This report comes with 10% free customization, enabling you to add data that meets your specific business needs.

1h Free Analyst TimeSpeak directly to the analyst to clarify any post sales queries you may have.

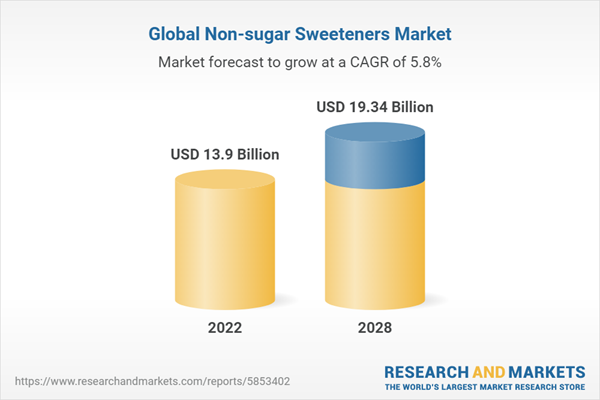

According to the research report, Global Non-Sugar Sweeteners Market Outlook, 2028 the market is expected to cross USD 19.34 Billion market size, increasing from USD 13.90 Billion in 2022. The global market is forecasted to grow with 5.75% CAGR by 2023-28. The growing consumer preference for nutritious foods, as well as the rising emphasis on good health and wellness, has resulted in a considerable growth in the use of products with no added sugars or sweeteners. National government measures to minimize sugar intake through selective taxation, reformulations, and explanatory front packaging labels are likely to encourage market growth in France and the United Kingdom. The primary factors driving demand for non-sugar sweeteners include changing eating patterns, increased diabetes prevalence, and global health concerns. The growing understanding of the negative effects of sugar consumption, such as decreased cognitive capacities, inflammation, and blood pressure, is increasing the need for non-sugar sweeteners. Various macroeconomic variables responsible for the worldwide non-sugar sweetener market's rise include rising disposable income and a high rate of urbanization, which are major factors in the increased use and affordability of non-sugar sweeteners. Stevia is a natural, plant-derived sweetener that has gained popularity as a low-calorie substitute for sugar. Its popularity has grown as a result of its natural origins and potential health benefits. The market has also seen substantial breakthroughs in the creation of new and superior non-sugar sweeteners in recent years. Researchers and companies have been investing in the development and production of innovative sweeteners that can mimic the taste of sugar without leaving an aftertaste or causing unpleasant side effects. These breakthroughs have widened the applications of non-sugar sweeteners, paving the way for new product launches and enhanced formulations.

Based on the region, Europe is dominating the global non-sugar sweeteners market with more than 30% market share in 2022.

The region's proactive dedication to health and wellbeing is one of the key reasons for Europe's supremacy in the non-sugar sweeteners market. European consumers are increasingly concerned about the negative health consequences of excessive sugar consumption, such as obesity, diabetes, and other linked health problems. As a result, there is a growing demand for healthier, lower-calorie alternatives, which is fueling the appeal of non-sugar sweeteners. Cultural and dietary factors also contribute to Europe's market supremacy in non-sugar sweeteners. European customers are more knowledgeable about food ingredients and nutritional information. They are frequently more willing to explore new items and embrace healthier options. As a result, non-sugar sweeteners, such as stevia, have gained significant acceptance in the region's food and beverage business, including in popular products like soft drinks, dairy items, and bakery goods. Different sugar substitutes, such as stevia, sugar alcohols, sucralose, and similar items, are very popular among European customers. This has prompted sugar substitute makers to consider developing new, high-quality, tastier, and more nutrient-dense goods for the market. The food and beverage industries in Europe are looking for sustainable and healthful sweeteners. The fact that stevia and monk fruit sweeteners are calorie-free is a big marketing feature. Consumer awareness of stevia is growing among European customers, who are increasingly seeking healthier and more natural products.

Based on the source, artificial source is expected to lead the market with more than USD 10 Billion market size by 2028.

Artificial sweeteners are significantly sweeter than natural sugars, ranging from 50 to 600 times sweeter. Because of its strong sweetness, far fewer amounts of sweetener are required to reach the appropriate level of sweetness in food and beverages. As a result, artificial sweeteners provide a cost-effective solution for manufacturers because they require less effort to obtain the same level of sweetness as natural sugars. Artificial sweeteners are essentially calorie-free or have a low caloric value, making them appealing to health-conscious consumers trying to cut calories. These sweeteners are extensively used in weight management and diabetes management products because they allow people to enjoy sweet flavors without adding a lot of calories to their diets. Artificial sweeteners can be found in a wide range of items, including soft drinks and confectionery, as well as medications and oral care products. Their adaptability and compatibility with various formulations have aided in their broad use in the food sector. Furthermore, artificial sweeteners often have a longer shelf life than natural sugars, which contributes to the overall stability and quality of the product.

Based on the type, high intensity sweeteners are expected to grow with over 5% CAGR in global non-sugar sweeteners market by 2023-28.

