Global Financial Analytics Market - Key Trends and Drivers Summarized

Why Is Financial Analytics Reshaping the Future of Business Strategy?

In today's dynamic business environment, financial analytics is at the forefront of strategic decision-making, offering companies the tools they need to navigate complexity and uncertainty. But what is it about financial analytics that is transforming business strategy on such a large scale? Financial analytics refers to the process of using data analysis techniques, statistical algorithms, and predictive modeling to provide insights that drive financial decisions. Traditionally, companies relied on historical data and static reports to forecast and manage their finances. However, modern financial analytics leverages real-time data and cutting-edge technology to provide forward-looking insights, making it a game-changer for organizations seeking to stay ahead in competitive markets.Financial analytics also plays a critical role in risk management, enabling businesses to identify potential threats and mitigate them before they become significant issues. By examining patterns and trends in financial data, companies can anticipate market shifts, assess the impact of economic variables, and plan for contingencies. Beyond finance departments, the benefits extend to marketing, operations, and human resources, as financial insights guide resource allocation, cost optimization, and performance improvement. This holistic integration across business functions enhances organizational agility, allowing companies to respond faster to changes in the marketplace. As businesses become more data-driven, the reliance on financial analytics will only increase, pushing firms to continually refine their analytics capabilities for more precise decision-making.

How Is Big Data Changing the Way Companies Make Financial Decisions?

The explosion of big data has revolutionized how companies approach financial decision-making, but how exactly does it reshape the process? In the past, businesses operated on limited data sets that offered a narrow view of performance. Now, with the rise of big data technologies, companies can collect and analyze massive amounts of data from a variety of sources - customer transactions, social media interactions, supply chain metrics, and more. This wealth of information, when processed through advanced analytics tools, provides deep insights into financial performance, operational efficiency, and future opportunities.One of the key ways big data is influencing financial decisions is through predictive analytics. By analyzing historical trends and current market conditions, companies can create predictive models that forecast future financial performance. This allows businesses to not only anticipate risks but also seize new opportunities by adjusting strategies in real-time. Moreover, financial analytics fueled by big data helps companies personalize services to individual customers. For example, in the banking sector, institutions use big data to offer tailored financial products based on a customer's transaction history, credit score, and spending patterns. Similarly, retailers rely on financial analytics to optimize pricing strategies, inventory management, and customer retention efforts by understanding purchasing behaviors. This integration of big data into financial analytics equips businesses with the ability to make more informed, timely, and accurate decisions.

What Role Do Emerging Technologies Play in Enhancing Financial Analytics?

In today's increasingly digital world, emerging technologies are revolutionizing the landscape of financial analytics, but how exactly are these innovations driving change? Artificial intelligence (AI), machine learning (ML), and blockchain are among the most disruptive technologies reshaping financial analytics. AI and ML, in particular, allow businesses to automate data analysis, detect trends, and generate forecasts faster and with greater accuracy. For instance, machine learning algorithms can analyze enormous volumes of financial transactions to detect fraud in real-time, significantly improving an organization's risk management capabilities. These technologies also facilitate more sophisticated predictive models that offer deeper insights into market trends and customer behaviors.Blockchain technology, on the other hand, is redefining how financial data is recorded, shared, and secured. By enabling decentralized and transparent financial transactions, blockchain reduces the risk of fraud, increases data security, and simplifies auditing processes. This technology is particularly valuable for sectors like banking and finance, where trust and transparency are critical. In addition to AI, ML, and blockchain, the rise of cloud computing has revolutionized financial analytics by providing scalable, cost-effective platforms for data storage and real-time analysis. Cloud-based financial analytics solutions offer organizations flexibility, enabling them to adapt quickly to changing business conditions without investing in expensive on-site infrastructure. Together, these emerging technologies are not only enhancing the accuracy and speed of financial analytics but also transforming how companies interact with financial data.

What Factors Are Driving the Rapid Growth of the Financial Analytics Market?

