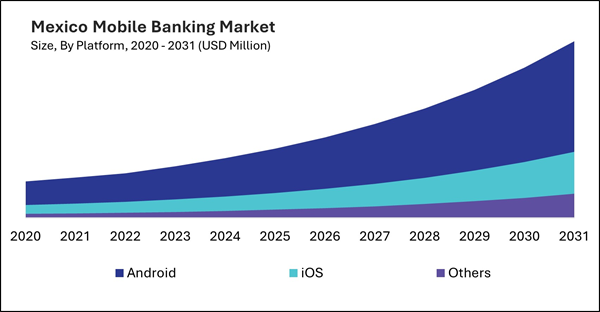

The US market dominated the North America Mobile Banking Market by Country in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $1,144.3 Million by 2031. The Canada market is experiencing a CAGR of 18.2% during (2024 - 2031). Additionally, The Mexico market would exhibit a CAGR of 17.2% during (2024 - 2031).

This banking offers a wide range of applications that empower users to conveniently manage their finances and access banking services on the go. For instance, banking apps allow users to view real-time account balances, past transactions, and statements. Users can also monitor their finances, track expenses, and identify any unauthorized transactions directly from their mobile devices.

Users can initiate fund transfers between their accounts and those within the same bank or external accounts held at different financial institutions. This banking facilitates quick and secure transfers, including peer-to-peer (P2P) payments, bill payments, and international remittances. Furthermore, banking apps enable users to pay bills, utilities, and other expenses directly from their smartphones.

The International Trade Administration (ITA) estimates that by the end of 2022, there will be 96.8 million Internet users in Mexico, a rise of 9.3 percent annually. Additionally, in 2022, e-commerce in Mexico increased by 23%. Mexico has been among the top five nations in the world for the last four years in terms of e-commerce growth. Similarly, according to Statistics Canada, more than three in four Canadians (78%) used the internet to conduct general online banking, and one in six (16%) used it to manage investments online, such as stocks, mutual funds, and cryptocurrencies. About two-thirds (68%) of Canadians stated that they have noticed the role of artificial intelligence (AI) in various applications online. Thus, the increasing internet penetration and rising internet use for banking activities in the region are driving the market’s growth.

Based on Platform, the market is segmented into Android, iOS, and Others. Based on Transaction, the market is segmented into Consumer-to-business, and Consumer-to-consumer. Based on countries, the market is segmented into U.S., Mexico, Canada, and Rest of North America.

List of Key Companies Profiled

- Mitsubishi UFJ Financial Group, Inc. (Mitsubishi group)

- JPMorgan Chase & Co.

- Wells Fargo & Company

- BNP Paribas S.A.

- American Express Company

- HSBC Holdings plc

- UBS AG (UBS Group AG)

- CAPITAL ONE FINANCIAL CORPORATION

- The Bank of America Corporation

- Citigroup Inc.

Market Report Segmentation

By Platform- Android

- iOS

- Others

- Consumer-to-business

- Consumer-to-consumer

- US

- Canada

- Mexico

- Rest of North America

Table of Contents

Companies Mentioned

- Mitsubishi UFJ Financial Group, Inc. (Mitsubishi group)

- JPMorgan Chase & Co.

- Wells Fargo & Company

- BNP Paribas S.A.

- American Express Company

- HSBC Holdings plc

- UBS AG (UBS Group AG)

- CAPITAL ONE FINANCIAL CORPORATION

- The Bank of America Corporation

- Citigroup Inc.