ashwagandha is alternatively referred to as Indian ginseng or Indian winter cherry. Ashwagandha is well-known for its rasayana (tonic) virtue. Rasayana, an herbal or metallic concoction, fosters happiness and a youthful physical and mental health state.

With a growing preference for natural and holistic healthcare solutions, consumers are turning to herbs like ashwagandha for their therapeutic benefits. Unlike synthetic pharmaceuticals, extract is perceived as safer with fewer side effects, driving its adoption among health-conscious individuals. Modern lifestyles characterized by stress, anxiety, and mental health disorders have fueled the demand for stress relief and mood-enhancing supplements. Ashwagandha’s adaptogenic properties make it an ideal candidate for addressing these concerns, leading to its widespread adoption as a natural stress reliever.

Mexican consumers are becoming more health-conscious and are actively seeking natural remedies and supplements to support their overall well-being. E-commerce platforms offer convenience and accessibility, allowing consumers in Mexico to browse, purchase, and receive the extract products from the comfort of their homes. The Mexican Online Sales Association estimates that the domestic e-commerce sector was worth USD 19.7 billion in 2021, an increase of 27% over 2020. In 2021, there were 57.5 million users of Mexican eCommerce, up 11% from the previous year. In 2020, women made up 51% of Mexican eCommerce users. Hence, the factors mentioned above will drive the regional market growth.

Based on the Distribution Channel, the market is segmented into Business to Consumer, and Business to Business. Based on Form, the market is segmented into Capsules/Tablets, Powder, and Others. Based on Application, the market is segmented into Dietary Supplements, Sports Nutrition, Food & Beverages, and Others. Based on countries, the market is segmented into U.S., Mexico, Canada, and Rest of North America.

List of Key Companies Profiled

- Kerry Group PLC

- Dabur India Ltd.

- Emami Limited

- The Procter and Gamble Company

- Patanjali Ayurved Limited

- Himalaya Wellness Company (Himalaya Global Holdings Ltd.)

- Shree Baidyanath Ayurved Bhawan Pvt. Ltd.

- Unilever PLC

- Taos Herb Company

- Kairali Ayurvedic Group

Market Report Segmentation

By Distribution Channel (Volume, Thousand Units, USD Billion, 2019-2030)- Business to Consumer

- Business to Business

- Capsules/Tablets

- Powder

- Others

- Dietary Supplements

- Sports Nutrition

- Food & Beverages

- Others

- US

- Canada

- Mexico

- Rest of North America

Table of Contents

Companies Mentioned

- Kerry Group PLC

- Dabur India Ltd.

- Emami Limited

- The Procter and Gamble Company

- Patanjali Ayurved Limited

- Himalaya Wellness Company (Himalaya Global Holdings Ltd.)

- Shree Baidyanath Ayurved Bhawan Pvt. Ltd.

- Unilever PLC

- Taos Herb Company

- Kairali Ayurvedic Group