Global Barley Flour Market - Key Trends & Drivers Summarized

What Is Barley Flour, And Why Is It Important in Modern Nutrition?

Barley flour is a versatile whole grain flour made by grinding barley, an ancient cereal grain. It has gained popularity due to its rich nutritional profile, offering high levels of dietary fiber, essential vitamins, and minerals. Unlike refined flours, barley flour retains the bran and germ of the grain, making it a nutrient-dense option for health-conscious consumers. The high fiber content, particularly beta-glucan, in barley flour is linked to numerous health benefits, such as improved heart health, better blood sugar control, and enhanced digestive function. Because of these health benefits, barley flour is increasingly being used as a substitute for traditional wheat flour in baked goods, soups, and sauces, as well as a key ingredient in gluten-free and whole grain food products.One of the primary reasons barley flour is essential in modern nutrition is its role in promoting heart health and aiding in weight management. Beta-glucan, the soluble fiber found in barley, has been shown to reduce cholesterol levels, helping to lower the risk of cardiovascular diseases. Additionally, barley flour's fiber content supports digestive health, promoting regularity and preventing issues like constipation. The flour's low glycemic index makes it an excellent choice for people managing diabetes or seeking to maintain steady blood sugar levels. As consumers increasingly focus on healthier diets and the benefits of whole grains, barley flour has become an important alternative for those looking to improve their nutritional intake while enjoying a versatile, easy-to-use ingredient.

What Types Of Barley Flour Are Available, And How Do They Cater To Different Culinary Uses?

Barley flour comes in a variety of forms, each suited to different culinary applications and dietary needs. The most common types include whole grain barley flour, hulled barley flour, and pearled barley flour. Whole grain barley flour is made from the entire grain, including the bran, germ, and endosperm, and retains all of the grain's nutrients and fiber. This type of flour is ideal for health-conscious consumers who want the maximum nutritional benefit. It is commonly used in baking bread, muffins, and other whole grain baked goods where the dense, slightly nutty flavor complements the recipe. Whole grain barley flour is also used to thicken soups and stews, adding both texture and nutritional value.Hulled barley flour is made from barley grains that have had the tough outer hull removed but retain the bran and germ. It offers a smoother texture than whole grain flour while still providing high fiber content and essential nutrients. Hulled barley flour is often used in recipes where a slightly finer texture is needed, such as in pastries or softer breads. Pearled barley flour, on the other hand, is made from barley that has had both the hull and bran removed, resulting in a finer, lighter flour. While pearled barley flour has a lower fiber content compared to hulled or whole grain varieties, it is still nutritious and can be used in recipes that call for a more refined flour. This type of barley flour is often used in delicate baked goods, sauces, and soups where a smoother, lighter consistency is desired.

Barley flour is also available in organic and gluten-free varieties, catering to specific consumer preferences. Organic barley flour is produced using barley grown without synthetic pesticides or fertilizers, making it a popular choice for environmentally conscious and health-focused consumers. Although barley contains gluten, there are gluten-free alternatives derived from specialized processes that remove gluten or from using alternative grains in combination with barley. These versions cater to individuals with gluten sensitivity or celiac disease. The versatility of barley flour allows it to be incorporated into a wide range of culinary creations, making it a valuable ingredient for both traditional and modern cooking.

How Are Technological Advancements Impacting The Barley Flour Market?

Technological advancements in food processing and agricultural practices are significantly enhancing the quality, availability, and nutritional value of barley flour. One of the major breakthroughs is in the milling process, where improved techniques such as stone milling and air classification are used to retain more of the grain's nutrients during production. These advancements ensure that barley flour maintains its high fiber content, essential vitamins, and minerals while providing a finer, more consistent texture for culinary use. Modern milling processes also allow for the creation of specialty flours, such as ultra-fine barley flour, which can be used in more delicate baking applications without compromising nutritional benefits.Advances in agricultural technology are also improving barley crop yields and quality, which directly impacts the availability and cost-effectiveness of barley flour. The development of disease-resistant barley varieties and the use of precision agriculture techniques have enabled farmers to produce higher yields with fewer inputs, supporting the growing demand for barley flour. This has particularly benefited the production of organic barley flour, where maintaining crop health without synthetic chemicals is a priority. Additionally, sustainable farming practices, such as crop rotation and minimal tillage, are being increasingly adopted in barley farming to improve soil health and environmental sustainability, further aligning barley flour production with the global trend toward sustainable food systems.