Consumers are seeking healthier alternatives to traditional sugars as they become more aware of the health dangers connected with excessive sugar consumption, such as obesity, diabetes, and tooth difficulties. High-intensity sweeteners are an option because they deliver sweetness without adding calories or affecting blood glucose levels. Demand for low-calorie and non-sugar sweeteners, including high-intensity sweeteners, is predicted to rise as consumers become more health-conscious. High-intensity sweeteners are deemed safe for diabetics because they have no effect on blood glucose levels. As the global prevalence of diabetes rises, there is an increasing demand for diabetic-friendly sweetening choices. High-intensity sweeteners have become an essential component in the formulation of goods for diabetics and those who want to control their carbohydrate intake. Various health agencies throughout the world have given high-intensity sweeteners regulatory certification, confirming their safety when ingested within recommended daily intake limits. These approvals offer consumers and businesses assurance, further encouraging the use of high-intensity sweeteners in food and beverage compositions.

Based on the product type, non-nutritive segment is expected to grow with more than 5% CAGR by 2023-28 in global non-sugar sweeteners market.

There is a growing desire for healthier alternatives to standard sugars as people become more health-conscious. Non-nutritive sweeteners provide sweetness without adding calories or influencing blood glucose levels, making them appealing options for people trying to cut back on sugar and calories. These sweeteners are frequently used in goods promoting weight loss, diabetic control, and overall health and wellness. Non-nutritive sweeteners are becoming increasingly popular in a variety of food and beverage applications, including soft drinks, sugar-free chocolates, dairy products, baked goods, and table top sweeteners. Because of their adaptability and stability in various formulas, they have become appealing solutions for producers looking to meet the need for healthier, lower-calorie products. The taste of non-nutritive sweeteners has improved over the years, addressing previous concerns about aftertastes or bitterness associated with some artificial sweeteners. Advances in taste innovation have made non-nutritive sweeteners more palatable, increasing consumer acceptance and driving their use in various products.

Based on the application, food & beverage segment is dominating the market of global non-sugar sweeteners with significant market share.

The global shift toward healthy eating habits, as well as increased knowledge of the health hazards associated with excessive sugar consumption, have fueled demand for non-sugar sweeteners in the food and beverage industry. Non-sugar sweeteners are a tempting choice for manufacturers as consumers seek goods with lower sugar content, fewer calories, and better nutritional profiles. Many food and beverage businesses have altered their products to reduce sugar content or offer totally sugar-free alternatives in order to address health concerns about sugar consumption and meet consumer demand for healthier options. Non-sugar sweeteners play an important part in such reformulation initiatives, allowing corporations to keep products sweet while decreasing or removing sugar content. Non-sugar sweeteners are versatile and can be used in a variety of food and beverage applications. Soft beverages, juices, dairy products, confectioneries, baked goods, sweets, and even savory foods can contain them. Because they can be effortlessly integrated into a variety of formulas, their flexibility has contributed to their dominance in the food and beverage sector. Non-sugar sweeteners have improved in taste over the years, alleviating concerns about aftertastes and harshness associated with some older formulations. As a result, people are increasingly accepting of non-sugar sweeteners in food and beverage goods, which contribute to their market dominance.

Market Drivers

- Rising Prevalence of Obesity and Diabetes: The global rise in obesity and diabetes rates has pushed individuals and healthcare professionals to focus on sugar reduction. Non-sugar sweeteners provide a feasible solution for managing weight and blood sugar levels, making them acceptable for those with diabetes or those trying to live a healthy lifestyle.

- Diabetic-Friendly Solutions: Non-sugar sweeteners are deemed safe for diabetics because they do not raise blood glucose levels appreciably. Their use in diabetic-friendly products helps diabetics consume a broader range of foods and beverages without harming their health.

Market Restraints

- Taste and Aftertaste Concerns: One of the most significant issues that non-sugar sweeteners face is their taste profile and associated aftertaste. Some artificial sweeteners, such as saccharin and aspartame, have been linked to a bitter or metallic aftertaste, which some customers find unpleasant. While technical developments have resulted in enhanced taste profiles for many sweeteners, individual taste preferences might still differ, limiting their mainstream acceptability.

- Perception of Natural Sweeteners: Natural sweeteners such as stevia and monk fruit extract are becoming increasingly popular as consumers seek out natural and less processed food ingredients. While artificial sweeteners provide low-calorie alternatives, customer perceptions of natural sweeteners as healthy may impact consumer decisions and affect demand for particular non-sugar sweeteners.

Market Trends

- Growing Demand for Low-Calorie and Sugar-Free Products: As people become more aware of the health dangers connected with excessive sugar consumption, there is a growing demand for low-calorie and sugar-free products. Non-sugar sweeteners enable food and beverage businesses to address this need by developing products with low or no added sugars. This trend can be found in a variety of products, including soft drinks, sweets, confectioneries, and dairy products.

