In Netherlands homeowners' shifting choices for energy-efficient and lavish living spaces are helping to propel the DIY Home Improvement industry forward. The industry has grown as a result of rapid urbanisation and government initiatives to provide incentives and tax credits for green building development. Total revenue generated by DIY retail stores in the Netherlands in 2020 is approx. 4,467 million euros. In 2021, the Netherlands have a total of 1955 DIY retail stores, a slight decrease from the previous year. North Brabant province have highest number of DIY retail stores which is approx 330.

The Netherlands market's target products are DIY home improvement products that are utilized for building maintenance, plumbing, and other home improvement purposes. DIY home improvement tools, equipment, and appliances enable homeowners to complete projects on their own with the support of DIY home improvement products and activities.

Key Market Trends

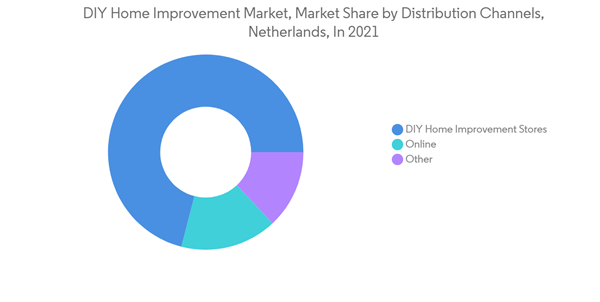

DIY Purchases made on an online platform and in stores

Because the bulk of DIY materials are available online, in-store displays play a significant part in how DIY customers learn to manage their projects. In Netherlands these strategies have helped big retailers increase sales, and they're just as beneficial for small and local home improvement businesses. In terms of customer service and store-consumer connections, small businesses frequently surpass large box retailers. Even if the final purchase is done online, 84 % of all DIYers are likely to investigate items in the shop, and millennial DIYers are more inclined to seek out and acquire quality materials in-store, especially for things like paint.

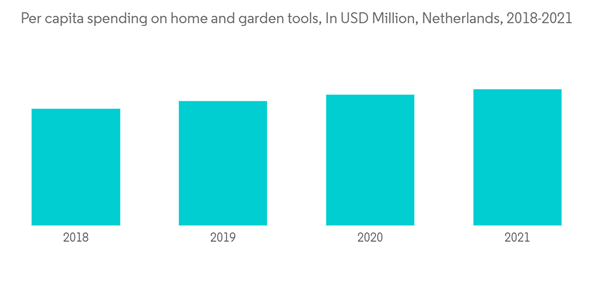

Growing interest towards personalized interior designing

DIY interior design has grown in popularity as people's lifestyles have changed in Netherlands. Also, the rising number of working consumers and their involvement in the decision-making process for home design is boosting sales of materials needed for such DIY and Home Improvement projects. As a result, DIY home improvement products are becoming more popular in Netherlands. DIY items are less expensive in the long run than hiring expensive labour. Customers' interest in modifying their homes and gardens has increased. The expanding population, which is boosting building activity throughout the residential sector as more housing units are required to fulfil the growing population's housing demands, is one of the primary drivers driving market expansion over the next five years.

Competitive Landscape

The DIY Home Improvement market in the Netherlands is a balance of fragmented and consolidated, with a large number of small and mid-sized businesses. Many local market participants are rapidly increasing their market presence to meet the growing demand for moderate DIY products. They're also investing in R&D, focusing on product development, frequent product launches, and increased product availability, as well as pricing and mergers and acquisitions strategies.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Vorwerk

- Ikea

- Dyson

- STIHL

- Miele

- Philips

- Whirlpool

- Geberit

- Grohe

- Electrolux

- Bissell*