The growth in the financial analytics market is driven by several factors that are reshaping how businesses operate and make decisions. One of the primary drivers is the increasing adoption of advanced technologies such as artificial intelligence, machine learning, and big data analytics. These technologies enable companies to process vast amounts of financial data in real-time, allowing for more precise forecasting, risk assessment, and decision-making. As more organizations realize the competitive advantages these technologies offer, there has been a significant surge in the demand for financial analytics solutions that incorporate them.Another factor fueling market growth is the shift toward cloud-based analytics platforms. Cloud technology has made financial analytics more accessible, offering scalability and flexibility that traditional on-premise solutions cannot match. This shift is particularly advantageous for small to medium-sized enterprises (SMEs), which now have the ability to leverage high-level financial analytics without the need for extensive infrastructure investments. In addition, the rise of data-driven decision-making across industries such as banking, retail, and healthcare has contributed to the growing need for advanced financial analytics. Companies in these sectors are increasingly using financial analytics to optimize pricing strategies, enhance customer experiences, and manage operational risks, further driving market expansion.

Moreover, evolving consumer behaviors are playing a crucial role in shaping the financial analytics market. As consumers demand more personalized and efficient services, businesses are using financial analytics to tailor their offerings to individual customer needs. In the banking industry, for example, financial institutions are leveraging analytics to offer personalized investment advice and financial products. Finally, regulatory pressures, especially in highly regulated industries like finance and healthcare, are pushing companies to adopt advanced financial analytics solutions to comply with stringent reporting and compliance standards. Together, these factors are propelling the rapid growth of the financial analytics market, making it an essential tool for modern businesses looking to thrive in a data-driven world.

Report Scope

The report analyzes the Financial Analytics market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Component (Solutions, Services); Deployment (On-Premise, Cloud); Vertical (BFSI, IT & Telecom, Manufacturing, Healthcare, Retail & eCommerce, Government, Other Verticals).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Financial Analytics Solutions segment, which is expected to reach US$17.2 Billion by 2030 with a CAGR of 8.5%. The Financial Analytics Services segment is also set to grow at 10.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $4 Billion in 2024, and China, forecasted to grow at an impressive 8.4% CAGR to reach $3.7 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Financial Analytics Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Financial Analytics Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Financial Analytics Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Deloitte Consulting LLP, FICO (Fair Isaac Corporation), Hitachi Consulting Corporation, IBM Corporation, Microsoft Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 19 companies featured in this Financial Analytics market report include:

- Deloitte Consulting LLP

- FICO (Fair Isaac Corporation)

- Hitachi Consulting Corporation

- IBM Corporation

- Microsoft Corporation

- MicroStrategy, Inc.

- Oracle Corporation

- Rosslyn Analytics, Ltd.

- SAP SE

- SAS Institute, Inc.

- Symphony Teleca

- Tableau Software, Inc.

- Teradata Corporation

- TIBCO Software, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Deloitte Consulting LLP

- FICO (Fair Isaac Corporation)

- Hitachi Consulting Corporation

- IBM Corporation

- Microsoft Corporation

- MicroStrategy, Inc.

- Oracle Corporation

- Rosslyn Analytics, Ltd.

- SAP SE

- SAS Institute, Inc.

- Symphony Teleca

- Tableau Software, Inc.

- Teradata Corporation

- TIBCO Software, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 162 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

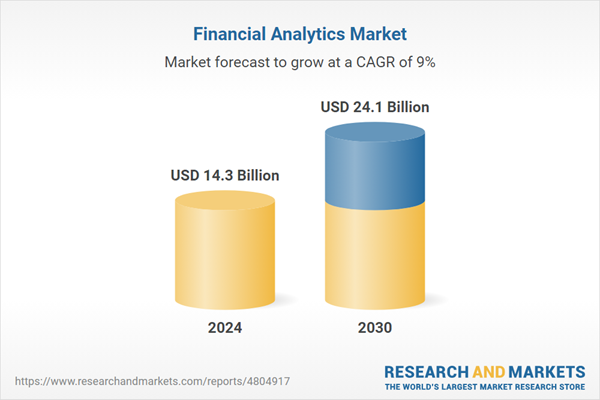

| Estimated Market Value ( USD | $ 14.3 Billion |

| Forecasted Market Value ( USD | $ 24.1 Billion |

| Compound Annual Growth Rate | 9.0% |

| Regions Covered | Global |