- Expansion of Plant-Based Sweeteners: Plant-based natural sweeteners, such as stevia and monk fruit extract, have grown in popularity as consumers seek more natural and plant-based alternatives. These plant-based sweeteners appeal to health-conscious and environmentally sensitive customers, propelling their use in a variety of food and beverage products.

Covid-19 Impacts

The pandemic of COVID-19 has had a huge impact on the Global Non-Sugar Sweeteners Market, producing extensive disruptions and affecting consumer behavior and business dynamics. Numerous factors converged to influence the market's direction as the world struggled with an unparalleled health catastrophe. Consumer demand for non-sugar sweeteners increased towards the start of the epidemic, owing mostly to a greater awareness of health and wellbeing. People are increasingly seeking healthier alternatives to traditional sugar-laden products, so the non-sugar sweeteners industry has seen a significant increase in sales across a variety of product categories, including artificial sweeteners, stevia, monk fruit extracts, and polyols. The increased emphasis on maintaining a robust immune system during the pandemic also prompted consumers to seek goods with lower sugar content, strengthening the industry even further.Market Players Insights

Cargill, Incorporated, The Archer-Daniels-Midland Company, Tate & Lyle PLC, Ingredion Incorporated, Ajinomoto Co., Inc, Celanese Corporation, DuPont de Nemours, Inc., International Flavors & Fragrances (IFF) , Roquette , Royal DSM N.V., Dohler Group SE, Morita Kagaku Kogyo Co., Ltd, Sunwin Stevia International, Inc., Hermes Sweeteners Ltd, JK Sucralose Inc., Zydus Wellness Limited, Foodchem International Corporation, Whole Earth Brands, The NutraSweet Company, The Real Stevia Company.Recent Developments

- Roquette: The French food ingredients company announced in January 2023 that it had launched a new allulose sweetener called PureBulk Allulose. Allulose is a naturally occurring sugar that is 70% as sweet as sucrose and has a low glycemic index.

- PureCircle: The Singapore-based stevia company announced in February 2023 that it had acquired the allulose company Sweet Green Fields. This acquisition will give PureCircle a leading position in the allulose market.

- DowDuPont: The American chemical company announced in March 2023 that it had developed a new method for producing sucralose that is more sustainable and environmentally friendly.

- Ajinomoto: The Japanese food company announced in April 2023 that it had launched a new monk fruit sweetener called Monk Fruit Sweetener K. Monk fruit is a naturally occurring sweetener that is 200-300 times sweeter than sugar.

- Merisant: The American food company announced in May 2023 that it had launched a new stevia-based sweetener called Truvia Clear. Truvia Clear is a zero-calorie sweetener that is clear and colorless, making it ideal for use in beverages.

Considered in this report

- Geography: Global

- Historic year: 2017

- Base year: 2022

- Estimated year: 2023

- Forecast year: 2028

Aspects covered in this report

- Global Non Sugar Sweeteners with its value and forecast along with its segments

- Region-wise Non Sugar Sweeteners market analysis

- Various drivers and challenges

- On-going trends and developments

- Top profiled companies

- Strategic recommendation

Regions & Countries covered in the report

- North America (United States, Canada, Mexico)

- Europe (Germany, United Kingdom, France, Spain, Italy, Russia)

- Asia-Pacific (China, Japan, India, Australia, South Korea)

- South America (Brazil, Argentina, Colombia)

- Middle-East & Africa (UAE, Saudi Arabia, South Africa)

By Source

- Artificial

- Sugar Alcohol

- Natural

By Type

- High-Intensity Sweeteners

- High Fructose Syrup

- Low-Intensity Sweeteners

By Product Type

- Non- Nutritive

- Nutritive

By Application

- Food & Beverages (Bakery, Confectionery, Dairy, Juices, Functional Drinks, Carbonated Drinks)

- Nutrition and Health Supplements

- Pharmaceuticals

- Cosmetics and Personal Care

The approach of the report

This report consists of a combined approach of primary and secondary research. Initially, secondary research was used to get an understanding of the market and list the companies that are present in it. The secondary research consists of third-party sources such as press releases, annual reports of companies, and government-generated reports and databases. After gathering the data from secondary sources, primary research was conducted by conducting telephone interviews with the leading players about how the market is functioning and then conducting trade calls with dealers and distributors of the market. Post this; we have started making primary calls to consumers by equally segmenting them in regional aspects, tier aspects, age group, and gender. Once we have primary data with us, we can start verifying the details obtained from secondary sources.Intended audience

This report can be useful to industry consultants, manufacturers, suppliers, associations and organisations related to the Non Sugar Sweeteners industry, government bodies, and other stakeholders to align their market-centric strategies. In addition to marketing and presentations, it will also increase competitive knowledge about the industry.Table of Contents

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 188 |

| Published | July 2023 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 13.9 Billion |

| Forecasted Market Value ( USD | $ 19.34 Billion |

| Compound Annual Growth Rate | 5.7% |

| Regions Covered | Global |