A smart toilet is a piece of equipment that includes numerous built-in amenities, like a heated seat and an automatic drier. Smart toilets are increasingly becoming the standard in smart homes all over the world. A smart toilet is a high-tech toilet with integrated smart technology, or technology that can connect and interact with the user. These toilets are frequently found in high-tech areas and smart homes across the world.

These gadgets can perform a wide range of tasks, including playing music and flushing at the push of a button, all while conserving valuable water as well as energy. The smart toilet is also known as an intelligent toilet or a modern bidet. It is a form of electronic bidet toilet that combines traditional bidet cleaning as well as the addition of cutting-edge SMART home technology. For a clean and contemporary look, modern intelligent toilets blend electronic bidet cleaning capabilities into a ceramic toilet bowl.

Depending on the manufacturer, make, and model of the toilet, intelligent bidet features can be controlled via voice command, mobile app, or remote-control navigation. A removable toilet seat known as an electronic bidet seat is one of the more affordable choices and is also growing in popularity. Toilets have been around for a very long time, despite being originally considered a luxury. In reality, a flushing toilet with a built-in tank was the first toilet mechanism ever designed. Smart toilets were quickly becoming popular in several countries all over the world.

The Numi, described as the first smart toilet in the world, was introduced by the manufacturer Kohler in 2011. The Numi was ground-breaking because it gave customers the ability to control their own ambient lighting, water temperature, and even music through an integrated radio. Many businesses have now entered the smart toilet market, each creating distinctive features that are significantly useful for people.

COVID-19 Impact Analysis

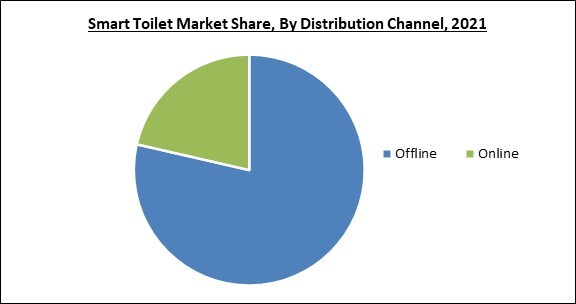

Due to the abrupt emergence of the pandemic, the industry for smart toilets almost came to an end. To stop the virus from spreading, the governments of many countries across the world imposed stringent lockdowns. As a result, production and manufacturing were abruptly suspended, and supply networks were upset. In addition, the disposable income of people was also reduced, due to which, their spending capability diminished by a significant rate. Additionally, the lockdown had a direct impact on the offline mode, which accounts for the major portion of the distribution route. Further, the infection also compelled governments worldwide to enforce travel restrictions, which, directly disrupted the supply chain. Owing to all these factors, the growth of the smart toilet market was limited.Market Growth Factors

Increased Energy Efficiency And Water Savings

Due to the current climate circumstances along with unequal distribution of limited resources, people are becoming more worried about energy conservation. Moreover, these toilets, along with energy, also save a lot of water. Given that they have automated flushes that use measuring techniques to estimate how much water is needed to flush, smart toilets provide better long-term options for water saving. For instance, smart toilets consume as little as 1.6 gallons of water to flush, compared to the 5 to 7 gallons used by conventional toilets.An Increasing Number Of Technological Advancements

One of the major factors that are rapidly increasing the adoption of smart toilets all over the world is the rising number of technological advancements in smart toilets due to the widespread modernization. Voice-activated equipment and IoT technology are becoming more common in the sector. To improve the user experience in restrooms, various major companies are frequently incorporating a variety of cutting-edge hygiene technology, including UV lighting, Bluetooth connectivity, auto-open seat covers, auto-flush, and much more.Market Restraining Factors

Higher Installation And Maintenance Cost

The smart toilet is a completely new class of electrical appliance that is both expensive as well as highly sophisticated. Because they are technological products, smart toilets are more expensive than standard toilets. Additionally, their maintenance is more expensive than their installation cost. Small-sized toilets cannot use smart toilets. Since the smart toilet takes up a fair amount of space, it is typically not recommended to deploy one in a tiny bathroom. A smart toilet takes up space and makes it difficult to place other toiletries or household appliances, so installing one in a tiny bathroom is expected to make the area appear extremely congested.Application Outlook

