Global RTD / High Strength Premixes Market - Key Trends and Drivers Summarized

Capturing Consumer Preferences with RTD / High Strength Premixes

Ready-to-Drink (RTD) / High Strength Premixes are pre-mixed alcoholic beverages that combine spirits or liquors with mixers, flavors, and other ingredients, packaged in convenient, ready-to-consume formats. These beverages are gaining popularity among consumers due to their convenience, consistency in taste, and wide variety of flavors. RTD / High Strength Premixes cater to a broad demographic, from young adults looking for on-the-go drinking options to mature drinkers seeking premium and low-calorie alternatives. Unlike traditional alcoholic drinks that require mixing and preparation, RTDs offer a hassle-free experience, making them ideal for social gatherings, parties, and outdoor events. With the growing trend towards premiumization, health-conscious choices, and flavor innovation, the RTD / High Strength Premixes market is expanding rapidly.How Are Technological Advancements Influencing the RTD / High Strength Premixes Market?

Technological advancements are driving significant innovations in the formulation, packaging, and distribution of RTD / High Strength Premixes, enhancing their appeal and market reach. The development of advanced flavoring and blending technologies is enabling the creation of unique and sophisticated flavor profiles that cater to evolving consumer tastes. Innovations in packaging, such as sleek cans, recyclable bottles, and resealable pouches, are improving product convenience, shelf life, and sustainability, aligning with consumer demand for eco-friendly and portable packaging. The integration of smart labeling and digital marketing tools is enhancing brand engagement and transparency, allowing consumers to access product information, ingredients, and origin through QR codes and augmented reality (AR) experiences. Additionally, advancements in cold chain logistics and distribution are ensuring product freshness and quality, expanding the market reach of RTD beverages to new regions and retail channels.What Challenges and Opportunities Exist in the RTD / High Strength Premixes Market?

The RTD / High Strength Premixes market faces several challenges, including regulatory compliance, intense competition, and shifting consumer preferences. Navigating the complex regulatory landscape, which varies by region and involves alcohol content limits, labeling requirements, and marketing restrictions, can be challenging for manufacturers. The market is highly competitive, with numerous global and regional players offering a wide range of products, creating pricing pressures and impacting profitability. However, these challenges present substantial opportunities for growth and innovation. The increasing demand for convenient, ready-to-consume alcoholic beverages, driven by busy lifestyles and changing social dynamics, is creating a strong market for RTD / High Strength Premixes. The growing trend towards premiumization, low-alcohol, and health-focused beverages is further boosting the market potential. Moreover, the expansion of e-commerce, digital marketing, and direct-to-consumer sales channels is creating new opportunities for RTD brands to reach a broader audience.What Factors Are Driving the Growth of the RTD / High Strength Premixes Market?

The growth in the RTD / High Strength Premixes market is driven by several factors, including the rising demand for convenient, ready-to-consume alcoholic beverages that cater to diverse consumer preferences. Technological advancements in flavor innovation, packaging, digital marketing, and cold chain logistics are enhancing the appeal, accessibility, and sustainability of RTD / High Strength Premixes, driving their adoption. The increasing focus on premiumization, health-conscious choices, and unique flavor experiences is also contributing to market growth. Additionally, the expansion of e-commerce, digital retail channels, and social media marketing is boosting the demand for RTD beverages, particularly among millennials and Gen Z consumers. The emphasis on product innovation, brand differentiation, and eco-friendly packaging is further propelling the RTD / High Strength Premixes market forward.Report Scope

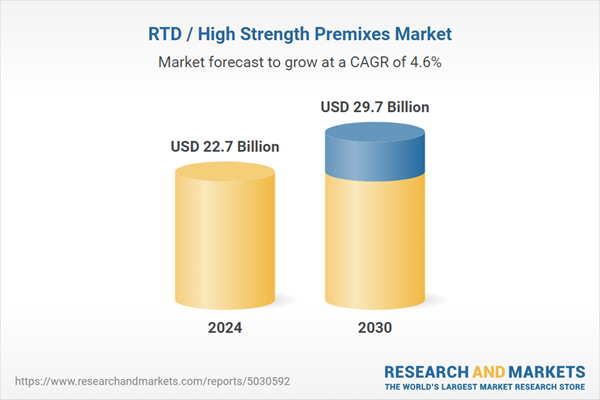

The report analyzes the RTD / High Strength Premixes market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (RTDs, High-Strength Premixes); Distribution Channel (Stored-Based, Online).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the RTDs segment, which is expected to reach US$22.6 Billion by 2030 with a CAGR of 4.9%. The High-Strength Premixes segment is also set to grow at 3.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $6 Billion in 2024, and China, forecasted to grow at an impressive 7.3% CAGR to reach $6.3 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global RTD / High Strength Premixes Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global RTD / High Strength Premixes Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global RTD / High Strength Premixes Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Anheuser-Busch InBev SA/NV, Asahi Group Holdings Ltd., Barcardi & Company Limited, Beam Suntory Inc., Brown-Forman Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 51 companies featured in this RTD / High Strength Premixes market report include:

- Anheuser-Busch InBev SA/NV

- Asahi Group Holdings Ltd.

- Barcardi & Company Limited

- Beam Suntory Inc.

- Brown-Forman Corporation

- Campari Group

- Diageo PLC

- Jose Cuervo

- Jubilant Ingrevia Limited

- Kent Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Anheuser-Busch InBev SA/NV

- Asahi Group Holdings Ltd.

- Barcardi & Company Limited

- Beam Suntory Inc.

- Brown-Forman Corporation

- Campari Group

- Diageo PLC

- Jose Cuervo

- Jubilant Ingrevia Limited

- Kent Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 199 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 22.7 Billion |

| Forecasted Market Value ( USD | $ 29.7 Billion |

| Compound Annual Growth Rate | 4.6% |

| Regions Covered | Global |