In addition, innovations in food formulation and processing are expanding the use of barley flour in new product categories. Food manufacturers are now incorporating barley flour into a wide array of products, from high-fiber breakfast cereals and snacks to gluten-free and plant-based foods. The ability to combine barley flour with other functional ingredients through modern food processing techniques is driving the development of new products that meet the rising consumer demand for nutritious, whole grain, and clean-label foods. Furthermore, e-commerce platforms and digital marketing are playing a crucial role in expanding consumer access to specialty barley flour products, allowing consumers to explore different varieties, such as organic or gluten-free, more easily. These technological advancements are transforming the barley flour market, making it more accessible, sustainable, and versatile in the modern food industry.

What Is Driving The Growth In The Barley Flour Market?

The growth in the barley flour market is driven by several factors, including increasing consumer awareness of the health benefits of whole grains, the rising demand for plant-based and gluten-free foods, and the growing focus on sustainable and organic products. One of the primary drivers is the widespread recognition of barley as a nutrient-dense grain, particularly for its high fiber content and its role in heart health. Barley flour, rich in beta-glucan fiber, has been linked to cholesterol reduction and improved cardiovascular health, which is driving demand among health-conscious consumers looking to incorporate whole grains into their diets. As part of a broader trend toward clean eating and preventive health, barley flour is gaining popularity as a functional ingredient in both home cooking and commercial food products.The surge in demand for plant-based foods and gluten-free alternatives is also contributing to the growth of the barley flour market. As more consumers shift towards vegetarian, vegan, or flexitarian diets, they are seeking out versatile plant-based ingredients like barley flour that can be used in a wide variety of recipes, from baked goods to meat substitutes. Although barley contains gluten, advancements in food processing are enabling the development of gluten-free barley flour options or blends, catering to the growing market of consumers with gluten sensitivities or celiac disease. Barley flour's versatility in creating high-fiber, nutrient-dense foods aligns well with these dietary trends, positioning it as a key ingredient in the expanding gluten-free and plant-based food sectors.

Additionally, the increasing demand for organic and sustainable food products is driving growth in the barley flour market. As consumers become more concerned about the environmental impact of food production, they are gravitating toward ingredients that are produced using sustainable farming practices. Organic barley flour, in particular, is experiencing strong demand as more consumers seek foods that are free from synthetic chemicals and align with their ethical values. The expansion of organic agriculture and improvements in barley farming practices have helped make organic barley flour more widely available, contributing to the overall growth of the market. With the rise of e-commerce and the increasing consumer preference for wholesome, minimally processed foods, the barley flour market is set for continued expansion, driven by the intersection of health, sustainability, and evolving consumer preferences.

Report Scope

The report analyzes the Barley Flour market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Nature Type (Organic, Conventional); Sales Channel (Retail Sales, Direct); End-Use (Industrial, Household).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

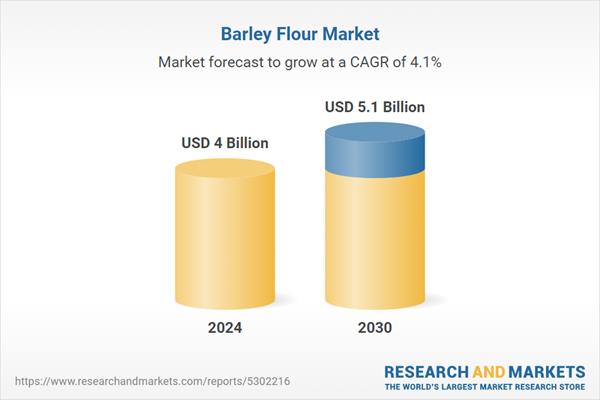

- Market Growth: Understand the significant growth trajectory of the Organic Barley Flour segment, which is expected to reach US$3.2 Billion by 2030 with a CAGR of a 4.4%. The Conventional Barley Flour segment is also set to grow at 3.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.1 Billion in 2024, and China, forecasted to grow at an impressive 6.3% CAGR to reach $1.1 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Barley Flour Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Barley Flour Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Barley Flour Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Alaska flour company, Arrowhead Mills, Bob’s Red Mills, Gimel organics, Grain Millers and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 48 companies featured in this Barley Flour market report include:

- Alaska flour company

- Arrowhead Mills

- Bob’s Red Mills

- Gimel organics

- Grain Millers

- Helsinki Mills Ltd

- Honeyville Food and Products, Inc.

- Kialla pure foods

- Morarka Organic

- P&H Milling group

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Alaska flour company

- Arrowhead Mills

- Bob’s Red Mills

- Gimel organics

- Grain Millers

- Helsinki Mills Ltd

- Honeyville Food and Products, Inc.

- Kialla pure foods

- Morarka Organic

- P&H Milling group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 372 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 4 Billion |

| Forecasted Market Value ( USD | $ 5.1 Billion |

| Compound Annual Growth Rate | 4.1% |

| Regions Covered | Global |