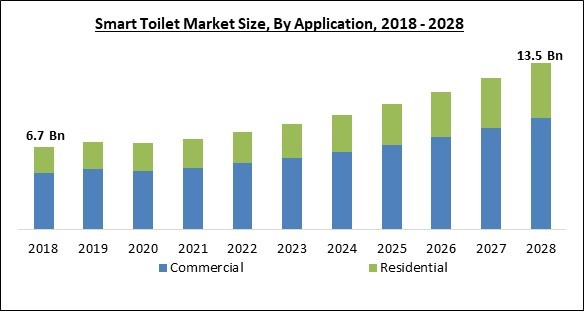

By Application, the Smart Toilet Market is bifurcated into Residential and Commercial. In 2018, the commercial segment acquired the largest revenue share of the smart toilet market. To offer hygienic services to their customers, several upscale restaurants, hotels, bars, and shopping centers have installed smart toilets. Additionally, the smart toilet is considered as a luxury item that may be installed in upscale business spaces. The increasing number of luxury hotels and restaurants is one of the major factors that is driving the growth of the segment.Distribution Channel Outlook

On the basis of Distribution Channel, the Smart Toilet Market is divided into Online and Offline. In 2021, the online segment witnessed a substantial revenue share of the smart toilet market. The growth of the segment is driven by the fact that these channels offer a variety of alluring features, like free cashback or membership, door-to-door delivery, and simple return procedures, which are chosen by customers, especially millennial. Through online channels, it is simple to comprehend the attributes of the products and compare their costs.Regional Outlook

Region-Wise, the Smart Toilet Market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. In 2021, Europe registered the highest revenue share of the smart toilet market. The expansion of the smart toilet industry is being driven by increasing consumer spending on ensuring bathroom hygiene. A significant portion of the population in Germany, as well as the United Kingdom, prefers to have an intelligent toilet seat installed rather than pull the seat manually, which is unclean. Moreover, an increasing number of concerns over water conservation in the region is also a key factor that is accelerating the adoption of smart toilets in the region.The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Xiaomi Corporation, Masco Corporation (Delta Faucet Company), LIXIL Group Corporation (Grohe AG), Roca Sanitario, SA (Roca Corporacion Empresarial, SA), Kohler Co., Toto Ltd., Bradley Corporation, Duravit AG, Wellis Magyarország Zrt., and Fortune Brands Home & Security, Inc.

Strategies deployed in Smart Toilet Market

- 2021-Oct: Duravit launched D-Neo, a complete bathroom range by Philippe Starck. Through this launch, the company aimed to offer a blend of best-in-class design, technology, and craftsmanship.

- 2021-Apr: Xiaomi rolled out DIIIB Supercharged, a new smart toilet of the company. The new smart toilet features water temperature heating, seat heating, warm air drying, soft night light, activated carbon deodorization, and an LCD display that helps users in adjusting the temperature of the water.

- 2020-Jul: Xiaomi unveiled Jenner XS, a fully Automatic flip integrated smart toilet. The new smart toilet features a patented smart lifting technology, which is developed by the company itself. In addition, the toilet bowl can be customized between the floor and the seat ring in accordance with the customer's convenience.

- 2020-May: Masco took over SmarTap, a manufacturer of shower systems for smart homes. Through this acquisition, the company aimed to integrate SmarTap's innovative products into its portfolio in order to offer a unique and customized shower experience to its customers.

- 2020-Mar: Duravit introduced Sensowash I, the first integrated shower toilet of the company. The new product aimed to testify to a completely new experience for comfort, hygiene, design, and quality of life.

- 2019-Oct: Xiaomi launched a new smart toilet. The new product offers heating and remote control along with its traditional features. Moreover, the new smart toilet provides enhanced hygiene.

- 2018-Nov: Xiaomi launched an AI-backed smart toilet seat cover. The new seat cover comprises a thermostatic surface along with an ergonomic 3D curved to heat uniformly as well as uses a low-temperature burn-proof technology.

Scope of the Study

Market Segments Covered in the Report:

By Application

- Commercial

- Residential

By Distribution Channel

- Offline

- Online

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Xiaomi Corporation

- Masco Corporation (Delta Faucet Company)

- LIXIL Group Corporation (Grohe AG)

- Roca Sanitario, SA (Roca Corporacion Empresarial, SA)

- Kohler Co.

- Toto Ltd.

- Bradley Corporation

- Duravit AG

- Wellis Magyarország Zrt.

- Fortune Brands Home & Security, Inc.

Unique Offerings from the Publisher

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- Xiaomi Corporation

- Masco Corporation (Delta Faucet Company)

- LIXIL Group Corporation (Grohe AG)

- Roca Sanitario, SA (Roca Corporacion Empresarial, SA)

- Kohler Co.

- Toto Ltd.

- Bradley Corporation

- Duravit AG

- Wellis Magyarország Zrt.

- Fortune Brands Home & Security, Inc.