The market for low-calorie foods is growing rapidly in the health food industry due to increasing health concerns and shifting lifestyles. Low-calorie foods help address various health issues, leading to greater consumption of these products. Between-course snacking refers to the small consumption of food, such as processed items like packaged snack foods. Snack foods are products that contain proteins, vitamins, and minerals, as well as other nutritious constituents. Low-calorie snacks, including baked goods like bagels, pancakes, and cookies, as well as sweet treats like candies, chocolates, and raisins, differ from traditional snacks because they contain healthier, gluten-free ingredients.

Moreover, an increasing number of consumers are becoming conscious of their diets due to a rising holistic sense of overall well-being, which encompasses all aspects of healthy living. With the negative consequences of traditional snacks - including rising instances of obesity, weight gain, and poor nutrition - people are increasingly emphasizing low-calorie food consumption and adopting more mindful eating habits. The growth of the low-calorie snack industry is driven by increased demand for these foods, rising consumer spending power - especially in emerging economies - and the growing trend of on-the-go snacking.

Global low-calorie food Market Drivers

Rising health awareness is contributing to the global low-calorie food market growth

Awareness of the necessity for a proper diet has developed over the years, with chronic ailments driving this rising awareness. People's diets and routines have changed dramatically, prompting them to adopt specific dietary regimens to stay fit or address health issues. One notable advancement in this development is the incorporation of low-calorie snack products. These snacks do not contain harmful chemicals and have calories that burn at less than half the amount required for healthy weight maintenance.However, the use of GMOs in the production of these products has been associated with harmful side effects, including organ failures and disorders of the immune and gastrointestinal systems, as well as issues like prematurity and infertility. The emerging advantages of low-calorie organic snack items, coupled with increased consumer awareness regarding fitness and health, are driving greater demand in the snack product industry. Consequently, this demand is generating growth in the market for low-calorie snacks.

Global Low-calorie Food Market Geographical Outlook:

North America is witnessing exponential growth during the forecast period.North America has more fast food and quick service restaurants than any other region. The increasing expenditure on healthy, good-quality foods and snacks such as low-calories, is a result of high per capita income and the trend that is evolving toward healthier eating. Moreover, rise in convenience-related consumption of products like snacks and increasing fitness and health concerns. North America also has a very modernized retailing infrastructure which enhances easy access for a consumer to most things such as grocery and food. Some of these including low-calorie snacks even have a higher volume of sales because they are readily available.

Reasons for buying this report:

- Insightful Analysis: Gain detailed market insights covering major as well as emerging geographical regions, focusing on customer segments, government policies and socio-economic factors, consumer preferences, industry verticals, other sub-segments.

- Competitive Landscape: Understand the strategic maneuvers employed by key players globally to understand possible market penetration with the correct strategy.

- Market Drivers & Future Trends: Explore the dynamic factors and pivotal market trends and how they will shape up future market developments.

- Actionable Recommendations: Utilize the insights to exercise strategic decision to uncover new business streams and revenues in a dynamic environment.

- Caters to a Wide Audience: Beneficial and cost-effective for startups, research institutions, consultants, SMEs, and large enterprises.

What do businesses use our reports for?

Industry and Market Insights, Opportunity Assessment, Product Demand Forecasting, Market Entry Strategy, Geographical Expansion, Capital Investment Decisions, Regulatory Framework & Implications, New Product Development, Competitive IntelligenceReport Coverage:

- Historical data & forecasts from 2022 to 2030

- Growth Opportunities, Challenges, Supply Chain Outlook, Regulatory Framework, Customer Behaviour, and Trend Analysis

- Competitive Positioning, Strategies, and Market Share Analysis

- Revenue Growth and Forecast Assessment of segments and regions including countries

- Company Profiling (Strategies, Products, Financial Information, and Key Developments among others)

The global low-calorie food market is segmented and analyzed as follows:

By Type

- Sugar Substitutes

- Stevia

- Saccharin

- Aspartame

- Others

- Sugar Alcohol Substitutes

- Erythritol

- Sorbitol

- Others

- Nutrient Based Substitutes

- Fat Based

- Protein Based

- Carbohydrate Based

By Applications

- Bakery Products

- Snacks

- Dairy Products

- Dietary Beverages

- Others

By Distribution Channel

- Offline

- Supermarkets

- Convenience Stores

- Others

- Online

By Geography

- North America

- South America

- Europe

- Middle East and Africa

- Asia-Pacific

Table of Contents

Companies Mentioned

- Cargill, Incorporated

- Zydus Wellness Ltd

- Bernard Food Industries

- Ajinomoto Co., Inc.

- Beneo Group

- Ingredion Incorporated

- Galam Ltd.

- Groupe Danone.

- Nestle S.A.

- Food Darzee

- General Mills

- Unilever

- Kraft Heinz

- Herbalife

- ConAgra Foods

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 162 |

| Published | December 2024 |

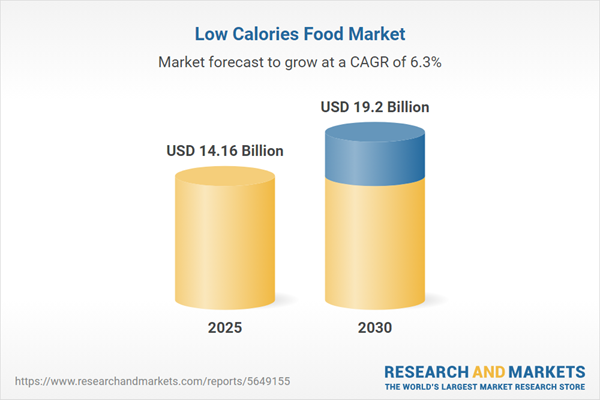

| Forecast Period | 2025 - 2030 |

| Estimated Market Value ( USD | $ 14.16 Billion |

| Forecasted Market Value ( USD | $ 19.2 Billion |

| Compound Annual Growth Rate | 6.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |